- New light commercial vehicle market falls -5.1% in July, the eighth successive month of decline.

- Electric van uptake up 72.6% but market share lags behind mandated levels.

- 2025 outlook revised down to 321,000 units, reflecting tough economic conditions and weak business confidence.

Data download

new LCV registrations July 2025

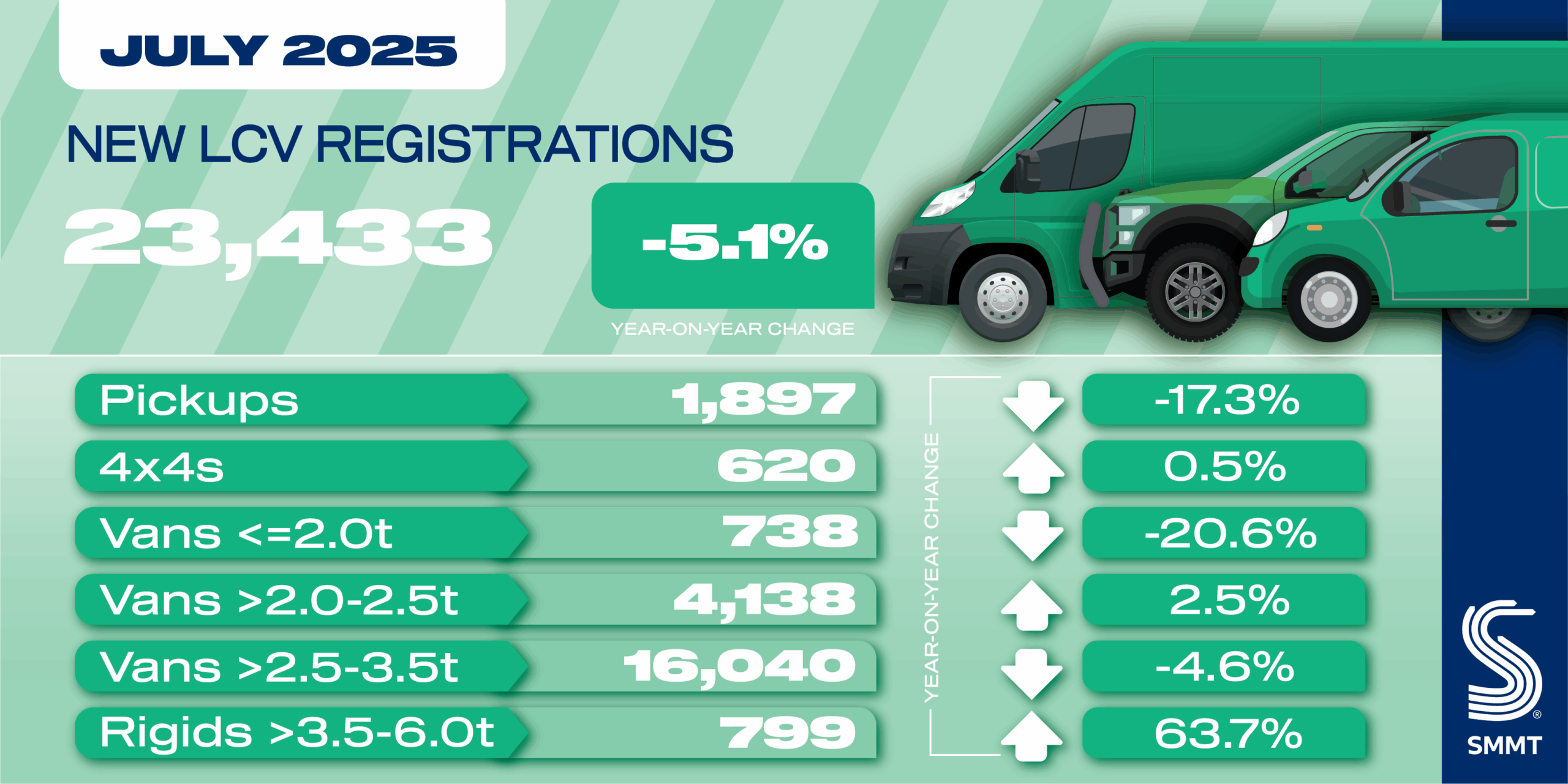

The new light commercial vehicle (LCV) market fell by -5.1% in July with 24,433 vans, 4x4s, pickups and taxis joining the road, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). This marks the sector’s eighth consecutive month of decline, and the weakest July since 2022,1 as sluggish business confidence deters fleet investment, and economic conditions remain tough.

Demand fell across most segments in the month, with uptake of the smallest vans recording the sharpest drop, down -20.6% to 738 units, while deliveries of the largest models fell -4.6% to 16,040 units. Following April’s tax change to treat double-cabs as cars for benefit-in-kind and capital allowance purposes, the pickup segment declined for a third consecutive month, down -17.3% to 1,897 units. Growth, however, was recorded in registrations of mid-sized vans, up 2.5% to 4,138 units, and 4x4s, up 0.5% to 620 units.

Manufacturers have invested heavily to deliver choice across a range of electric van models, payloads and price points – with more than 40 to choose from. The market is responding, with deliveries of BEVs rising by 72.6% to 2,442 in July – totalling eight months of continuous growth. In the year to date, however, BEVs represent just 8.8% of the overall market – a significant distance from the 16% mandated, indicating a pressing need for action to boost operator confidence.2 Expediting depot grid connections, ensuring efficient implementation of local planning and promptly delivering LCV-suitable infrastructure, are all essential to encourage investment and accelerate the transition.

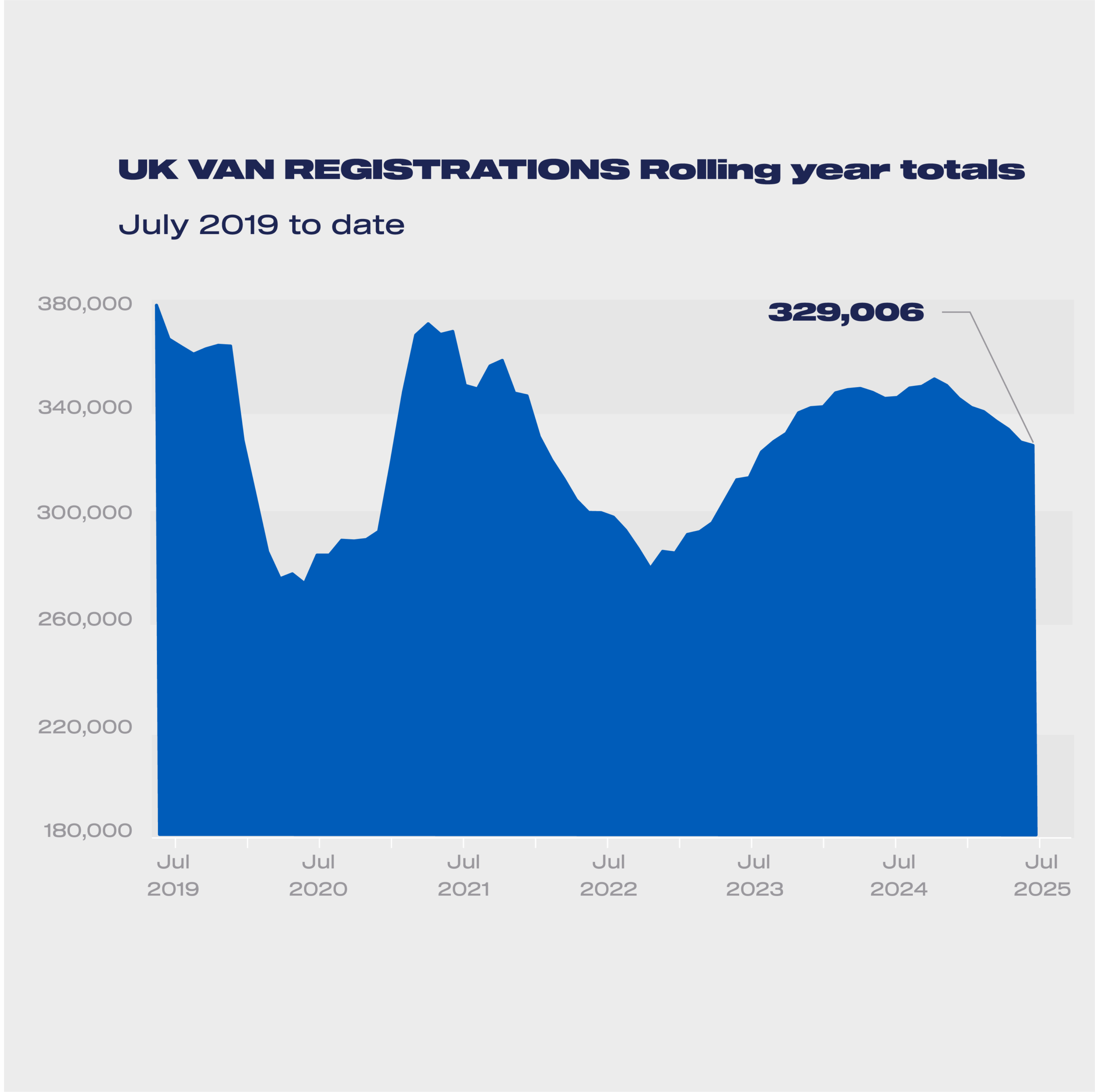

The latest 2025 outlook has been revised downwards, with the market now expected to decline by more than 30,000 units, or -8.7%, to 321,000 units.3 The BEV share of LCV registrations up to 3.5T has also been adjusted downwards for 2025, to 8.6%,4 with a marginal increase to 13.7% expected in 2026 against a mandated target of 24% in that year.

Mike Hawes, SMMT Chief Executive

Eight months of LCV market decline underlines the ongoing economic pressures facing businesses, yet the sector remains steadfast in its commitment to decarbonise. Manufacturers continue to invest in delivering a diverse range of zero emission vans to suit every use case, and it’s encouraging to see uptake growing – but to meet mandated targets, it must grow faster. Accelerating infrastructure rollout, streamlining planning processes and providing targeted support for fleet operators are essential to drive progress and keep the UK at the forefront of road transport decarbonisation.

Notes to editors

- LCV registrations, July 2022: 18,722 units

- SMMT’s BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t

- Previous outlook for 2025 at April: total LCV market 337,000 units, with BEV share at 9.1% in 2025 and 13.3% in 2026

- 2025 outlook is inclusive of vehicles up to 3.5t and does not include vans in the >3.5-4.25t range

SMMT Update

Sign up

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields