- Car and commercial vehicle manufacturing declines -11.9% in first half of 2025 as global trade disruption and economic uncertainty reduce output.

- Pressures begin to ease in June as car production increases by 6.6%.

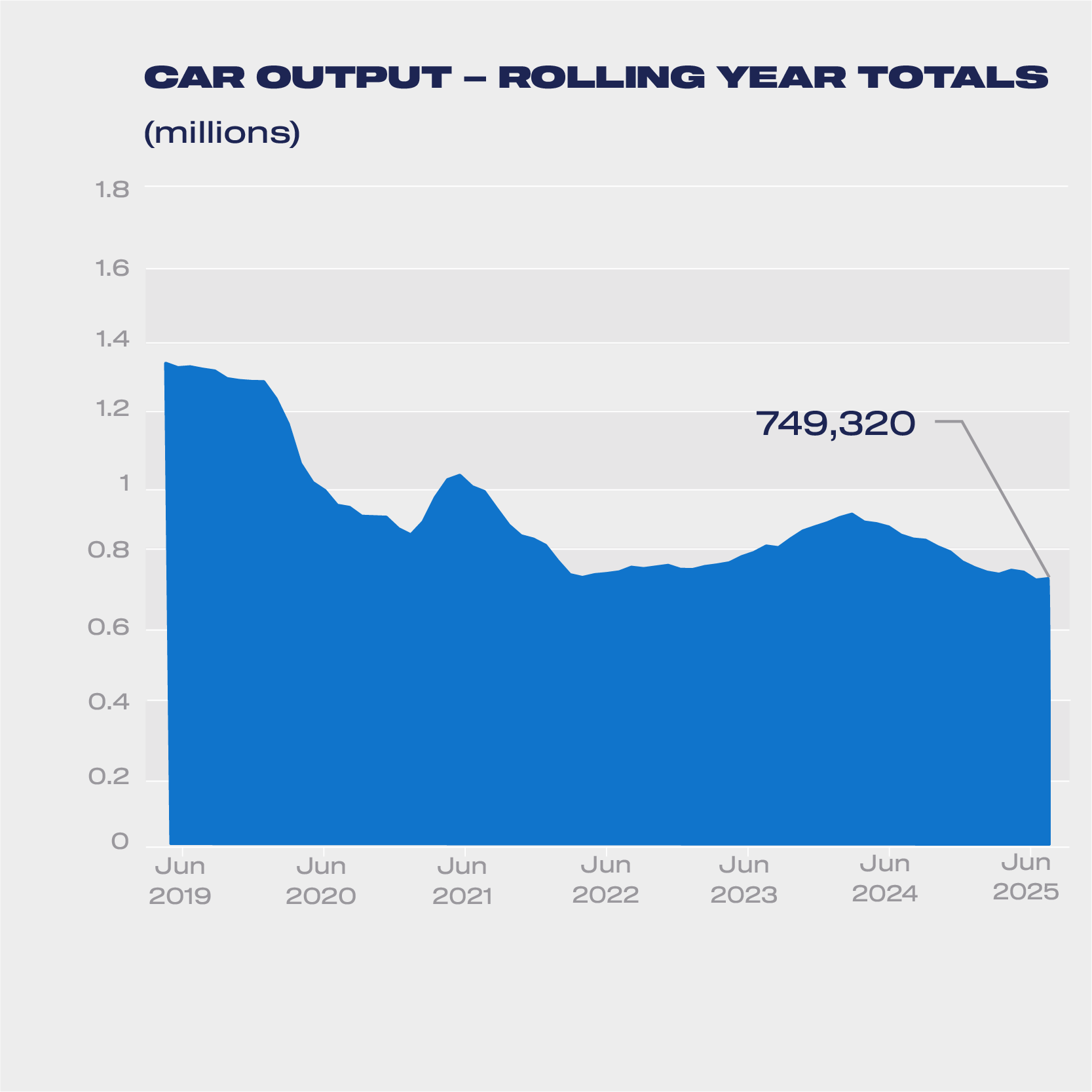

- Total annual output anticipated to fall by -15% to 755,000 units, but reversal expected in 2026 with 6.4% growth now anticipated, back to more than 800,000 units.

File download

UK New Vehicle Manufacturing June 2025

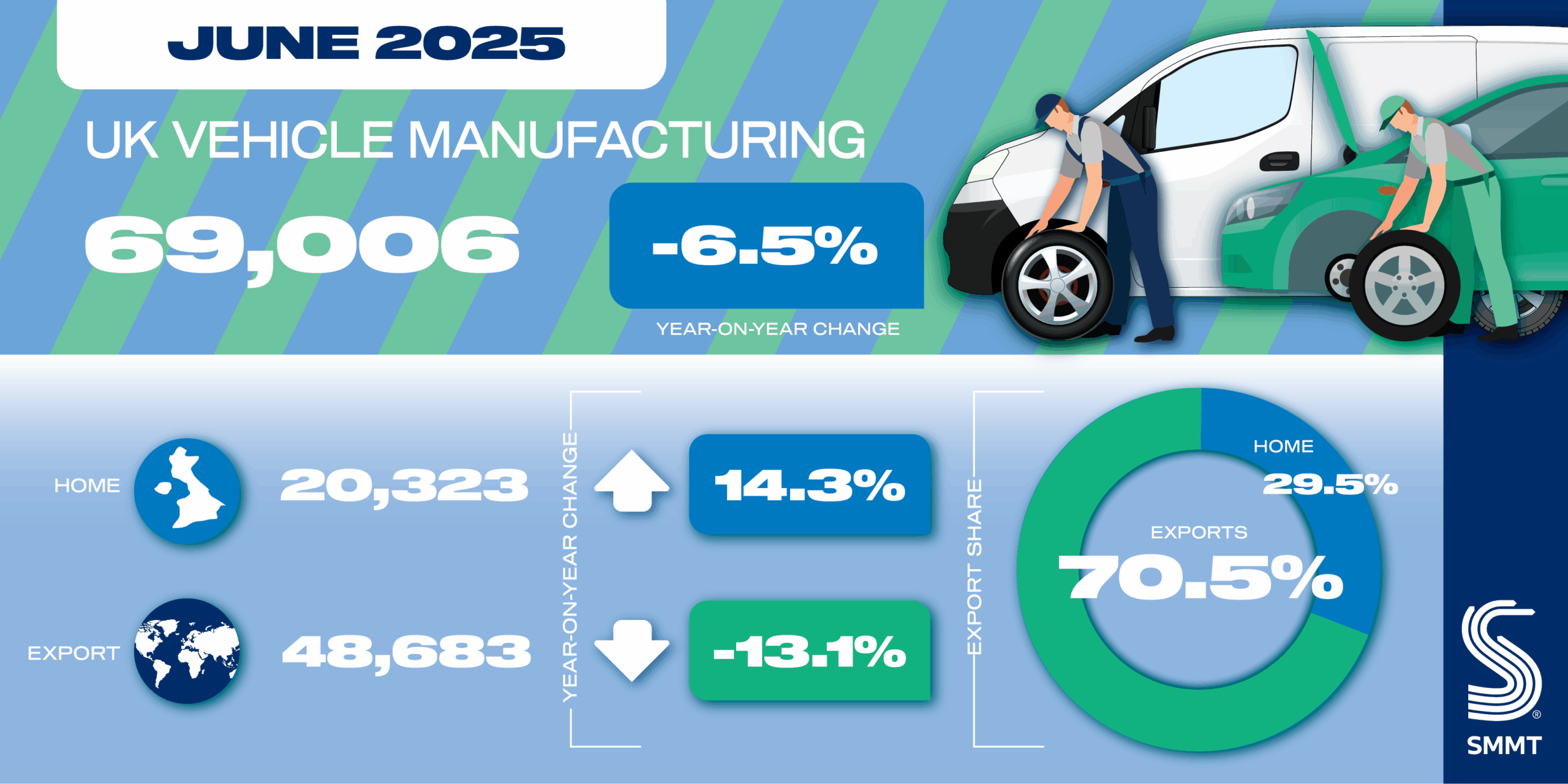

UK new vehicle manufacturing declined by -11.9% to 417,232 units in the first six months of the year, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

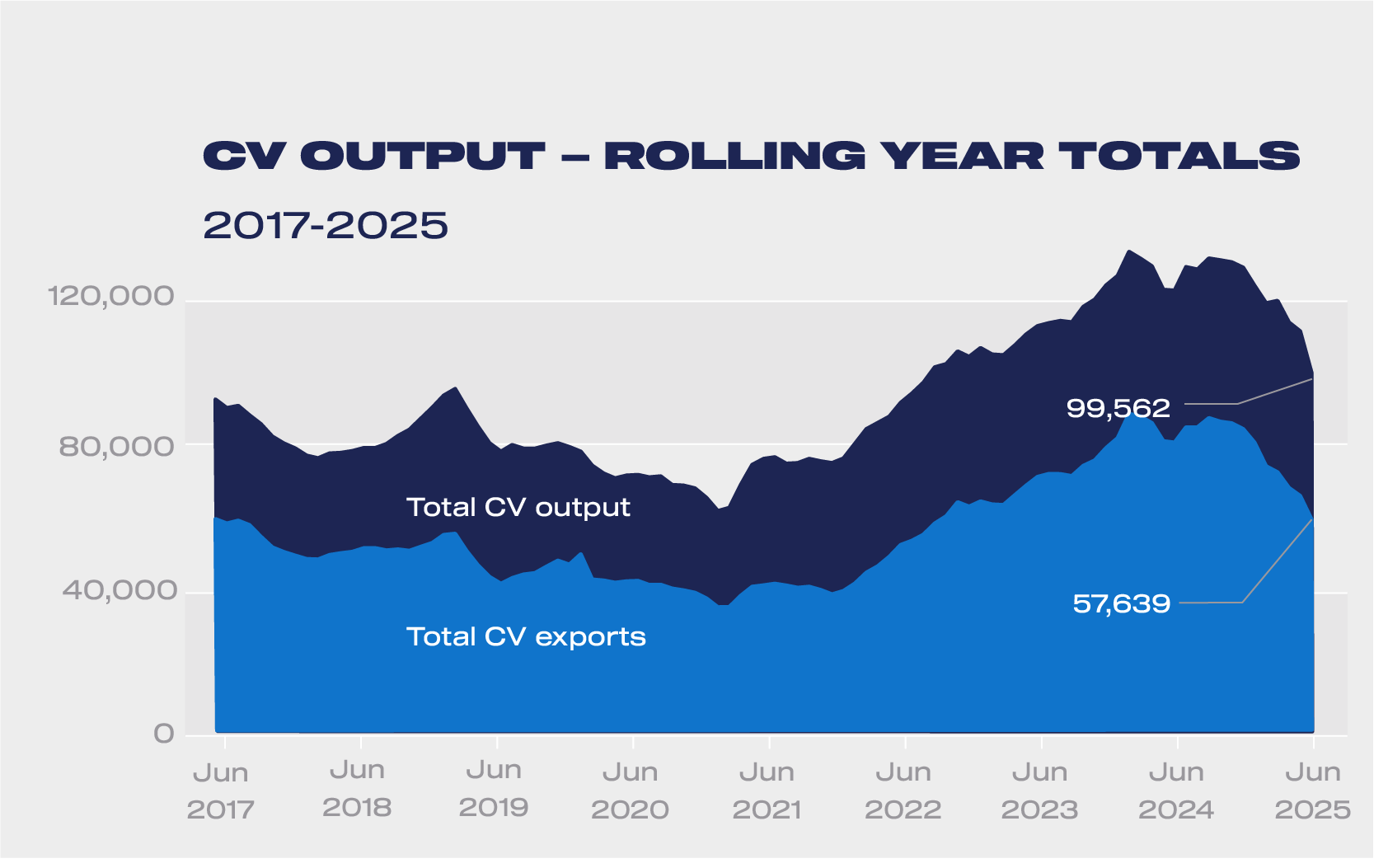

The decline was softened by a 6.6% increase in car production in June, although this was in comparison with last year when model changeovers and supply chain issues stymied output.1 As a result, year-to-date car output declined by -7.3% as 385,810 cars rolled off factory lines. Restructuring at commercial vehicle production plants, meanwhile, resulted in a first-half volume fall of -45.4% to 31,422 units.

While overall output fell, electrified car production rose by 1.8% to 160,107 units – delivering a record share of output for the first half of the year, with hybrid, plug-in hybrid and battery electric vehicles accounting for more than two in five (41.5%) units produced in the UK in 2025.

UK car production remains export-focused, with 76.9% of output headed overseas year-to-date and greater certainty now returning to key markets. The EU remains the main destination for UK car exports (54.4% share), followed by the US (15.9%) China (7.5%), Turkey (4.1%) and Japan (2.7%), with these five destinations alone accounting for more than eight in 10 overseas sales. Despite three straight months of declining export volumes culminating in an -18.7% drop in June, the US maintained its position as the UK’s biggest single export market underscoring the importance of the UK-US trade deal. That deal, which came into force on 30 June, gives the UK reduced tariff rates into the US automotive market, which can become a basis for future growth.

With the global economy continuing to be buffeted by economic and trade uncertainty, the latest independent production outlook anticipates total 2025 vehicle output will fall by -15% to 755,000 units in 2025, but an expected 6.4% increase next year would take total production to 803,000 units.

Rapid implementation of the new Industrial Strategy, however, with wider measures to reduce energy costs, accelerate infrastructure, and address skills gaps, could restore the UK’s competitive edge, returning Britain to a top 15 global auto manufacturing location and providing an additional £50 billion economic windfall. The government’s automotive sector strategy, DRIVE35, also sets out a package of measures which will support the sector and its economic and environmental ambitions. Furthermore, with the announcement of the Electric Car Grant, which provides £650 million of fiscal incentives for EVs, there is the potential to energise the domestic market that underpins the UK’s attractiveness as an industrial investment opportunity.

Mike Hawes, SMMT Chief Executive

Global economic uncertainty and trade protectionism have taken their toll on automotive production across the globe, with the UK no exception. The figures are not, therefore, unexpected but remain very disappointing. However, there are foundations for a return to growth.

The industry is moving to the technologies that will be the future of mobility, our engineering excellence, highly-skilled workforce and global reputation are strengths, and we have an Industrial Strategy with advanced manufacturing and automotive at its core. With rapid delivery and the right conditions, UK Automotive can reverse the current decline and deliver the jobs, economic growth and decarbonisation that Britain needs.

Notes to editors

- UK car production June 2024: 62,231 units, down -26.6%

SMMT Update

Sign up

SMMT Update

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields