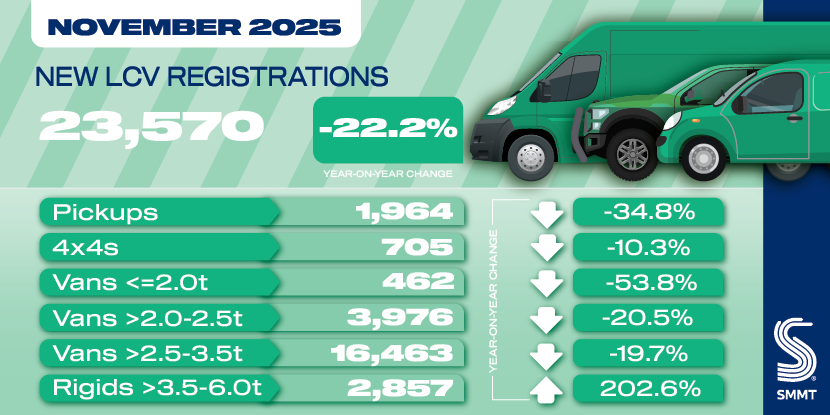

- New light commercial vehicle registrations fall by -22.2% in November to 23,570 units.

- Battery electric van uptake bucks trend, up 25.3% following October decline.

- At 9.4%, year-to-date EV share lags ambition with urgent action needed.

Data download

new LCV registrations November 2025

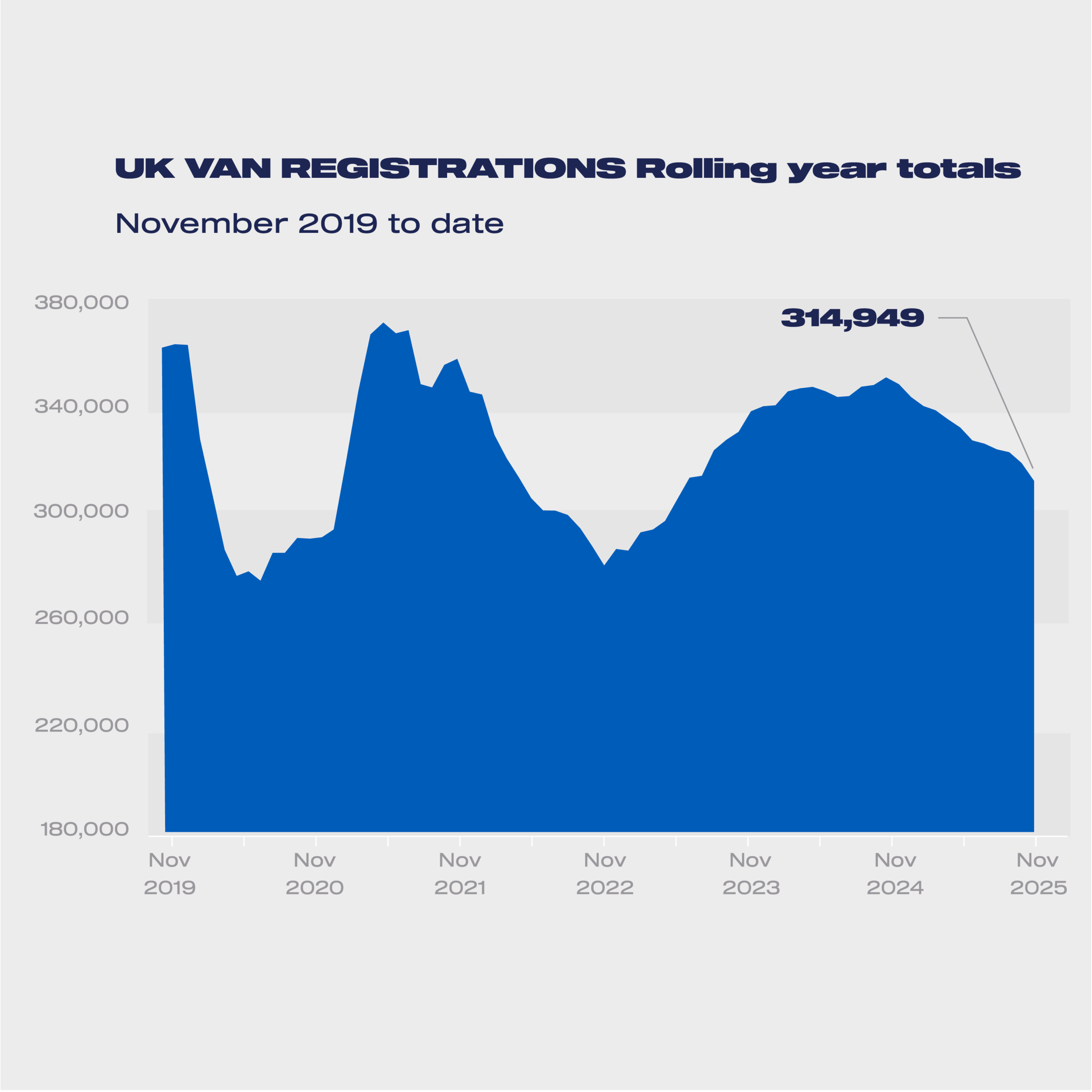

UK registrations of new light commercial vehicles (LCVs) declined by more than a fifth (-22.2%) in November, with 23,570 vans, pickups and 4x4s joining the road, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The fall continued a contraction in fleet renewal across 2025, amid weak business confidence and a tough economic environment, with -11.4% fewer registrations than the same 11-month period last year.1

November saw demand fall in every LCV segment, with large vans down -19.7% to 16,463 units – albeit still representing the majority (69.8%) of the overall market. Medium-sized vans fell by -20.5% to 3,976 units, while registrations of new 4x4s and small-sized vans also shrank, by -10.3% and -53.8% to 705 and 462 units respectively.

New pick-up deliveries recorded a steep decline for the second month in a row, down by -34.8% to 1,964 units, following fiscal changes to treat double cabs as cars for benefit in kind and capital allowance purposes. Industry continues to urge government to reverse the decision given the impact on fleet renewal in key sectors of the economy, undermining Treasury tax receipts while keeping older, less efficient and more polluting vehicles on the road for longer.

More positively, registrations of new battery electric vans (BEVs) returned to growth,2 up 25.3% to 2,909 units, accounting for 12.3% of the overall market – 2025’s highest monthly share.3 Growth has been impressive across the year, up 44.7% compared with the same period in 2024, with 27,159 registrations. Despite this performance, the year-to-date BEV market share stands at 9.4% – a significant distance behind the 16% share mandated by government for 2025.

Manufacturers remain steadfast in their commitment to deliver the UK’s net zero ambitions having invested heavily in new BEV products and discounts, with a choice of more than 40 models – more than half of all those available – to suit a wide range of fleet operator needs. There are major barriers to growing uptake, however, including higher cost of acquisition given the higher cost of production, lengthy depot grid connection waiting times, and a paucity of van-suitable public charging infrastructure.

Positive announcements this year include the extension of the Plug-in Van Grant, new Depot Charging Scheme and proposed planning reform for private charger installations – all will help. However, with just one month of 2025 remaining, and the mandated target rising to 24% next year, urgent rollout of support is essential to protect the UK’s investment appeal.

Mike Hawes, SMMT Chief Executive

Lacklustre light commercial vehicle uptake highlights weak economic confidence, and slower fleet renewal means slower decarbonisation. While it is encouraging that zero emission van uptake is rising, the pace of change severely lags government ambition, and every lever must be pulled to support demand and protect industry investment – both of which are essential to our shared net zero goals.

Notes to editors

- New LCV registrations, January-November 2025: 287,728 units; 2024: 324,613 units.

- New BEV LCV registrations declined by -5.8% in October. 3 SMMT’s BEV LCV registration data reflects the Vehicle Emissions Trading Scheme, in which BEVs weighing >3.5-4.25t contribute towards each manufacturer’s target, in addition to those weighing ≤3.5t.

SMMT Update

Sign up

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields