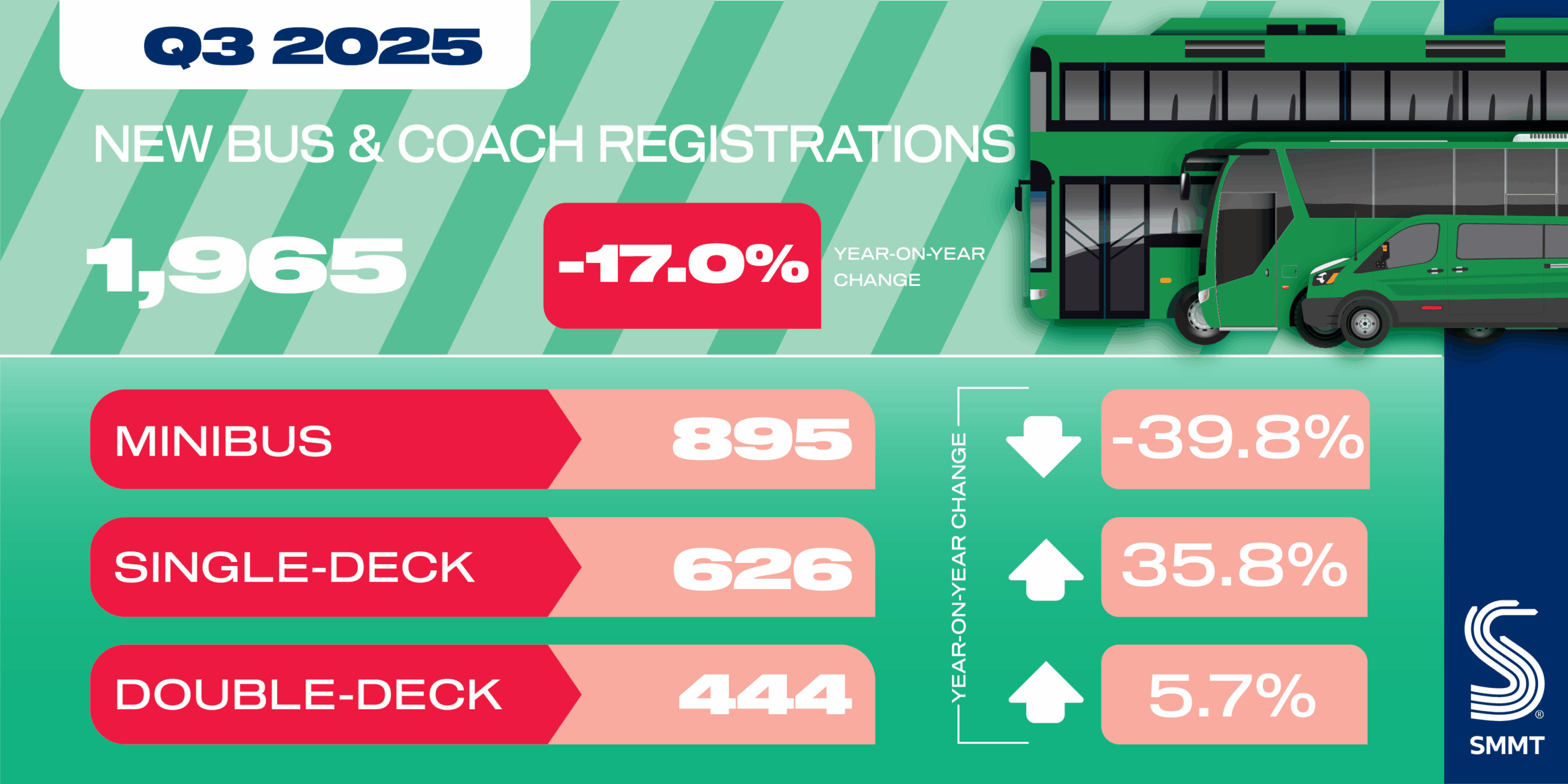

- New bus, coach and minibus market down by -17.0% to 1,965 units in Q3.

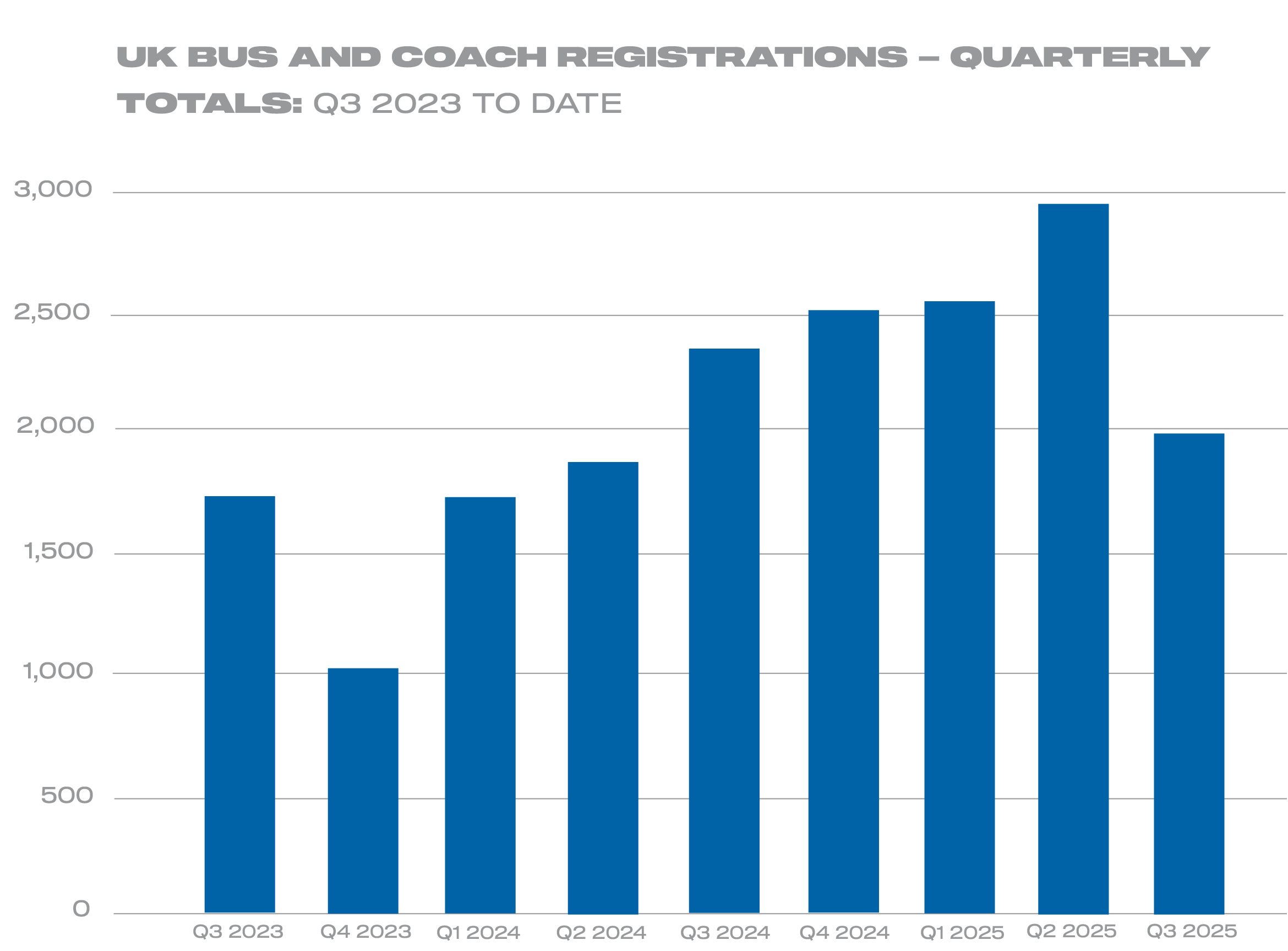

- Strong growth in year-to-date market, however, up 26.9% with 7,465 registrations.

- More than one in four (28.7%) registrations are zero emission in first nine months of 2025.

Data download

Bus & Coach Q3 registations

UK registrations of new buses, coaches and minibuses fell -17.0% in the third quarter of 2025, reaching 1,965 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT). The decline marks the end of nine consecutive quarters of growth, with falling minibus registrations chiefly responsible, volumes down -39.8% to 895 units following strong growth in the same period last year. Single and double-deck bus and coach registrations, however, both rose – up 35.8% and 5.7% to 626 and 444 units respectively.

Zero emission vehicle uptake also recorded growth, rising 16.3% in the quarter to 563 units and accounting for more than a quarter (28.6%) of all new buses, coaches and minibuses joining the road in July, August and September. Diesel registrations, meanwhile, declined -25.5% to 1,402 units. This progress reflects significant industry investment in new technologies, with more than 20 zero emission models now available, alongside government support through Zero Emission Bus Regional Area funding.

England accounted for 87.0% of the market, equivalent to 1,709 registrations, although the performance was down -17.9% on the same period in 2024. The second largest market, Scotland, saw the most growth, up 96.9 % to 191 units, while fleet renewal declined in Wales and Northern Ireland – down -65.9% and -61.9% – but at small volumes of just 57 and 8 registrations respectively.

Despite the overall quarterly decline, 2025 still saw the second best Q3 since 2017,1 while year-to-date registrations are 26.9% above 2024 volumes, at 7,465 units. More than half (53.5%) of demand has been driven by minibuses, with an uplift of 23.4% meaning almost 4,000 have gone into service since January. Registrations of single and double decker buses, meanwhile, have risen by 28.4% and 35.0% respectively, with 1,965 and 1,503 units joining the road this year.

Even more positively, more than one in four (28.7%) new registrations in the first nine months have been zero emission, equivalent to 1,918 units and up 55.9% year on year. The UK, as a result, remains Europe’s largest zero emission bus market2 – a significant achievement but one which can only be sustained with a renewed focus on delivering charging infrastructure fit for the sector. A long-term national infrastructure strategy with provision at depots, shared hubs and along routes will be vital to ensure zero emission mass transport becomes a reality for operators and passengers.

A dip in registrations is disappointing but not enough to stall fleet renewal year-to-date. Yet more growth in zero emission demand is good new as the sector continues to invest in new, cleaner models to give operators choice. Given the role these public transport vehicles play in delivering mobility for millions of people – especially in urban and rural areas – we must focus on speeding up the transition. That means investing in sector-specific charging and continuation of Zero Emission Bus Regional Area funding.

Notes to editors

- New bus, coach and minibus registrations, Q3 2017: 1,996 units.

- https://www.acea.auto/cv-registrations/new-commercial-vehicle-registrations-vans-8-2-trucks-9-8-buses-3-6-in-q1-q3-2025/