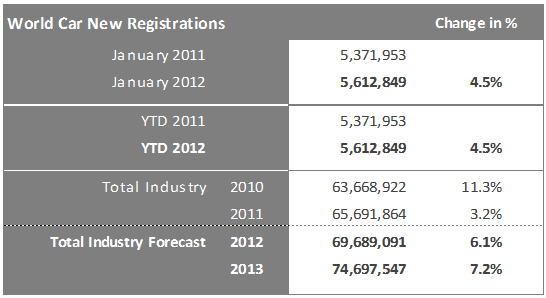

Based on data which is preliminary in some cases, global demand for passenger vehicles in January was up significantly from the year before. All regions except for Western Europe posted clear gains, which were in the double digits in some cases.

The Asia/Pacific region was up by more than 4% from the year before in January, according to preliminary estimates. Japan was up about 40% from the year before. In addition to the dynamic rebound in these markets, it is apparent that new incentives are beginning to bear fruit. In China as well, new registrations are back up after the decline in December.

In Eastern Europe (up 15%), the growth continued in January 2012 with double-digit gains, as Russian growth has not let up following expiration of the scrappage scheme. Latin America was up 13% over the year before in January, as all key markets posted clear growth.

Only in Western Europe were new registrations down (down 7.7%). The performance of the individual markets was once again uneven, as some smaller countries posted gains, such as Austria (up 5%) and Switzerland (up 13%), while significant losses were posted in Italy (down 17%), Greece (down 13%), Portugal (down 29%) and France (down 21%). Spain was able to post a slight gain because of its weak year-before comparison. Even the former engine of the Western European region, Germany, was not able to post a gain in January.

All in all, the impact of the financial crisis at the start of 2012 has not yet carried over significantly from Western Europe to other regions.

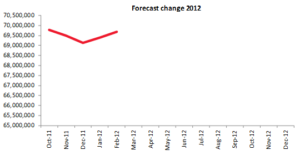

The global passenger vehicle market is still on track for growth: the risk lies in Western Europe

The Asia/Pacific will be up 10% from the year before in 2012. This is attributable to the aforementioned situation in the Japanese passenger vehicle market and the continuing growth in China. Only in South Korea is a slight decline expected.

The NAFTA region is expected to continue to recover, although its former levels will remain out of range. Nevertheless, new registrations will exceed the 16 million mark. Eastern Europe will grow by more than 6% in 2012 thanks to the good conditions in Russia.

Western European passenger vehicle demand will be down again in 2012 (by 5%), as was the case in 2010 and 2011. New registrations are expected to fall in every country except Germany. Germany has been only slightly affected by the crisis so far, and its outlook for the current year is very good, especially in the job market. As a result, the German economy is expected to remain stagnant at the least, and will perhaps even manage to post slight growth.

Data: Copyright R.L. Polk Europe Holding Ltd, all rights reserved. No reproduction allowed without prior written consent from Polk – www.polk.com.

For more detailed data on the UK vehicle market, contact SMMTAutomotive Information Services (AIS).