Automotive Intelligence

UK Automotive plays a critical role in the economy and society – keeping Britain on the move. It is a major contributor to the nation’s economic wellbeing, investing in and developing technologies to advance zero emission mobility, and providing well-paid skilled jobs in businesses and their supply-chains in all regions across the UK. Our commitment to business intelligence in the automotive industry enhances decision-making and market strategies.

keeping Britain on the move

Leading net zero, supporting high-value, rewarding jobs; delivering for the economy; producing cutting-edge technology; providing mobility to people, families and businesses; and driving exports and growth – a strong domestic automotive sector is rightfully an ambition of all nations.

The UK’s automotive industry is one of its most valuable assets and one of the world’s most diverse. It is home to manufacturers of cars, commercial vehicles, buses, engines, parts and components, as well as a thriving aftermarket and one of the most vibrant and progressive markets, seeking to lead on technological change.

CHAMPIONING COMPETITIVENESS

Automotive is global and the UK industry is not alone in its ambition, its transformation or its challenges. But the UK must also deal with changing trade relationships, markedly higher energy costs and the most ambitious timescale for regulatory measures to deliver zero emission mobility.

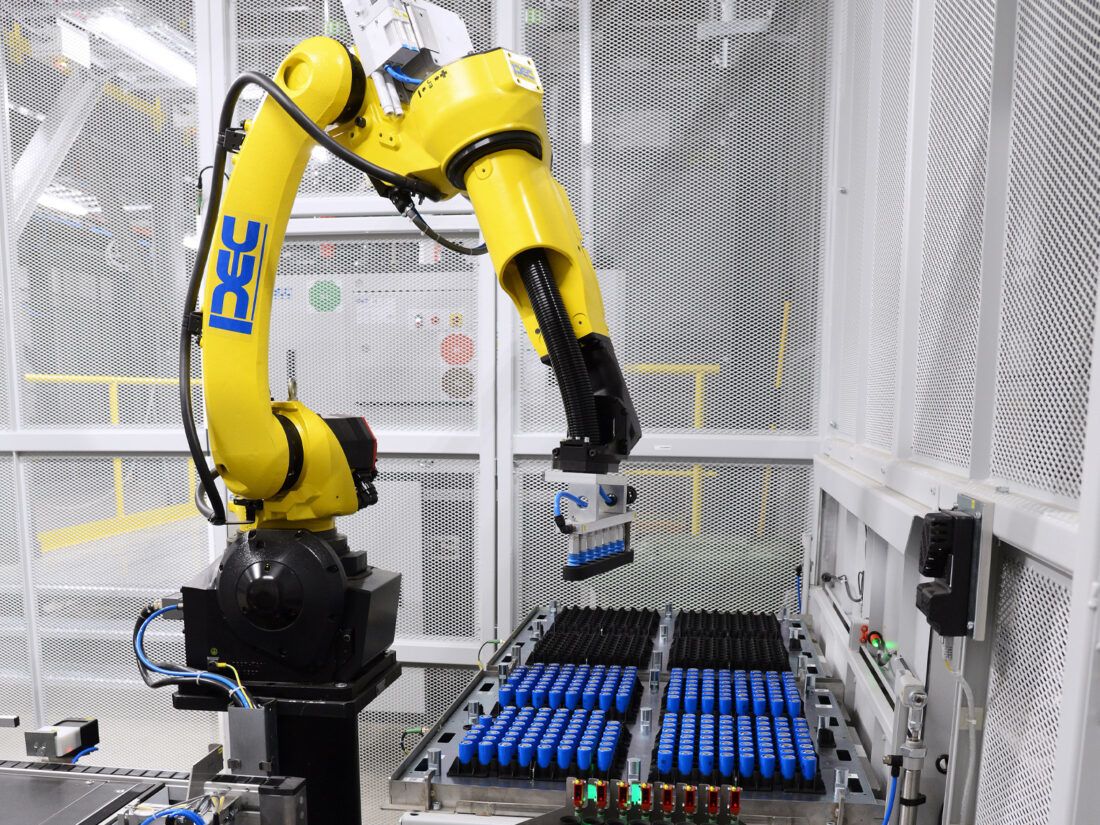

The race is on. We must create the most competitive conditions for investment; to build battery production and electrify supply chains; to upskill our globally renown workforce to ensure they are fit for the future; and to help our existing manufacturing base grow and prosper in the electrified age.

A comprehensive industrial strategy, aligned with an ambitious trade strategy, is crucial to ensure the competitiveness of UK Automotive, enabling innovation, attracting investment and securing manufacturing of – and markets for – clean technologies in the UK to deliver economic growth and zero emission mobility for all.

Reports & Insights

The UK’s Small Volume Automotive Manufacturers

The UK is home to one of the world’s most diverse automotive industries and is a leading location for the design, prototyping, engineering and manufacturing of luxury, high performance and niche vehicles….

SMMT Motor Industry Facts 2025

UK Automotive Trade Snapshot 2024

SMMT Update

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields