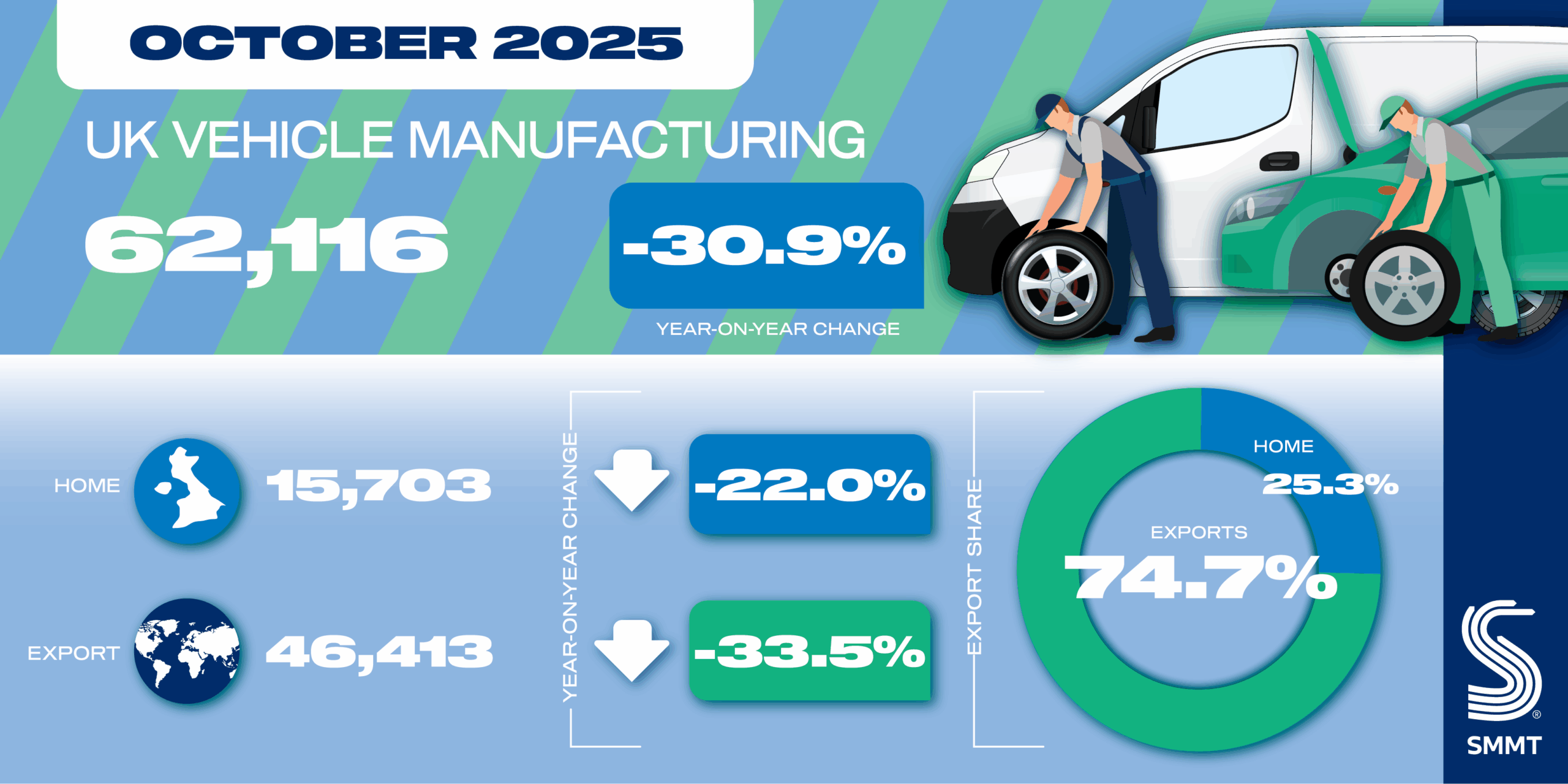

- Vehicle production falls -30.9% in October with 62,116 cars and commercial vehicles leaving factories.

- Car output down -23.8% to 59,010 units as phased recovery from cyber incident begins.

- Latest independent production outlook anticipates a return to growth next year and beyond.

- Sector welcomes additional manufacturing support announced in Budget but warns of new EV tax impact on UK’s investment appeal.

File download

UK New Vehicle Manufacturing September 2025

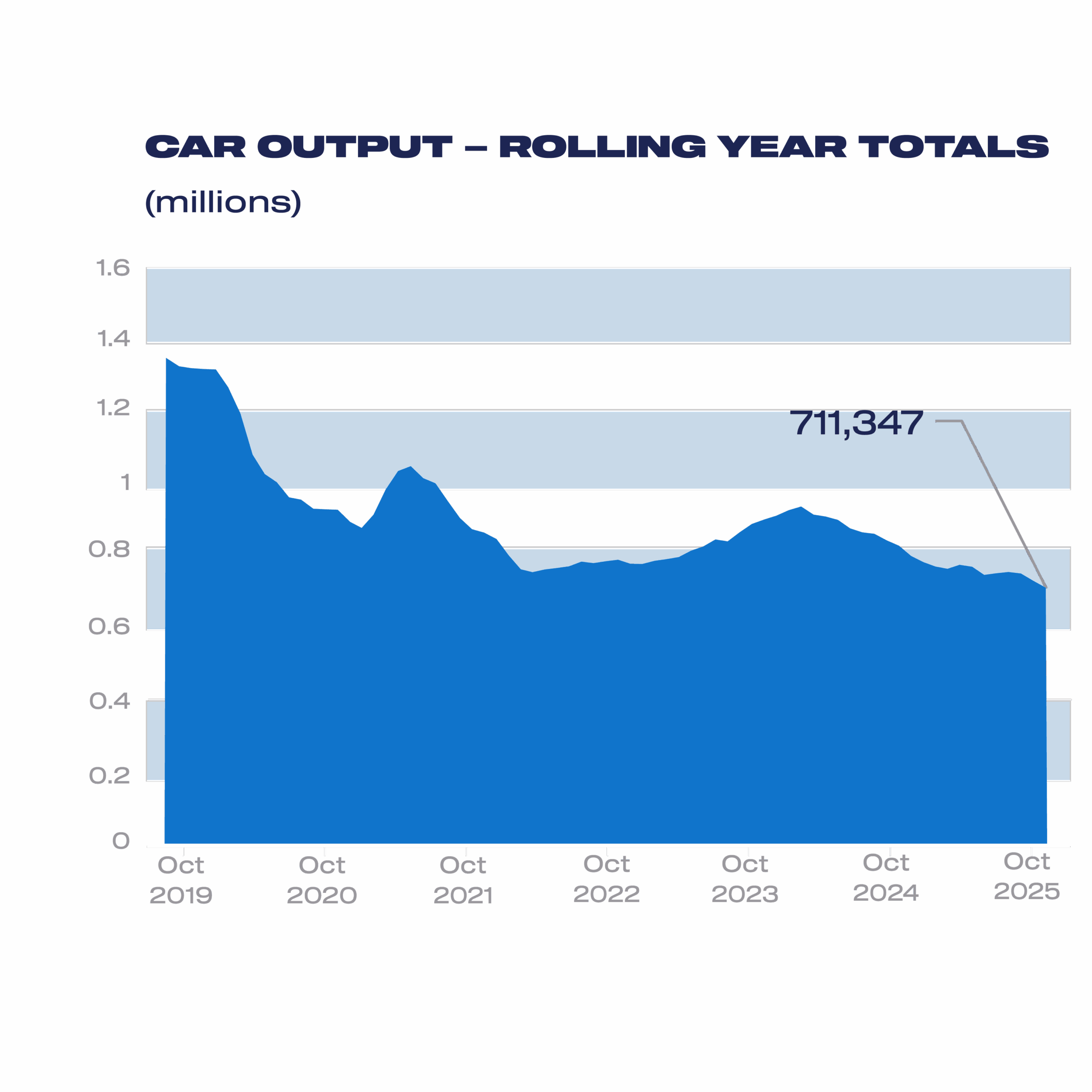

UK car production fell in October, down -23.8%, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 59,010 units left factory gates – 18,474 fewer than in the same month last year – as Britain’s biggest automotive employer began its phased restart of operations after a cyber incident forced a pause in production.

Following the recent trend, almost half the cars (46.2%) made in the month were either battery electric, plug-in hybrid or hybrid, with volumes up 10.4% to 27,287 units. Overall car production for the UK market fell by -10.6% to 13,785 units, while output for export declined -27.1%. 45,225 cars were produced for global markets – representing more than three quarters of total output – with the EU, US, Türkiye, China and Japan the top five export markets. Shipments to the EU, US and Japan all fell, while those to Türkiye and China rose.

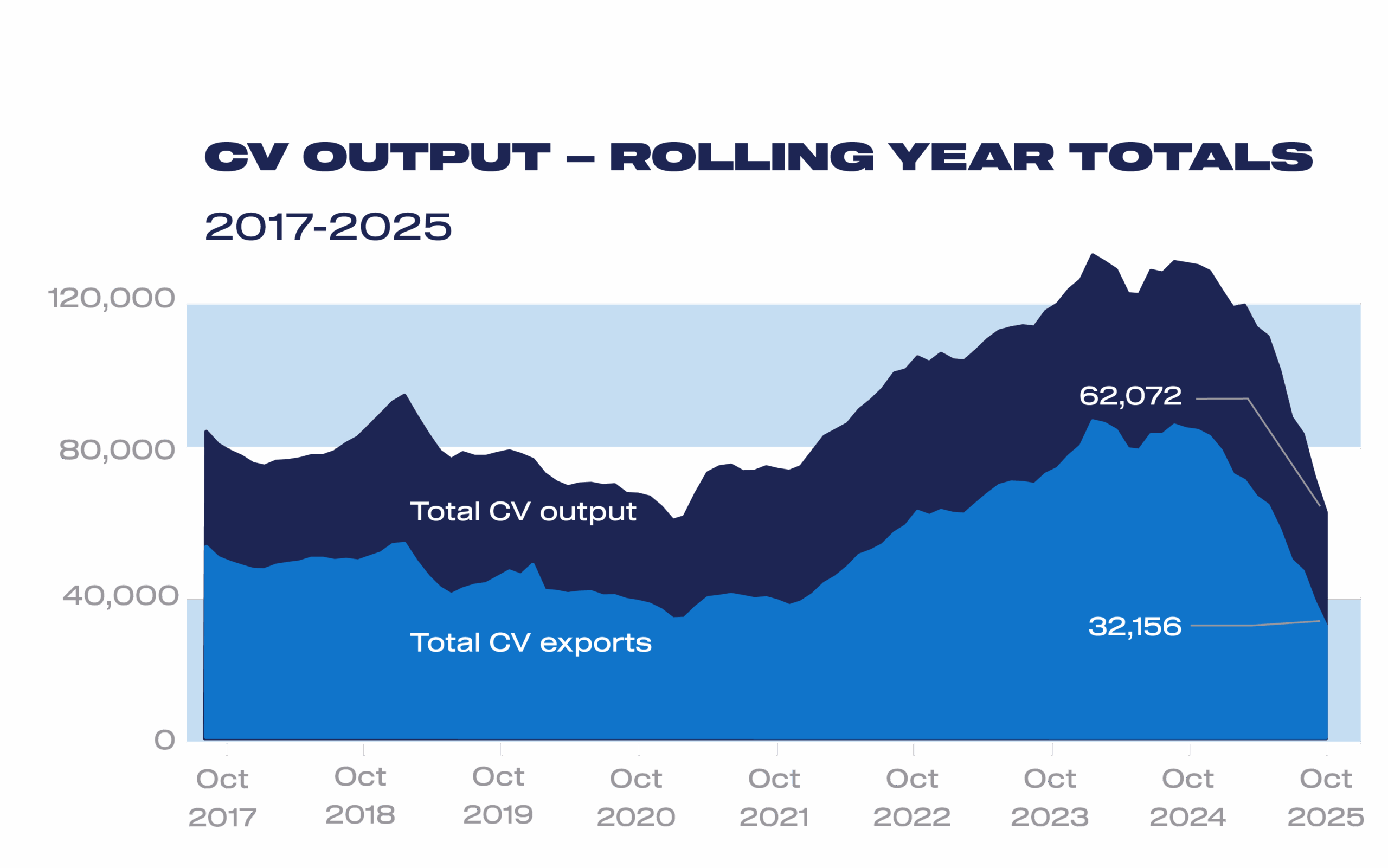

Commercial vehicle (CV) production, meanwhile, declined for the seventh month in a row, by -74.9% to 3,106 units, reflecting the ongoing impact on volumes following a major manufacturer consolidating operations into the North West. Combined car and van production, therefore, was down by -30.9% in October with 62,116 units leaving factories.

The news comes two days after the Budget in which the Chancellor announced a number of welcome competitiveness-boosting measures, including a further £1.5 billion in automotive transformation funding, and the deferral of regulation to end critical employee car ownership schemes into the next parliament – a move the industry had warned could lead to annual losses of £1 billion and put up to 5,000 jobs at stake. It also comes after government published a consultation on its proposed British Industrial Competitiveness Scheme (BICS) which should bring down sky-high energy costs for manufacturers.

In terms of market measures – which help make the UK an attractive place for manufacturing investment – there was welcome news of a £1.3 billion top up to the Electric Car Grant and changes to the VED expensive car supplement, reducing the number of EVs that will be subject to the higher tax. However, the introduction of a new pay per mile EV tax (eVED) would undermine the impact of those supportive EV measures, reducing demand for the very vehicles manufacturers are compelled to sell. This in turn will reduce further the UK’s investment appeal just as it strives to attract new manufacturing operations given the Industrial Strategy’s ambition to boost vehicle output to 1.3 million units by 2035.

So far this year, UK car and van manufacturers have turned out a total of 644,366 units representing a -17.0% fall on the same period in 2024. However, the latest independent production outlook expects growth to return in 2026 with a total of 828,000 cars and vans anticipated to be made next year, driven by new electric car models coming into production – with the potential to reach some 1m units by the end of this decade if the right conditions are in place.1

Mike Hawes, SMMT Chief Executive

Another difficult month for UK vehicle production as the impact of the earlier cyber attack continued to be felt. Growth is on the horizon, however, and Government has recognised the automotive industry as a pillar of national strategic importance, backing it with an industrial strategy and additional £1.5 billion to drive manufacturing competitiveness. Investment competitiveness also depends on a healthy domestic market, however, notably for EVs, and introducing a new electric-Vehicle Excise Duty is the wrong measure at the wrong time. This new tax will undermine demand, so government must work with industry to reduce the cost of compliance and protect the UK’s investment appeal.

Notes to editors

October’s data contains provisional figures from one manufacturer and may therefore be subject to future revision. The next release will be published on Friday 19 December 2025.

- November Production Outlook by Auto Analysis

SMMT Update

Sign up

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields