- New study reveals majority of UK workshops (81.2%) are ready to service electric vehicles, with four in five investing in skills and tools needed to maintain EVs and advanced safety technologies.

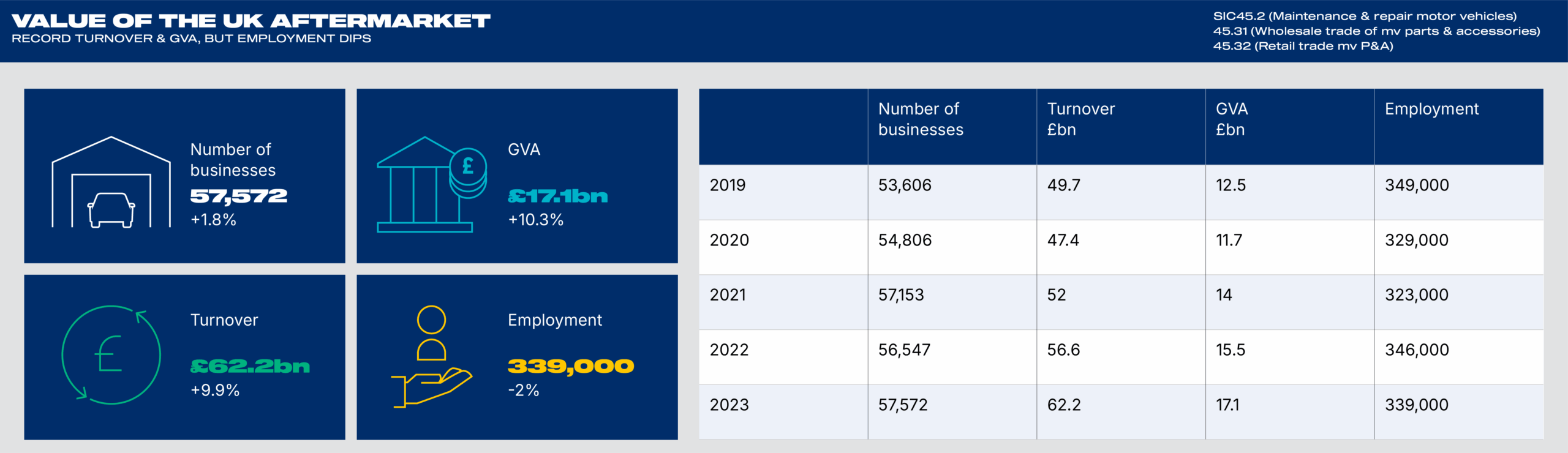

- New SMMT Aftermarket Report highlights £62.2 billion sector’s adaptation to new mobility technologies – but calls for targeted investment incentives and access to unused apprenticeship levy funds to unlock further growth, talent and jobs.

- Ongoing investment will ensure drivers rapidly upgrading to safer, greener cars have ample service provision while helping accelerate the UK’s transition to net zero.

Four in five (81.2%) automotive aftermarket workshops have invested in training, talent and tooling to carry out servicing and maintenance of the latest vehicle safety and powertrain technology, according to a new survey by the Society of Motor Manufacturers and Traders (SMMT).1 Sustaining such investment will be critical if Britain’s roads are to become ever safer and ever greener.

The findings come as the Society of Motor Manufacturers and Traders (SMMT) publishes its latest Aftermarket Report, Jobs, Growth, Mobility – What the aftermarket needs to deliver, which explores the sector’s readiness to support increasingly sophisticated and electrified vehicles.

The aftermarket sector is crucial to the British economy, turning over £62.2 billion, contributing £17.1 billion towards UK GDP, and supporting at least 339,000 jobs.2 A new survey, conducted for SMMT by Censuswide, has revealed that industry is investing heavily to acquire the skills and facilities to maintain and repair the latest vehicle technology – with more than four in five workshops surveyed (81.2%) equipped to service electric vehicles and a further 83.3% of those with these capabilities expecting this spend to increase over the next year. In addition, 77.6% of respondents are equipped to service and maintain Advanced Driver Assistance Systems (ADAS) systems, with 83.5% expecting to increase spending on ADAS training and equipment over the next 12 months.

There are an estimated 1.6 million electric cars on UK roads, with EVs now accounting for more than a fifth (21.9%) of all new car registrations – a proportion that must almost quadruple to 80% of the new car market by 2030 under the Zero Emission Vehicle Mandate, with vehicle manufacturers continuing to invest billions to fulfil government ambition. Meanwhile, eight out of 10 new cars include ADAS such as autonomous emergency braking, lane-keeping assistance and adaptive cruise control.3

Ensuring there is ample maintenance provision for the millions of new, more sophisticated vehicles reaching the road today will be essential if more drivers are to make the switch to zero emission motoring while supporting the UK’s robust road safety record. This transition, however, demands significant capital investment – particularly from smaller, often family-run workshops – who must upgrade equipment and upskill staff to keep pace with fast-evolving vehicle technologies. Providing capital investment relief for these businesses, and unlocking unused apprenticeship levy funding, would help spur investment in the tools and talent the industry will need in the years to come, as well as creating jobs and driving economic growth.

The UK aftermarket is embracing the future of automotive technology, and investing in the skills and equipment needed to maintain the very latest vehicles to help deliver safe, sustainable mobility for all. With a rapid influx of smarter, zero emission vehicles reaching the road, however, helping businesses invest will be crucial if more drivers are to make the switch while maintaining the UK’s leading road safety record, and creating crucial jobs in every part of the country.

Recommendations for Government:

- Ensure access to technical repair and maintenance data for independent operators through Great Britain Whole Vehicle Type Approval and the Motor Vehicle Block Exemption Order. These regulations ensure fair competition, consumer choice and value.

- Ensure adequate funding and resource for the Driver and Vehicle Standards Agency’s (DVSA) Market Surveillance Unit to effectively monitor the use of non-compliant replacement parts being used on-road and illegal modifications.

- Accelerate stakeholder collaboration on MOT reform. Updates to the fee structure, test content and operational flexibility are needed to reflect modern vehicle technologies. Mandatory Advanced Driver Assistance Systems checks and enhanced emissions testing should be introduced, particularly as ICE vehicles will remain in circulation beyond 2040. A full cost benefit analysis should be done to ensure a realistic and proportionate MOT is in place to deliver the real-world benefits of modern vehicle technologies.

- Introduce capital investment relief for vehicle test stations and workshops upgrading equipment to meet enhanced MOT standards.

Boost industry skills development. Increase the release of unused apprenticeship levy funds to small businesses, simplify apprenticeship systems and expand access to non-apprenticeship training pathways. - Consider need to mandate Security-Related Vehicle Repair and Maintenance Information (SERMI) in Great Britain. Greater confidence in the scheme would encourage the establishment of Conformity Assessment Bodies in GB and support a framework with the potential to deliver technical information exchange between vehicle manufacturers and workshops in areas outside of security.

Recommendations for the Automotive Industry:

- Strengthen collaboration between vehicle manufacturers and the aftermarket. Easier access to technical information enhances customer experience, brand perception and affordability.

- Engage insurers and stakeholders in joint efforts with manufacturers and the aftermarket to improve confidence and affordability in repairs – especially for complex vehicles and EVs.

- Invest in workforce skills and modern equipment to keep pace with evolving technologies.

- Recognise the value the consumer places on friendly and knowledgeable communication and the location convenience that the aftermarket is able to provide them.

Notes to editors

- The research was conducted by Censuswide, who surveyed a consumer sample of 2,001 17+ full driving licence holders who own and drive a car alongside 250 18+ Decision makers in businesses involved in the service, repair and maintenance of vehicles. The data was collected between 19.08.25 – 27.08.25. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

- ONS data, based on SIC codes 45.2, 45.31 and 45.32 (maintenance and repair of motor vehicles, wholesale trade of motor vehicle parts and accessories and retail trade of motor vehicles parts and accessories)

- Latest JATO ADAS technology data; 2023 new car registrations