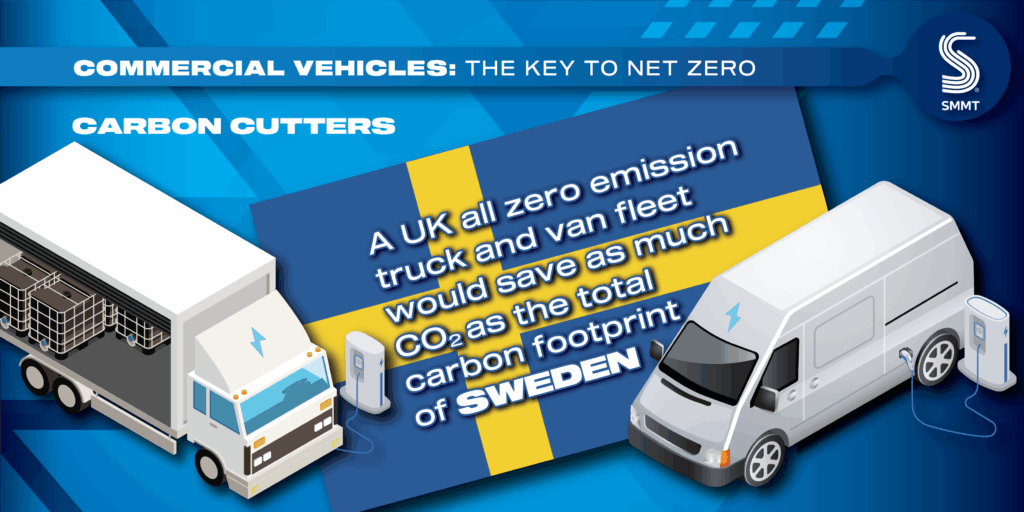

- Switching to zero emission commercial vehicles would shrink UK’s carbon footprint by 35.7 megatonnes – more than the total emissions of Sweden.

- Current grid processes mean truck and van operators may wait up to 15 years for depot charging connections – past the end of sale date for all new non-zero emission commercial vehicles.

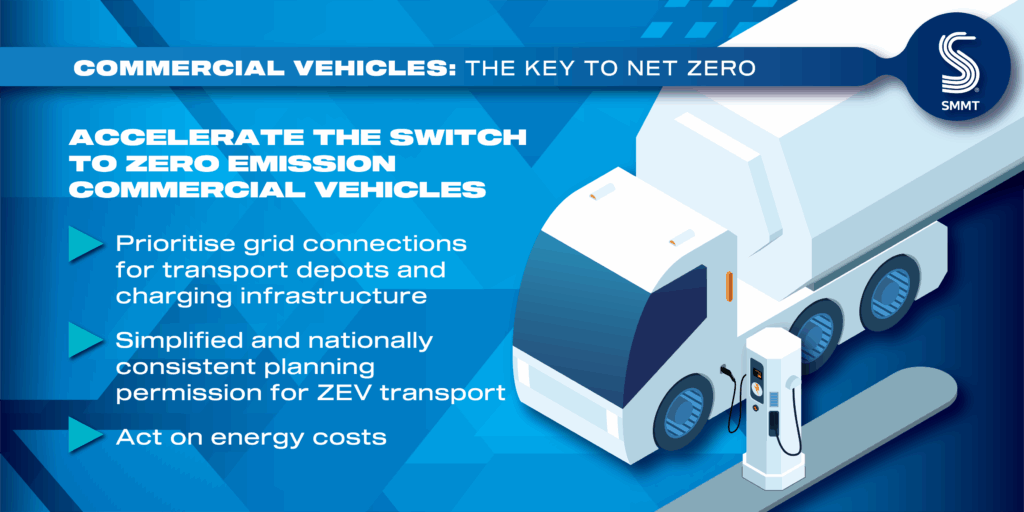

- Industry calls for planning overhaul, prioritised grid connections and action on energy costs to cut carbon, improve air quality and drive economic growth.

- Commercial Vehicle Show 2025 showcases huge range of zero emission vans and HGVs on offer as long-term infrastructure strategy for goods vehicles urgently needed to boost investment confidence.

Decarbonising commercial vehicles (CVs) is crucial for delivering net zero – but current grid connection processes mean many operators’ EV investments are blocked and will remain so even after fossil fuel vehicle sales end, according to new analysis by the Society of Motor Manufacturers and Traders (SMMT).

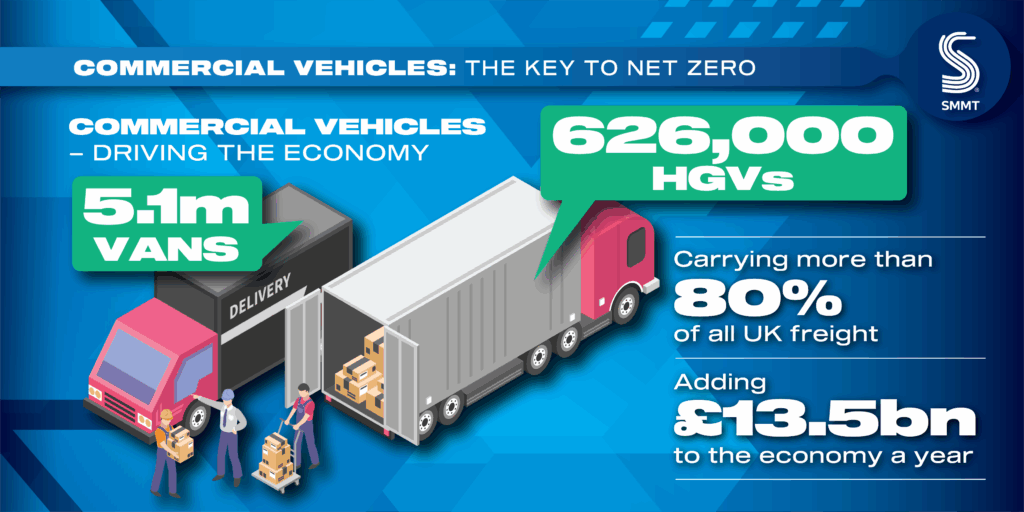

Around 5.1 million vans and 626,000 trucks are currently on UK roads,1 all helping to keep Britain on the move by transporting more than 80% of all domestic freight and directly adding £13.5 billion to the economy each year.2 While CVs make up 14% of all vehicles on the road, their higher mileages and energy demands make them responsible for more than a third of all road transport CO2 – and almost an eighth (12%) of the UK’s carbon footprint.3 Replacing conventionally fuelled CVs with zero emission vehicle (ZEV) models is critical to the achievement of net zero – and transitioning the entire fleet would deliver a CO2 savings greater than the total carbon footprint of Sweden.4

As business tools, investment in new vans and trucks must be commercially and operationally viable. But deriving the full benefits of going electric requires affordable energy, access to depot charging and access to charging facilities suitable for larger vehicles across the UK’s strategic road network. The fact that companies currently face wait times of up 15 years for grid connections is the biggest barrier to EV adoption,5 and is too late not just for 2035 – when the sale of new, non-ZEV vans and HGVs under 26 tonnes is due to end – but for 2040 when all new HGVs sold in the UK must be zero emission.

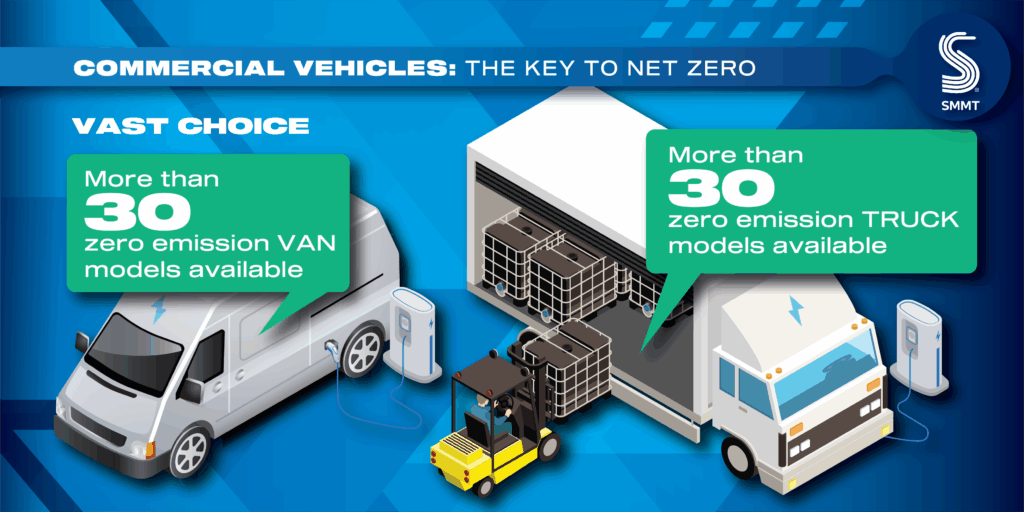

Massive manufacturer investment means operators can now choose from 35 zero emission van models – more than half of the market – and more than 30 ZEV truck models. Uptake, however, remains significantly behind ambition with the ZEV mandate requiring 16% of new van sales to be ZEVs in 2025. Currently, electric van registrations are running at little more than half that (8.3%) with around 167,000 more expected to reach the road over the next three years – which would see the market reach 25% ZEV by the end of 2027, below the mandate target of 34%. The challenge is even steeper for the HGV sector, with ZEVs making up just 0.5% of registrations and accounting for fewer than 600 trucks currently in use.6

While grants for plug-in vans and trucks and government’s Zero Emission HGV and Infrastructure Demonstrator (ZEHID) programme continue to incentivise the zero emission commercial vehicle transition, action is needed now to remove administrative gridlock to investment.

Government recently announced that it will fast-track grid connections for data centres, wind farms and solar power installations. This preferential treatment, as well as consistent and efficient implementation of local planning policy, must also be afforded transport depots if the UK’s net zero and air quality improvement ambitions are to be realised. Together with more affordable energy and a faster rollout of infrastructure across the strategic road network, this would make the case for operator investment in ZEVs unarguable. To do otherwise risks ceasing the mass transition of the HGV sector before it has even begun, while holding back uptake of electric vans given they would use these same facilities.

Mike Hawes, SMMT Chief Executive

We cannot deliver net zero and improve air quality without decarbonising commercial vehicles. But if operators have to wait up to 15 years just to be able to plug them into their depots, there is no case for investment. Prioritising grid connections, alongside reform to planning and action on energy costs, would reduce barriers to adoption, ensuring commercial vehicles continue to carry the loads that keep our economy on the move whilst doing the heavy lifting the nation needs to reach net zero.

The analysis comes as industry gathers today at the National Exhibition Centre in Birmingham for the 25th Commercial Vehicle Show, the largest trade event for the UK’s road logistics sector. More than 200 exhibitors from across industry, including vehicle manufacturers, the supply chain, and services and solutions providers will be present, with more than 50 zero emission vans and trucks on display. As many as 15,000 visitors are expected to attend, many representing fleet operators looking to find out how to grow their business with a conference agenda that will demonstrate how businesses can succeed in a challenging global environment while delivering decarbonisation for the UK.New LCV registrations, March 2024: 52,916 units.

Notes to Editors

- SMMT Motorparc 2024

- RHA Industry Facts and Stats

- DESNZ UK territorial greenhouse gas emissions statistics: HGV and LCV CO2 emissions 2023: 35.7Mt CO2. Total road transport emissions: 98.6Mt. Total UK CO2 emissions: 302.8Mt.

- Emissions Database for Global Atmospheric Research

- DESNZ, 15 April 2025

SMMT Update

Sign up

Notes to editors

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields