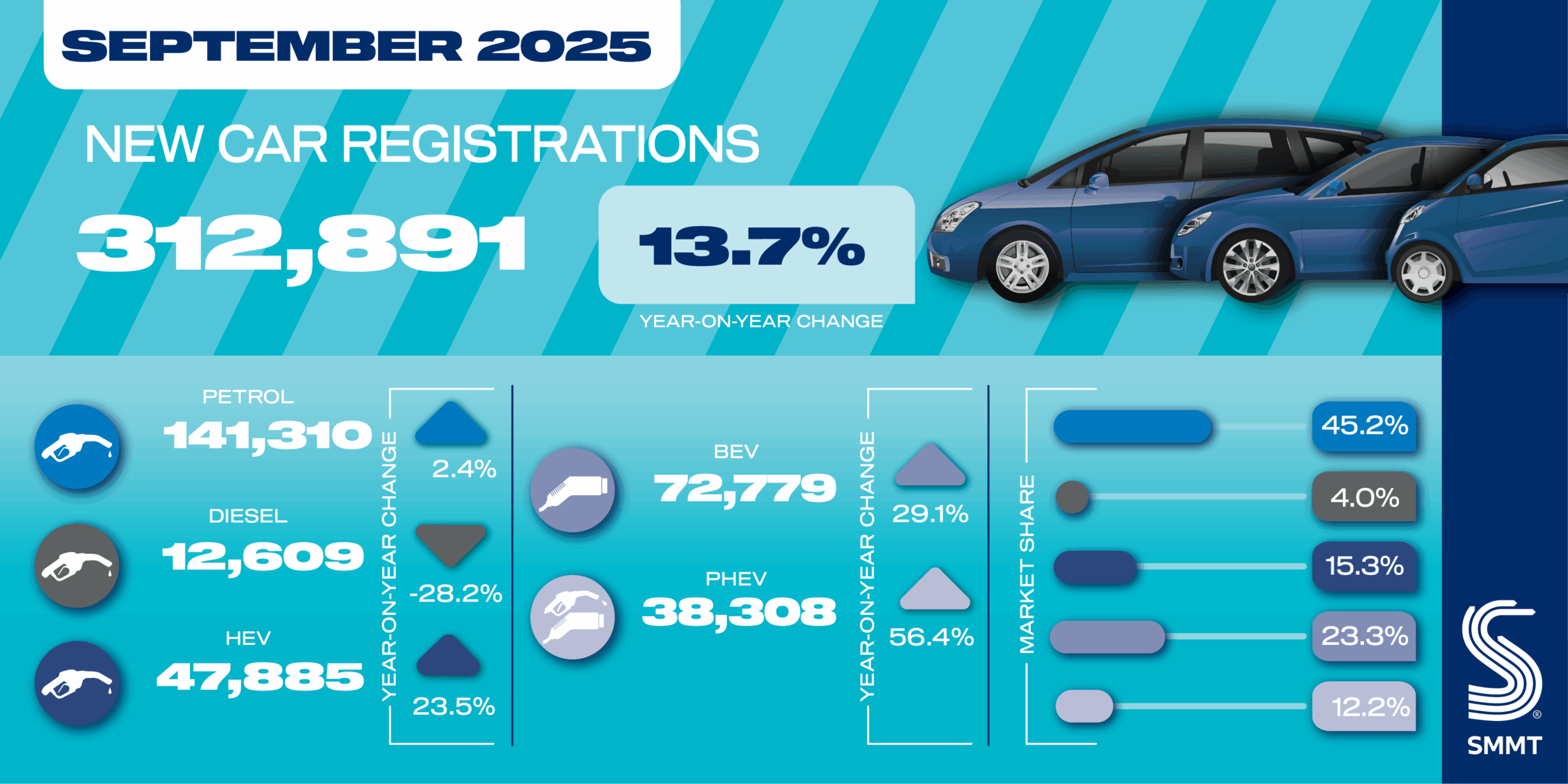

- New car market rises by 13.7% to reach 312,891 units – the best September performance since 2020.

- Manufacturer investments and model choice, complemented by new Electric Car Grant, deliver 72,779 new battery electric vehicles – the highest ever monthly volume and, when combined with hybrids, means electrified vehicles comprise the majority of registrations.

- Overall market up 4.2% YTD after second biggest month of the year, with BEV share rising to 22.1%.

Data download

New car registrations data September 2025

This press release was updated at 9am on 6 October, 2025 with final data

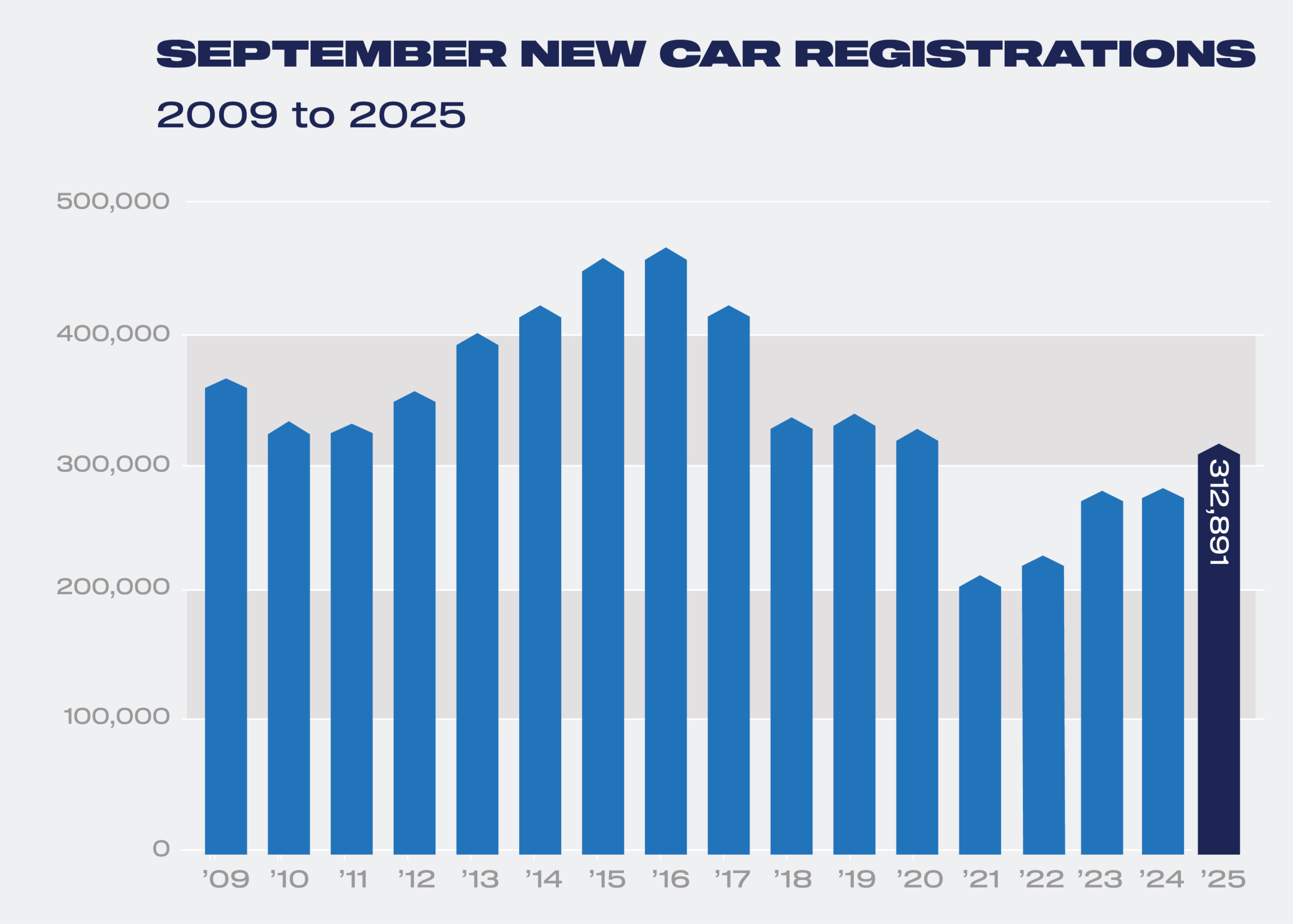

The UK new car market rose by 13.7% in September to reach 312,891 registrations, according to figures from the Society of Motor Manufacturers and Traders (SMMT). The performance was the strongest for the crucial ‘new numberplate’ month since September 2020 which, despite lockdown restrictions, remains the best so far this decade.1

All market sectors drove growth, with the biggest increase recorded by fleets, where volumes rose 16.9% to reach 174,336 units. Private consumer demand also rose, up 8.9% to 131,003 units, while business registrations rose 28.6% to reach 7,552 deliveries.

More than half (50.8%) of all new vehicles registered during the 75-plate month were electrified. Plug-in hybrids (PHEVs) were the fastest growing powertrain, rising 56.4% to achieve a 12.2% market share, while hybrid electric vehicles (HEVs) comprised 15.3% of deliveries. Battery electric vehicle (BEV) uptake grew by 29.1%, on par with the growth seen so far this year. With 72,779 registrations it was the best month on record for BEV volumes, accounting for 23.3% of the market, driven by manufacturer discounting, an ever-increasing choice of models, and the introduction of the Electric Car Grant, which provided added impetus in certain segments. Qualifying models – which comprise about 25% of available BEVs – enjoyed growth in uptake that outpaced the overall electric market.2

September typically accounts for around one in seven annual registrations and the strong performance offers a welcome boost after a summer slowdown. Demonstrating the sector’s resilience, overall demand year to date is up 4.2%, while the significant efforts to grow BEV demand are succeeding, with zero emission vehicles comprising more than one in five (22.1%) new cars registered so far in 2025.

Boosting demand is critical, with an ongoing gap between EV uptake and government targets. While rising electrified vehicle volumes can also help, private buyers, who account for fewer than one in four (24.5%) new BEV registrations year to date, must be re-energised with more confidence to switch to zero emission motoring. The Electric Car Grant can help break down one crucial barrier to uptake – affordability. Further efforts to sustain and grow demand, matching those already made by manufacturers, can help boost confidence, drive up volumes across the sector and deliver the fleet renewal so essential for the UK’s net zero goals.

Mike Hawes, SMMT Chief Executive

Electrified vehicles are powering market growth after a sluggish summer – and with record ZEV uptake, massive industry investment is paying off, despite demand still trailing ambition. The Electric Car Grant will help to break down one of the barriers holding back more drivers from making the switch – and tackling remaining roadblocks, by unlocking infrastructure investment and driving down energy costs, will be crucial to the success of the industry and the environmental goals we share.

Notes to editors

- September 2020 registrations: 328,041

- ECG qualifying model volume growth: 36.0%; non-ECG qualifying model volume growth: 26.9%

SMMT Update

Sign up

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields