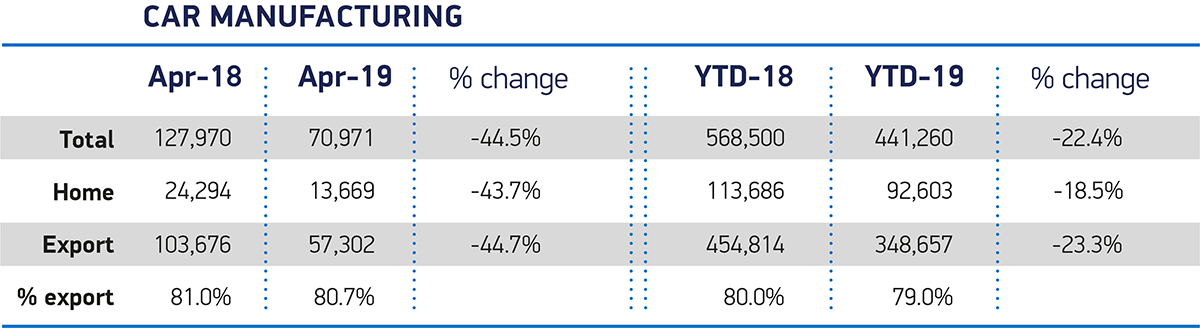

- UK car production falls -44.5% in April with 56,999 fewer units built in extraordinary month.

- Manufacturing for home and overseas markets down, by -43.7% and -44.7% respectively.

- Year to date performance shows underlying downward trend, with April 11th consecutive month of decline.

- SMMT repeats call for urgent action to end Brexit deadlock and prevent ‘no deal’ devastation.

British car manufacturing output plummeted by almost half in April, according to figures published today by the Society of Motor Manufacturers and Traders (SMMT).

70,971 cars rolled off production lines in the month, down -44.5% year on year as factory shutdowns, rescheduled to mitigate against the expected uncertainty of a 29 March Brexit, took effect in many plants across the UK.

Manufacturing for domestic and overseas markets fell -43.7% and -44.7% respectively as most volume manufacturers brought forward, and extended, production stoppages normally scheduled for the summer holiday period.

The shift in shutdown, which cannot now be repeated for a 31 October deadline, was part of a raft of costly and ongoing contingency measures, including stockpiling, rationalisation, training for new customs procedures and rerouting of logistics – all designed to try to protect business when the UK leaves the customs union and single market.

April’s dismal performance, the 11th straight month of decline, exacerbated the underlying downward trend, due largely to slowing demand in key international markets, including the EU, China and the US, as well as at home.

In the year to date, 127,240 fewer cars have been built compared with the same period in 2018 – a decline of more than a fifth (-22.4%) – with similarly large percentage falls in production for the UK and export.

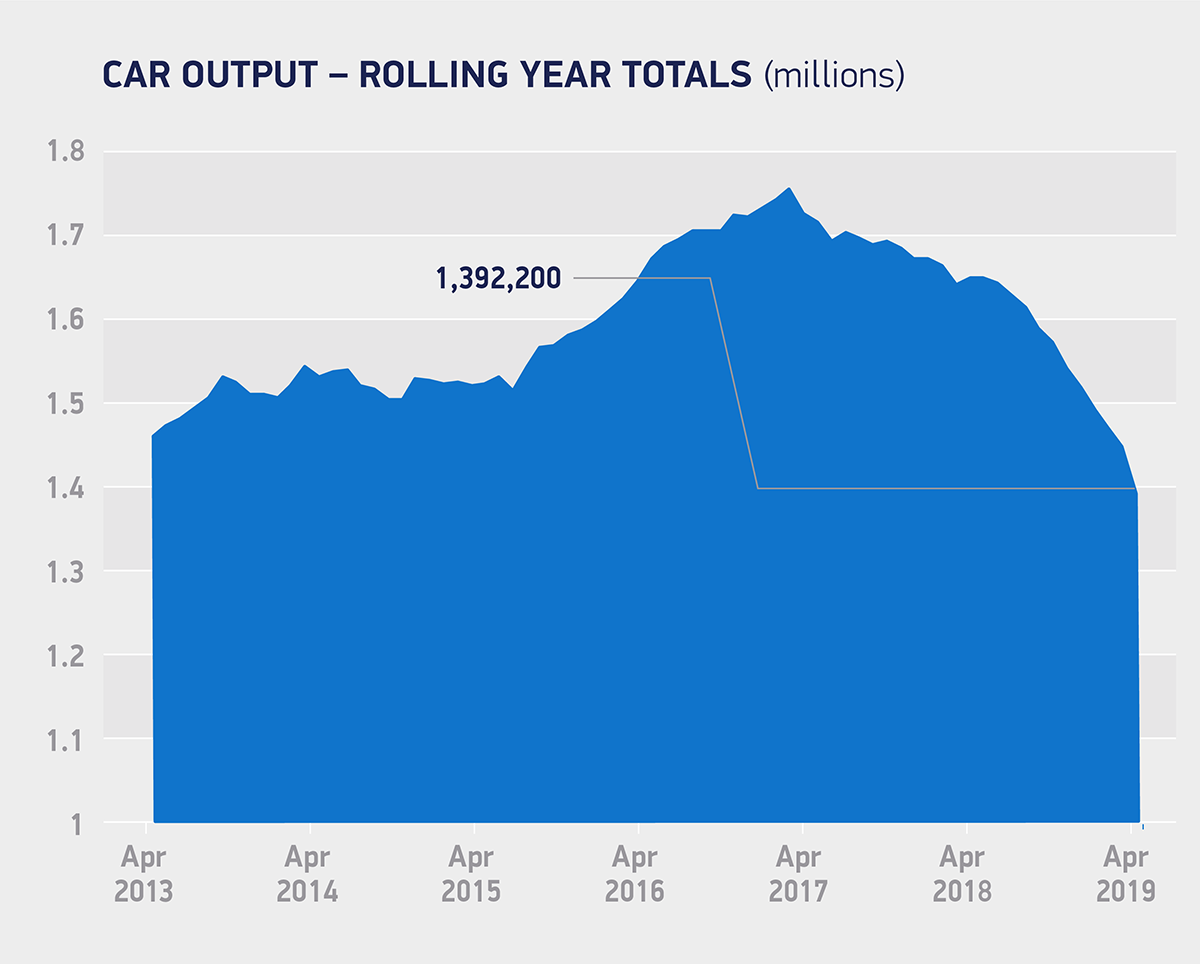

Provided the UK leaves the EU with a favourable deal and substantial transition period, and notwithstanding any escalation of global trade tensions, the decline in volumes is expected to ease by the end of the year, as new models come on stream and production lines remain active over the usual summer shutdown months.

However, the latest independent outlook suggests output will still be down some -10.5% on 2018 levels. A ‘no deal’ Brexit, however, could exacerbate this decline, with the threat of border delays, production stoppages and additional costs compromising competitiveness.1

Mike Hawes, SMMT Chief Executive, said,

Today’s figures are evidence of the vast cost and upheaval Brexit uncertainty has already wrought on UK automotive manufacturing businesses and workers. Prolonged instability has done untold damage, with the fear of ‘no deal’ holding back progress, causing investment to stall, jobs to be lost and undermining our global reputation.

This is why ‘no deal’ must be taken off the table immediately and permanently, so industry can get back to the business of delivering for the economy and keeping the UK at the forefront of the global technology race.

Notes to editors

1. The Production Outlook is an independent forecast of UK vehicle manufacturing commissioned from AutoAnalysis. It is updated up to four times a year to respond to market and production cycle fluctuations. The latest analysis, assuming a favourable Brexit deal and transition period maintaining the status quo, forecasts 1.36 million units for 2019, down from 1.52 million units in 2018.