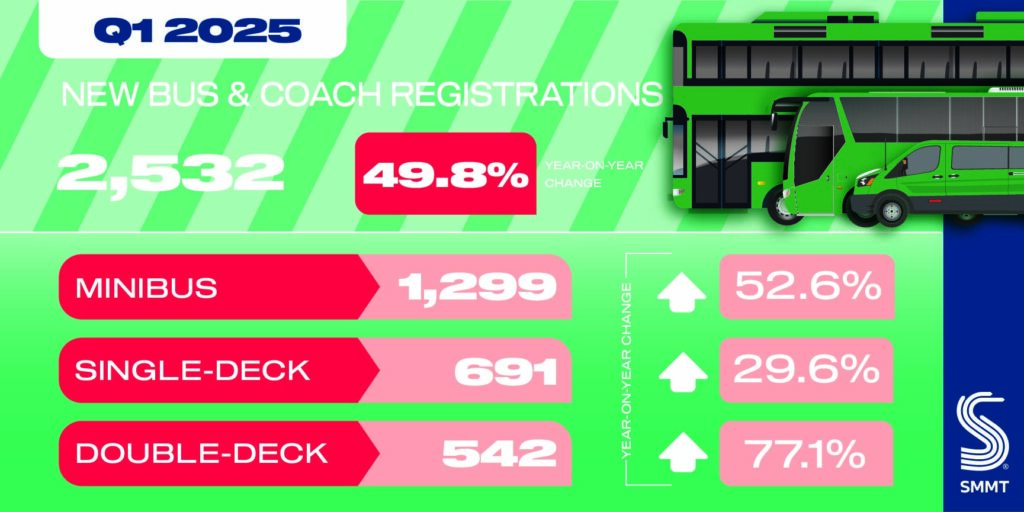

- New bus, coach and minibus deliveries up 49.8% to 2,532 units in first quarter of 2025.

- Rising demand across all segments with largest growth in double decker buses, up 77.1%.

- Sector leads UK road decarbonisation as zero emission uptake surges by 129.5% to reach more than a quarter of the market.

Data download

Bus & Coach Q1 registations

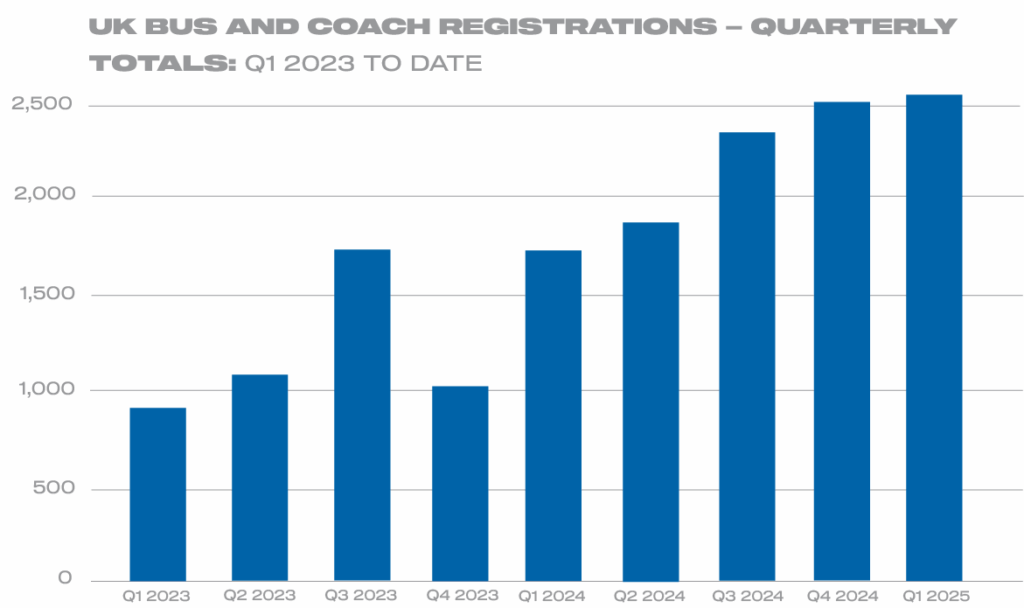

The number of new public service vehicles joining UK roads grew by half (49.8%) in the first three months of 2025 with 2,532 buses, coaches and minibuses registered, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The increase, compared with a particularly strong Q1 in 2024, is the eighth successive quarter of growth and represents the best start to a year since 2008.1 The growth reflects rising demand as increasing passenger numbers give fleet operators confidence to invest at levels not seen since before the pandemic.2

Demand rose across all segments in the quarter, with minibuses bringing the most substantial volume growth, up 52.6% to 1,299 units, while deliveries of new single decker buses and coaches increased by 29.6% to 691 units. The largest percentage growth, however, was for double deckers, surging by 77.1% to 542 units.

Buses have an essential role providing affordable mass mobility across every region – a role that will be enhanced with increased demand across all four British nations in Q1. In England, demand rose by 33.7% to 1,954 units – representing the lion’s share (77.2%) of the market – while deliveries in Scotland more than tripled, up 213.7% to 389 units. Wales and Northern Ireland, meanwhile, registered 148 and 40 units respectively – up 78.3% and 90.5% on the same period last year.

The bus sector is also pivotal to decarbonisation and, impressively, the UK remains Europe’s largest market for new zero emission buses by volume – a position solidified by a more than doubling of demand in Q1, up 129.5% to 739 units. With single and double deckers representing the vast majority of zero emission rollout, these now account for more than a quarter (29.2%) of the overall market – making the sector Britain’s most advanced for road transport decarbonisation. It is a significant achievement thanks to major manufacturer innovation, offering almost 20 different models, as well as funding from the Zero Emission Bus Regional Area (ZEBRA) grants.

While many of the UK’s largest operators have committed to ambitious decarbonisation timelines and have the resources to secure funding support, a long-term strategy is needed to help smaller and rural operators make the switch. Such operators can face additional challenges including lower ridership, tighter margins and longer routes, making the business case for zero emission vehicles more difficult. Targeted funding and infrastructure rollout will be needed, therefore, including a national plan for depot and shared hub infrastructure – ensuring no region, operator, driver or passenger is left behind on the route to net zero.3

Eight consecutive quarters of bus rollout growth reflects recovering passenger numbers and, as a result, more operators investing in fleet renewal. The sector is an essential driver of growth in society and the economy and that growth is also green with zero emission rollout more than doubling to offer affordable access to sustainable mobility, cleaner air and quieter roads in more communities across the country.

Notes to editors

- UK new bus, coach and minibus registrations, Q1 2008: 2,670 units.

- Full-year 2024 was the best annual performance since 2008.

- SMMT, Next Stop, Net Zero: The Route To A Decarbonised UK Bus Market.