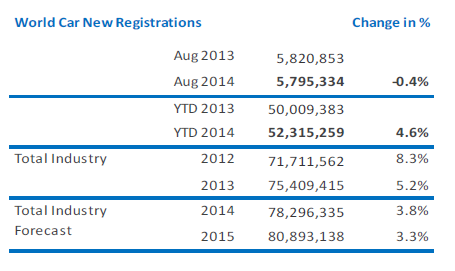

Based on results (preliminary in some cases), passenger vehicle registrations in August were down 0.4% from the year before. YTD, however, new registrations are up around 2.31 million units from the year before (up 4.6%). Growth in Asia was weaker than in prior months, and was unable to make up for losses in Latin America and Eastern Europe.

Sales in the Asia/Pacific region were up just 3.7% in August. Growth in China was once again strong, but lagged behind the rates posted in recent months. Meanwhile, the uptrend in the Indian market continued unabated, but sales in Japan were down sharply, due to the after-effects of the VAT rate hike in April.

Sales in the NAFTA region were up once again thanks to good economic news and attractive automotive financing offers. Registrations are up 4.7% YTD over the year before.

Sales in Latin America were down significantly once again (down 15.3% in August and 8.9% YTD). Sales in the region’s two largest markets, Argentina and especially Brazil were down sharply from the year before once again.

Growth in Western Europe was 1.1% in August (YTD: up 5.1%). While strong gains were posted in two key markets in the regions, the United Kingdom and Spain (incentives), regional growth was restrained by losses in many smaller markets, and by weak data in France.

The civil war in Ukraine, as well as the sanctions imposed on Russia, was an enormous drag on sales in the Eastern European market (August: down 18.9%; YTD: down 9.9%).

2014: New registrations expected to be 78.3 million units

Global new registrations will once again set a new record in 2014, growing by about 3.8% over 2013.

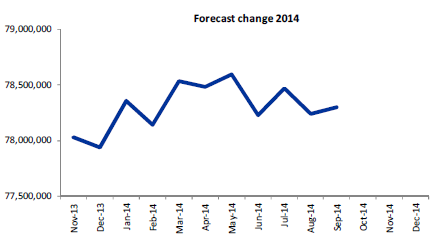

The forecast for the Western European region was revised slightly downward due to the current weak performance in France and some of the smaller markets. The forecast for LATAM, on the other hand, and Brazil especially, had to be cut significantly once again. The same applies for Eastern Europe, in response to the escalation of the Ukraine conflict and the extension of sanctions against Russia.

Positive adjustments to the Asia/Pacific region and the US more than make up for the aforementioned reductions so that the global forecast was actually revised slightly higher.

New registrations in the Asia/Pacific region will increase by 6.9% in 2014 compared to 2013. In China alone, sales in the current year will be up around 1.81 million units from the year before. Japanese sales at first appeared to be surprisingly unaffected by the VAT rate hike in April, inducing us to raise our forecast. However, if last month’s weak performance continues in the coming months, this upward revision will have to be reversed.

New registrations in the NAFTA region are also expected to continue to climb to about 19.2 million units (up 5.4%). Sales in the Latin American markets, on the other hand, will fall to about 5.4 million units (down 9.2%).

Sales will be down in Eastern Europe as well (down 9.6%). The region’s largest market, Russia, is currently suffering from the impact of the Crimean crisis (flight of capital out of the country, sanctions), a weakening currency (inflation) and low oil prices.

Passenger vehicle demand in Western Europe, on the other hand, will be up once again in 2014 (up 4.6%), as gains in markets like the United Kingdom and Germany, as well as in Southern Europe (especially Spain), will more than make up for losses in relatively small markets like the Netherlands, Switzerland and Austria.