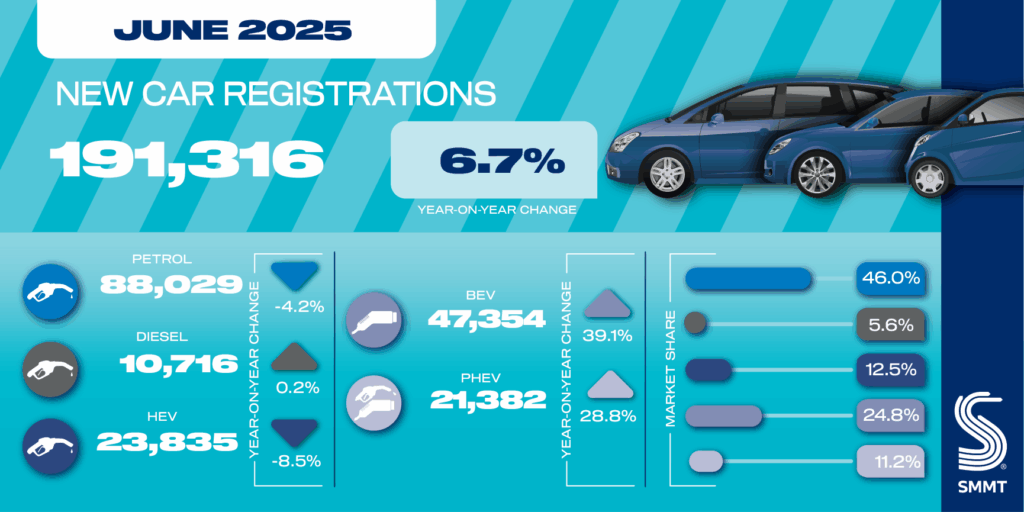

- New car market up 6.7% in June to 191,316 units as manufacturers use every channel to drive registrations to highest level since 2019.

- Battery electric car demand rises 39.1% to 47,354 units with one in four buyers going electric – but still below mandated levels.

- Manufacturer discounting continues to shore up EV demand with mandate bill now exceeding £6.5 billion since regulation commenced.

Data download

New car registrations data June 2025

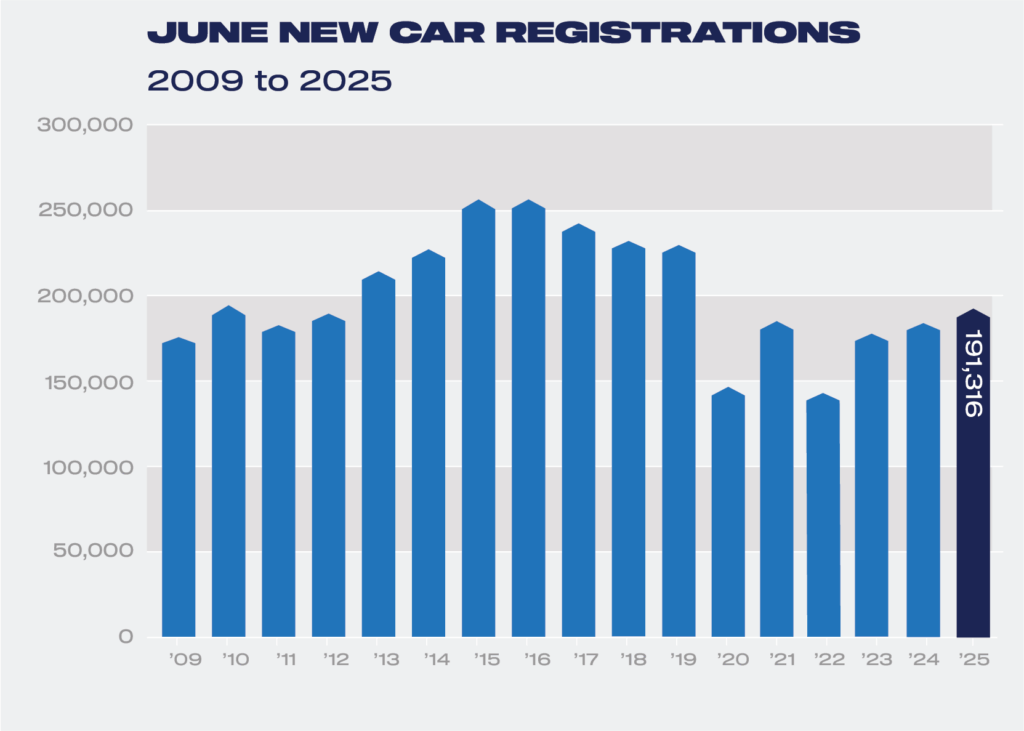

The UK’s new car market grew for the second consecutive month in June, as registrations rose 6.7% to 191,316 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). It was the best June since 2019, helping lift first half performance 3.5% above the same period last year, although the market remains -17.9% behind pre-Covid levels.1

Despite a positive June performance, it too remained behind pre-pandemic levels, -14.4% lower than in 2019, and driven mostly by fleet activity with uptake climbing 8.5% to 114,841 units.2 Private retail demand grew 5.9% to 71,616 units but still accounted for just less than four in 10 new cars registered (37.4%). Business registrations fell -15.8% to 4,859 units.

New petrol registrations declined -4.2% and diesel volumes were flat (+0.2%), meaning their combined share of the market is now just over half (51.6%), with total electrified vehicle registrations (92,571) achieving a 48.5% market share. Registrations of vehicles with plugs rose strongly as battery electric vehicles (BEVs) jumped 39.1% to 47,354 units, equivalent to a quarter (24.8%) of the market, and plug-in hybrid electric vehicles (PHEVs) grew 28.8% to 21,382 units. The market for new hybrid electric vehicles (HEVs), meanwhile, fell by -8.5% to 23,835 registrations.

Across the first six months of 2025 new BEV registrations have risen 34.6% to 224,841 units but, at 21.6% market share, they remain significantly behind the 28% mandated for this year. Moreover, achieving even this level of market penetration has required discounts totalling £6.5 billion over the last 18 months.3 In a recent survey of automotive CEOs carried out for SMMT’s new Automotive Business Leaders Barometer, more than half (55%) said they believe the UK is significantly behind plan to meet the 2030 end of sale date for new cars powered solely by combustion engines.4

A lack of governmental purchase and charging incentives, combined with fiscal disincentives such as the newly applied VED Expensive Car Supplement (ECS), which is estimated to impose an effective fine of more than £360 million on BEVs bought from April in this year alone, are acting as a brake on BEV demand. Industry bosses have reaffirmed this, citing fiscal incentives for private BEV sales as the biggest single action needed to boost BEV demand, economic growth and the UK’s automotive manufacturing base – a key objective of government’s new Industrial Strategy.4

Mike Hawes, SMMT Chief Executive

A second consecutive month of growth for the new car market is good news, as is the positive performance of EVs. That EV growth, however, is still being driven by substantial industry support with manufacturers using every channel and unsustainable discounting to drive activity, yet it remains below mandated levels. As we have seen in other countries, government incentives can supercharge the market transition, without which the climate change ambitions we all share will be under threat.

Amending the ECS to remove the majority of BEVs from its scope and cutting VAT on new BEVs and public charging would boost demand significantly. This would also help deliver a vibrant domestic market, becoming a leader not just in decarbonisation but in affordability. If implemented for three years, an additional 267,000 BEVs – rather than fossil fuel vehicles – would be put on the road, driving down CO2 emissions by six million tonnes a year.5

Notes to editors

- June 2019 – 223,421 registrations

- YTD 2019 – 1,269,245 registrations

SMMT Update

Sign up

1: UK new car sales up in March 2025 and down in all other months since October 2024.

1: 161,064 units registered April 2019

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields