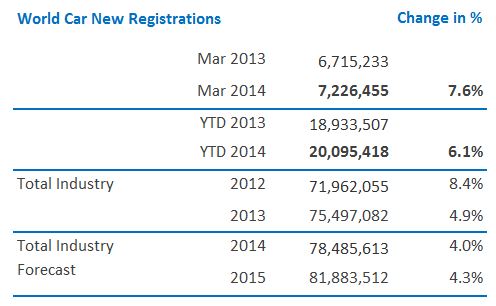

Based on POLK data, which are preliminary in some cases, passenger vehicle registrations in March were up 7.6%. With strong growth in the first two months of the year, global new registrations are now up 6.1%, 1.2 million units, for the first quarter of 2014.

Growth in the Asia/Pacific region was the strongest in March. While the Thai market continues to suffer from the after-effects of an incentive program, the losses were more than made up by the gains in Japan and China. Registrations in this region, the largest in the world, were up a total of 11.9% in March, and by 9.4% in the first quarter as a whole.

The NAFTA region posted 5.1% growth in March, which was much stronger than in prior months, for a gain of 2.5% in the first quarter of the year. Demand in the U.S. has suffered at the start of the year due to severe winter weather in the northeast.

Sales in Latin America were down around 7.0% in the month, while registrations in the region’s two largest markets, Argentina and Brazil, fell sharply. For the first quarter as a whole, regional demand was about even with the year before (up 0.8%).

Registrations in Western Europe were up 9.6% in March, and by 7.3% in the first quarter. The United Kingdom (up 17.7% in March) posted the strongest growth, but Germany and Southern Europe also contributed their share.

The slump in Turkey (down 27.0%) weighed down the Eastern European market last month (down 2.2% in March, down 1.8% YTD).

2014: New registrations expected to be 78.5 million units

Global new registrations are expected to set a new record in 2014, growing by around 4.0% over 2013.

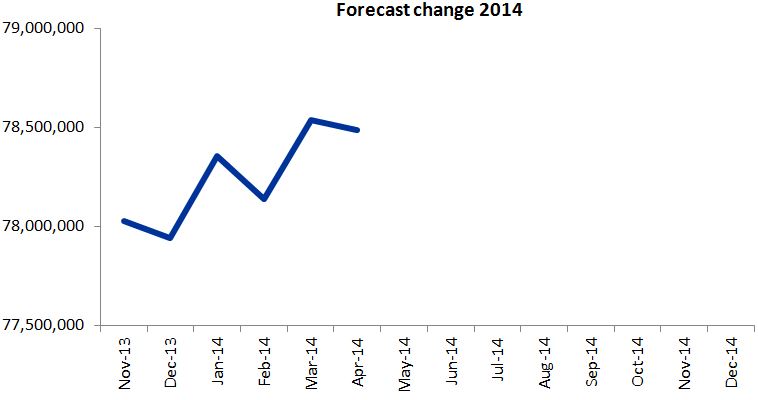

The advancing recovery in Southern Europe, together with the strong performance of some northern markets, and especially the United Kingdom, led to a positive adjustment to our forecast for the Western European region. The forecast for LATAM, on the other hand, and Brazil especially, was cut significantly. The outlook for the U.S. has also been reduced. The same applies for Eastern Europe, where the forecast for Turkey has been reduced by a significant amount. Positive adjustments to the Asia/Pacific region (particularly in China) largely compensate for the aforementioned reductions.