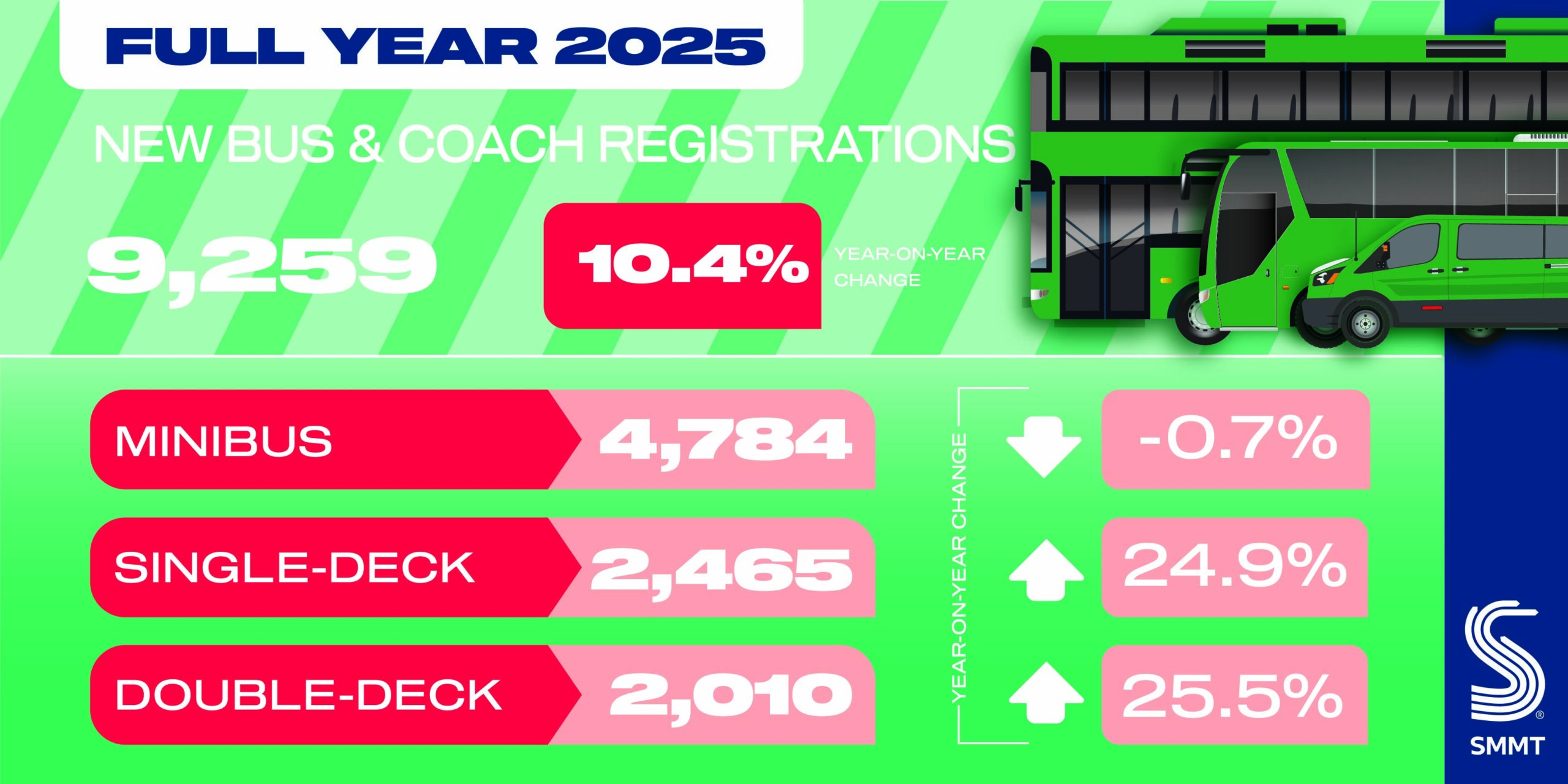

- New bus, coach and minibus market grows 10.4% in 2025, with 9,259 vehicles joining UK roads.

- Best year for the market since 2008 despite -28.4% dip in deliveries in Q4.

- Sector maintains road transport decarbonisation lead with 27.3% of registrations zero emission.

Data download

New Bus & Coach Q4 Registrations

UK registrations of new buses, coaches and minibuses grew 10.4% in 2025 to reach 9,259 units, delivering the best performance for the market in 17 years, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).1

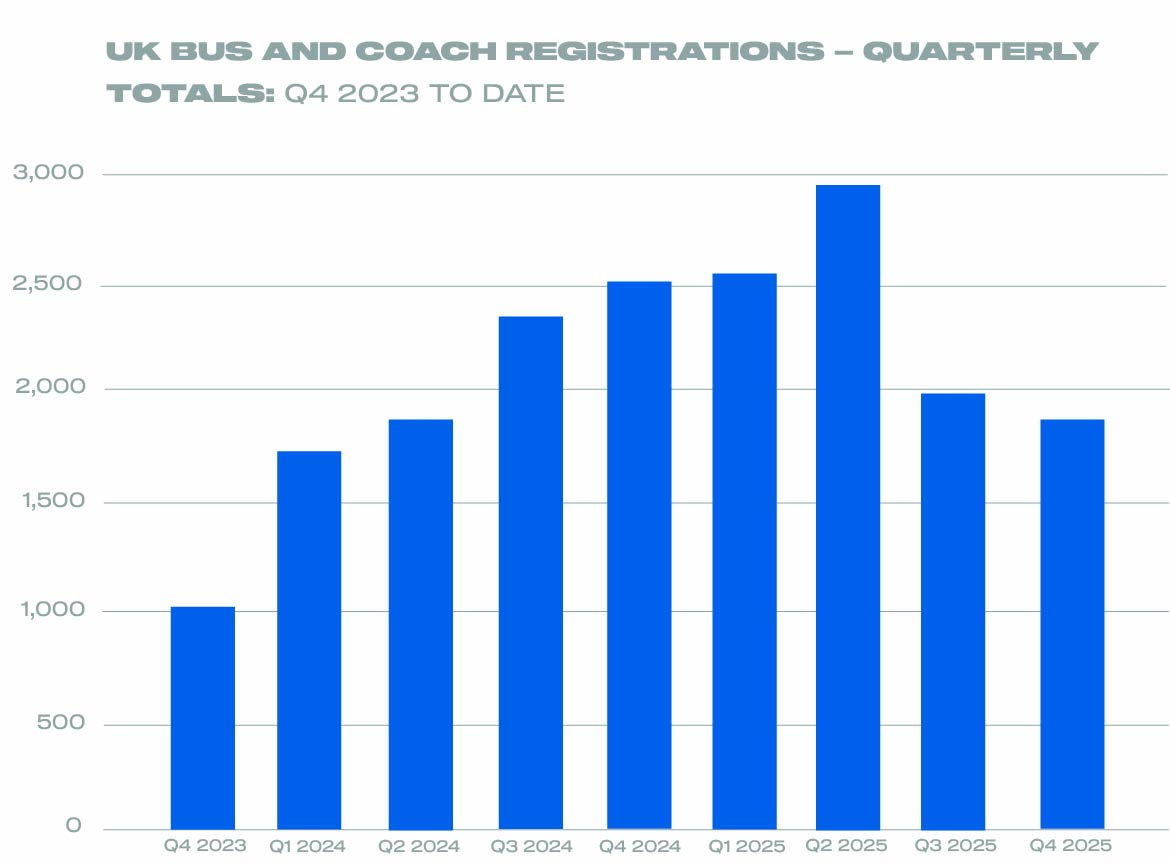

While the year ended with a decline of -28.4% in the fourth quarter, driven by a halving of minibus registrations, this was not enough to detract from a market that remains in robust health as operators across the country continued to invest in the latest mass mobility vehicles.

Growth for the year was driven by single and double-deck bus and coach deliveries, up 24.9% and 25.5% to 2,465 and 2,010 units respectively. Minibus uptake fell -0.7% to 4,784 units in 2025 as a result of a weak performance in the second half of the year.2

Scotland recorded the highest growth, up 162.3% to 1,188 units, in part driven by the Scottish Zero Emission Bus Challenge Fund (ScotZEB), a government-backed programme designed to accelerate the shift to greener bus fleets. England accounted for 82.8% of the market, with registrations up 4.8% to 7,671 units. Fleet renewal declined in Wales, down -38.9% to 299 units, while Northern Ireland deliveries grew 5.2% to 101 units.

The bus and coach sector also retained its position as the UK’s most rapidly decarbonising road segment, overtaking progress made across cars, vans and HGVs. Zero emission vehicle uptake rose 62.2% in 2025 to 2,523 units, representing 27.3% of all new public transport vehicles joining the road. This performance positions the UK as Europe’s largest zero emission bus market by a significant margin.3 This is testament to sustained industry innovation and commitment as well as substantial government incentives such as the Zero Emission Bus Regional Areas (ZEBRA) fund, helping accelerate the transition to cleaner, greener public transport across the country.

Maintaining this momentum is crucial for the UK’s decarbonisation goals. This means ongoing investment support to enable operators to renew their fleets at scale, as well as rapid progress on grid connections to bus depots which require substantial and costly upgrades to deliver the power required for large-scale vehicle charging. Streamlining these processes will be critical if the full potential of zero emission fleets is to be realised, helping deliver significant carbon savings, improving air quality and reducing noise pollution in towns and cities across every region of the UK.

Strong growth in Britain’s bus, coach and minibus market is clear evidence of an industry committed to cleaner, reliable and accessible transportation for all. The substantial increase in the uptake of zero emission vehicles has been enabled by significant manufacturer investment and targeted government schemes, but momentum must be maintained. Upgrading bus fleets can be complex and costly – challenges that industry and government must address together so Britain can maintain its leadership in green public transport and accelerate our journey towards Net Zero.

Notes to editors

- Full year bus and coach registrations, 2008: 9,558 units.

- Q3 minibus registrations fell -39.8%.

- ACEA new vehicle registrations 2025: Germany is the second largest market, with 1,808 ZEV bus registrations.