- Car production rises for second successive month, up 5.6% in July to 69,127 units.

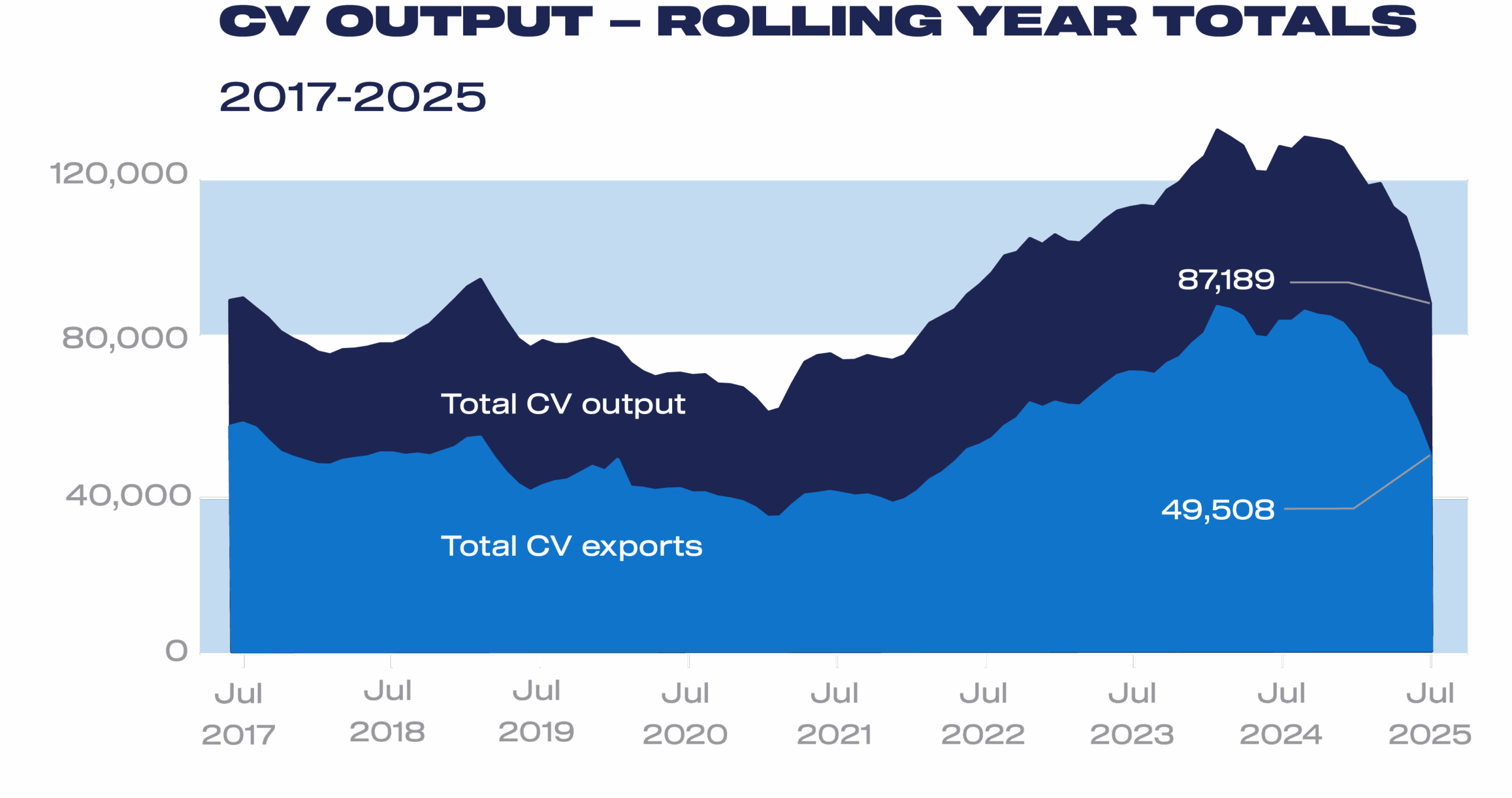

- Commercial vehicle output falls -81.1% reflecting restructuring and bumper month last year.

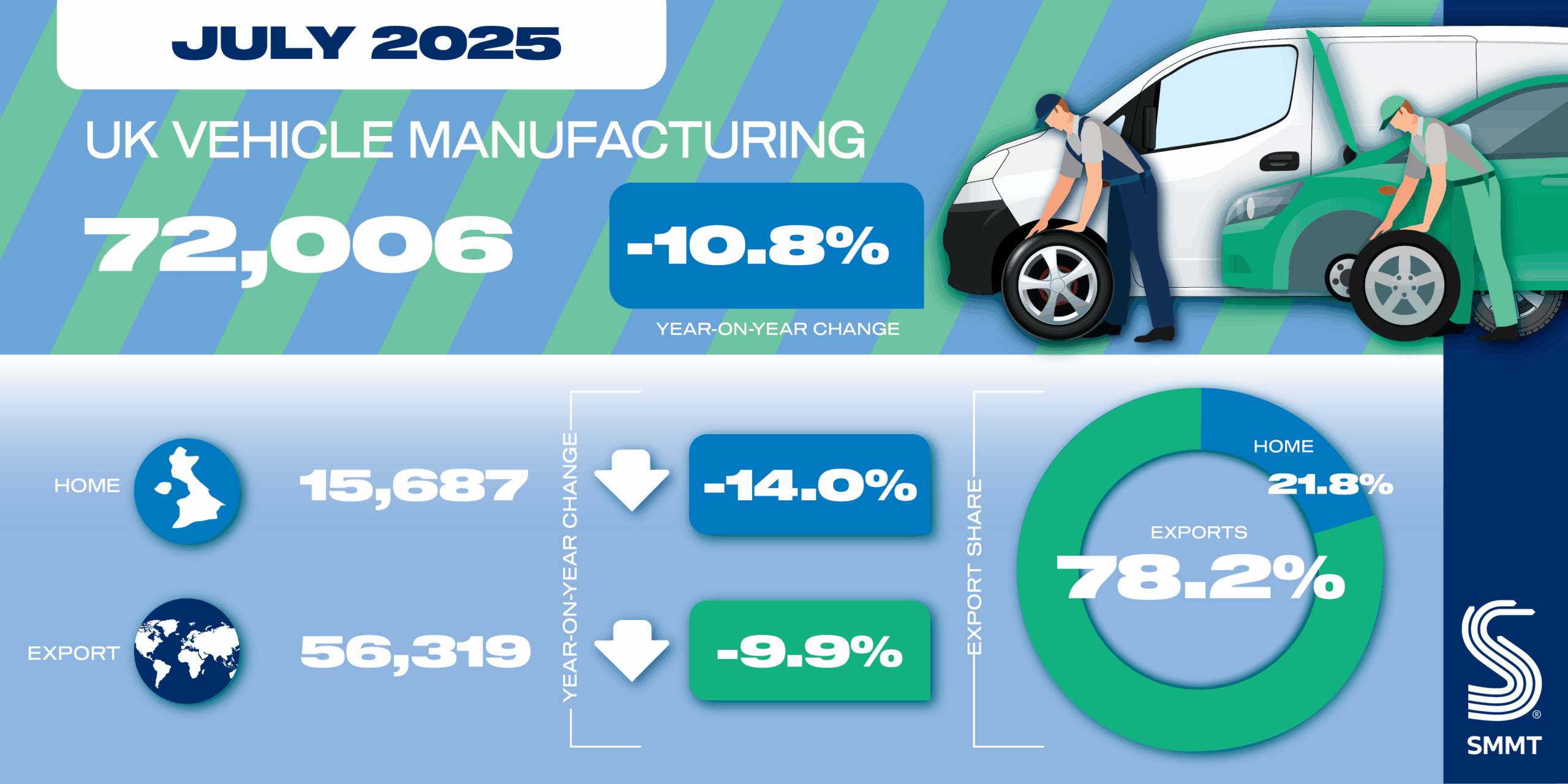

- Total vehicle production down -10.8% in the month to 72,006 units.

File download

UK New Vehicle Manufacturing July 2025

UK car production rose for the second consecutive month in July, up 5.6% to 69,127 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Commercial vehicle (CV) output, however, fell -81.1%, reflecting plant restructuring and a bumper month last year, when the sector recorded the best July in 17 years which, when combined, dragged total vehicle production down -10.8% to 72,006 units.1

Car production for domestic and export markets improved, rising 13.6% and 3.7% respectively with overseas markets taking by far the majority (79.4%) of output. The EU remained the main destination for UK car exports (45.6% share), followed by the US (18.1%) China (7.7%), Turkey (7.2%) and Japan (3.4%). While shipments to the EU and China fell by -7.9% and -7.1% respectively, output for Turkey and Japan grew 35.4% and 14.9%. Exports to the US, meanwhile, rose by 6.8% to almost 10,000 units, reversing three straight months of decline.

The US remains the largest single national market for British built cars, underscoring the importance of the UK-US trade deal, and July’s performance illustrates the impact of this deal which came into force on 30 June. Australia, Canada, Korea, the UAE and Switzerland rounded off the top 10 export markets, although combined they represented just 6% of all shipments in the month.

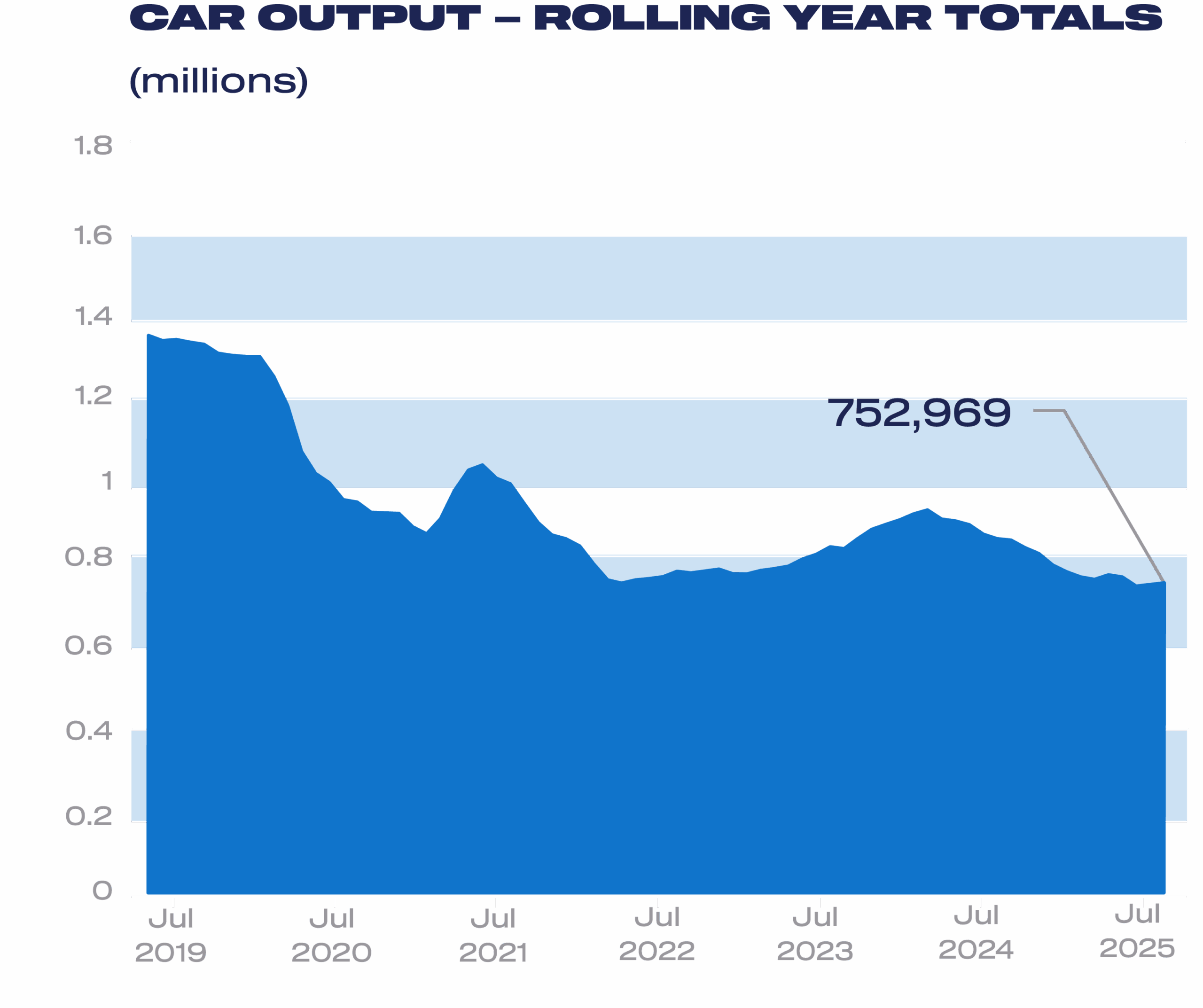

In the year to date, total vehicle output is down -11.7% with just shy of half a million units (489,238) produced. However, the latest independent production outlook for light vehicles anticipates growth to return in 2026, with output expected to rise 6.4% to 803,000 units. Rapid implementation of the new Industrial Strategy – including the dedicated automotive sector programme DRIVE35 – plus measures to reduce energy costs, accelerate infrastructure rollout and address skills gaps should help improve the UK’s competitiveness and ability to attract investment.

Mike Hawes, SMMT Chief Executive

It remains a turbulent time for automotive manufacturing, with consumer confidence weak, trade flows volatile and massive investment in new technologies underway both here and abroad. Given this backdrop, another month of growing car output is good news – signalling the sector’s underlying resilience in the face of intense global competition. To unlock sustained growth, however, government strategies must become tangible actions as a thriving automotive sector can support well paid jobs and economic development across the UK.

Notes to editors

The next release will be published on Thursday, 25 September 2025

- 1: 15,252 CVs turned out in July 2024

SMMT Update

Sign up

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields