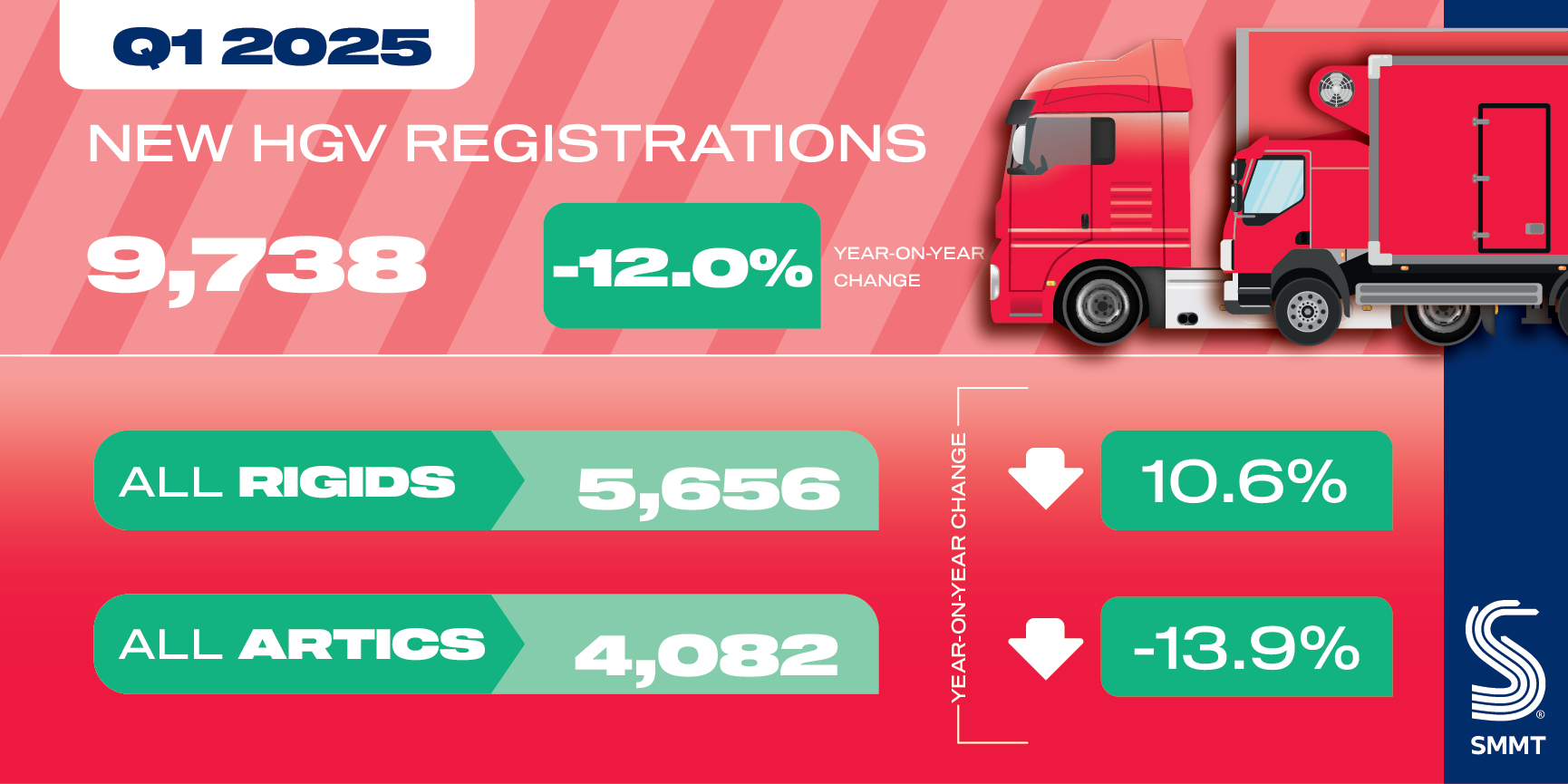

- New HGV registrations fall by -12.0% in Q1 as market continues to normalise post-pandemic.

- Rising deliveries of new refuse trucks but demand declines in other segments.

- Zero emission truck uptake rise 94.0% to reach record level but still just 1.0% of the market as grid connection challenges inhibit decarbonisation.

Data download

HGV registrations Q1

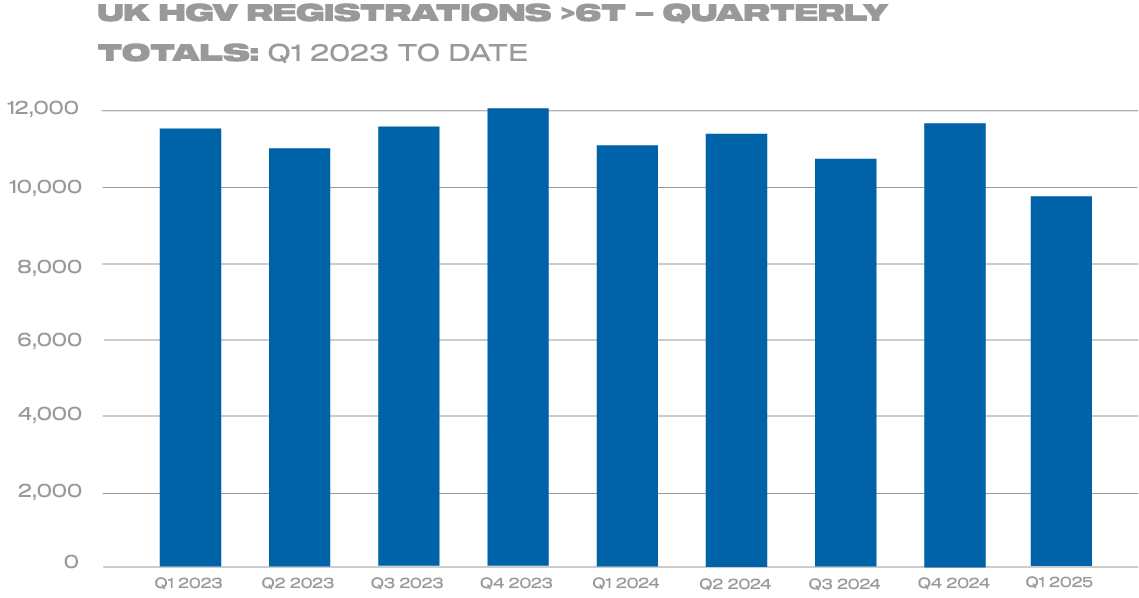

Britain’s new heavy goods vehicle (HGV) market declined by -12.0% in the first three months of 2025 with 9,738 new trucks joining the road, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The decline is in comparison with a relatively strong Q1 last year – the second-best first quarter since 2019 – as order volumes continue to normalise following the Covid pandemic.1

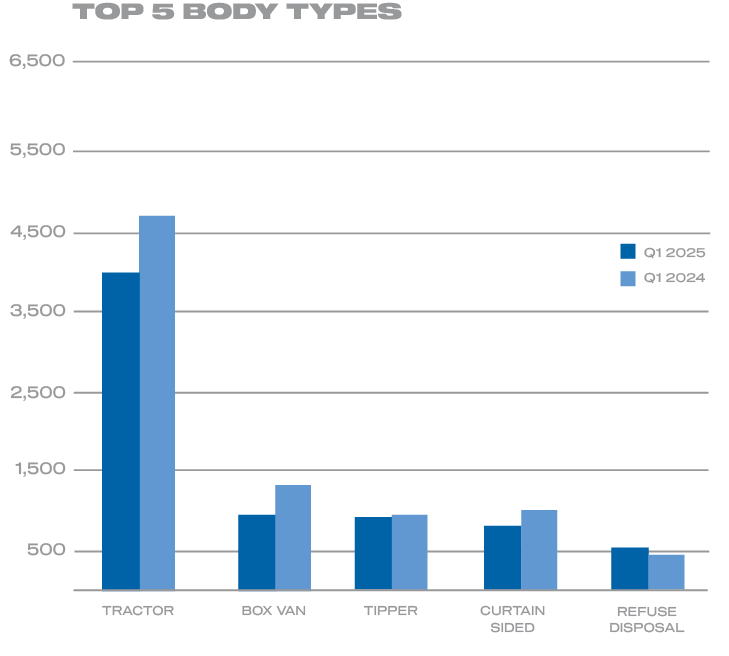

The bulk of the decline came from a -15.0% fall in registrations of new tractors, at 3,953 units in the quarter, accounting for 40.6% of the overall market in the quarter. Demand for new box vans and curtain-siders also fell, by -26.3% and -18.1% to 959 and 767 units respectively, while new tipper registrations dipped by just -4.6%, equivalent to 41 units. Bucking the trend, demand for refuse collection vehicles rose, up 20.6% to 520 units.

Registrations of new zero emission HGVs almost doubled, up 94.0%, albeit translating to just 97 units. With an overall market share of 1.0%, up from 0.5% a year ago, this is the highest proportion of zero emission trucks registered in a quarter, demonstrating small but growing demand for the very latest and greenest models after flatlining last year.1 Manufacturers continue to invest heavily in innovation with 35 models currently available as zero emission – an impressive array of vehicle technology that can meet the needs of many different use cases.

Zero emission HGVs still remain a fraction of the market, however, and must grow rapidly over the next decade if the UK is to achieve its target for all new HGVs up to 26 tonnes – the majority of the market – to be zero emission by 2035, with the remainder of the sector following by 2040. The heavy commercial vehicle transition continues to be supported by government’s improved Plug-in Truck Grant and its Zero Emission HGV and Infrastructure Demonstrator (ZEHID) programme but immediate action is needed to remove onerous planning procedures that prevent timely rollout of charging and refuelling infrastructure at depots – meaning operators may have to wait up to 15 years for a grid connection – as well as on the strategic road network.

The transition can be accelerated by affording transport depots the same priority for fast-tracked grid connection as that recently announced for data centres, wind farms and solar – along with a national strategy that delivers HGV-suitable infrastructure at public and en-route locations. Guaranteeing more affordable depot and public charging would further underline the case for operators to switch sooner – delivering cleaner air and quieter streets, and cutting operating costs.

As the UK’s new truck market normalises after a turbulent few years, industry is already setting a new course for green growth with three dozen different zero emission models now available, and a record quarterly market share. Onerous planning processes, however, are acting as a handbrake on depot and public infrastructure, and fast-tracked grid connections are essential if more HGV fleets are to be decarbonised.

Notes to editors

- HGV market Q1 2024: HGV growth stabilises while zero emission market share rises – SMMT

- Zero emission trucks represented 0.5% of the overall HGV market in full-year 2024, the same share as 2023.