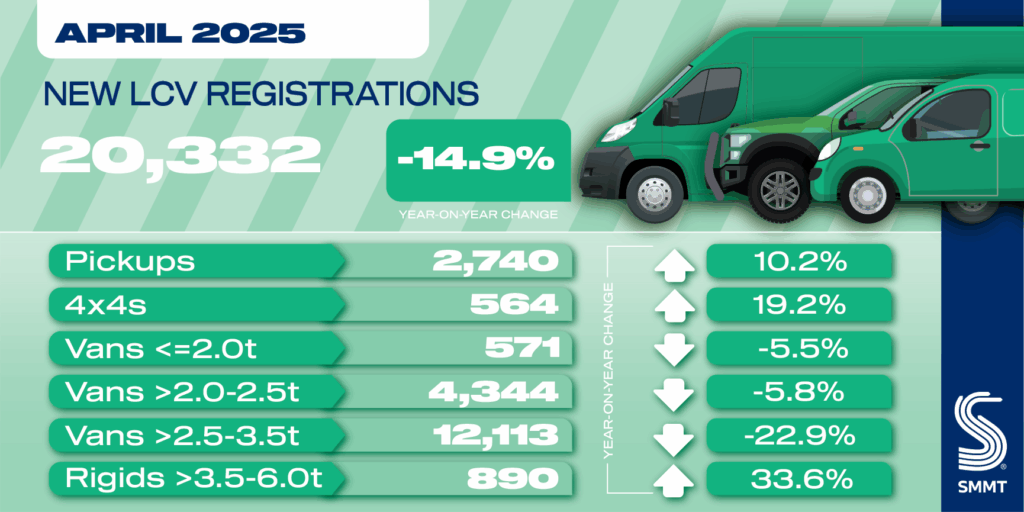

- New light commercial vehicle (LCV) deliveries fall -14.9% in April, the fifth consecutive month of decline.

- Demand for new vans of all sizes softens while 4x4s and pick-ups enjoy growth, but April double-cab tax change risks further decline.

- New electric van uptake surges by 77.5% – but still represents just half the 16% market share mandated in 2025.

- Manufacturers continue major investment in greenest model choices, but infrastructure planning overhaul needed to speed up decarbonisation.

Data download

new LCV registrations April 2025

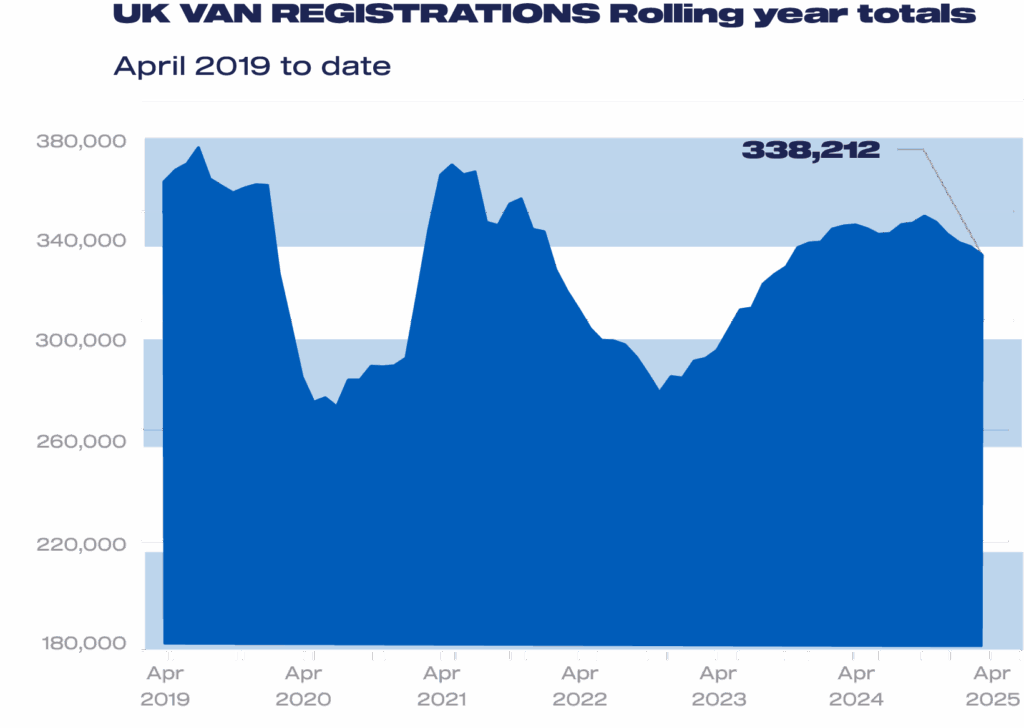

UK demand for new light commercial vehicles (LCVs) fell by -14.9% in April with 20,332 vans, 4x4s and pick-ups joining UK roads, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). It was the worst April performance since 2020, in part due to the timing of Easter, while it is also traditionally a low volume month and, therefore, subject to fluctuations.1 More concerningly, the decline marks the fifth consecutive month of falling demand as weak business confidence holds back investment in the very latest models.

April’s decline was led by -22.9% fewer registrations of the largest new vans, down to 12,113 units, albeit still representing almost six in 10 (59.6%) new LCVs. Deliveries of medium and small new vans also fell, by -5.8% and -5.5% to 4,344 and 571 units respectively. The contraction was softened by growth in new 4x4s, up 19.2% to 564 units while, more substantially, registrations of pickups rose for the second consecutive month, by 10.2% to 2,740 units – likely reflecting the fulfilment of orders placed before the introduction of new fiscal measures to treat double-cabs as cars for benefit in kind and capital allowance purposes.

The tax change, which will heap additional costs on businesses across such sectors as farming, construction and utilities, risks forcing many companies to hold off placing new orders – keeping more polluting vehicles on the road for longer while, counterproductively, reducing tax revenues. SMMT continues to urge government to delay the change for at least one year and give industry, businesses and customers more time to prepare.

More positively, April demand for new battery electric vans (BEVs) weighing up to 4.25 tonnes grew for the seventh month running, surging by 77.5% to 1,686 units, representing 8.3% of the market – a significant 4.3 percentage point rise on the same month last year.2 Such growth is the result of massive investment by manufacturers, with the UK market now approaching 40 different models – an ever-increasing choice, with three new models launched at the Commercial Vehicle Show in Birmingham last week.

Industry remains fully committed to decarbonisation but BEV uptake during 2025 remains at 8.3%, little more than half the 16% market share mandated. While the Plug-in Van Grant remains essential to sustain demand at current levels, fleet operators need further action to switch sooner. With current grid connection procedures, in particular, meaning van operators may have wait up to 15 years for depot charging connections – past the sector’s 2035 end-of-sale date – an overhaul of the process is urgently needed.

Accelerating this transition, therefore, requires more commercial vehicle-specific public charging infrastructure across the UK’s strategic road network – along with more affordable energy and consistent, efficient implementation of local planning policy. Given government recently announced it will fast-track grid connections for data centres, wind farms and solar power installations, prioritisation must also be afforded to transport depots so that fleet operators can be confident to go zero emission sooner rather than later.

Mike Hawes, SMMT Chief Executive

Five months of shrinking demand for new vans reflects weaker business confidence and a challenging economic environment. Such conditions discourage fleet upgrades into new zero emission technology, meaning older, more polluting vehicles stay on the road longer.

Switching must have clear commercial benefits, so the sector needs bold and assertive action if ambitious mandate targets are to be met. Preferential treatment for grid connections, more affordable energy and consistent local planning – all are needed to make the case for going electric unarguable.

SMMT’s latest market outlook expects the new LCV market to fall by -4.3% to 337,000 units in 2025, almost 11,000 units fewer than expected in January, due to a more challenging economic setting and changes in vehicle taxation. The overall BEV share (up to 3.5 tonnes), meanwhile, is expected to end the year at just 9.1% before reaching 13.3% in 2026 – considerably below mandated targets of 16% and 24% this year and next.

Notes to editors

- New LCV registrations, April 2020: 3,387 units; April 2024: 23,889 units

- SMMT’s BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t