- UK car manufacturing falls -13.7% in June as 136,901 cars leave production lines.

- First half performance declines -2.9% to 866,656 units.

- Exports drive volumes in first six months, with 78.9% of British-built cars shipped overseas and year-on-year demand broadly stable at -0.9%.

- Independent report forecasts sector will just miss 2m units by 2020.

- Industry calls for government to put Brexit plans for automotive on the table to secure investment, jobs and growth.

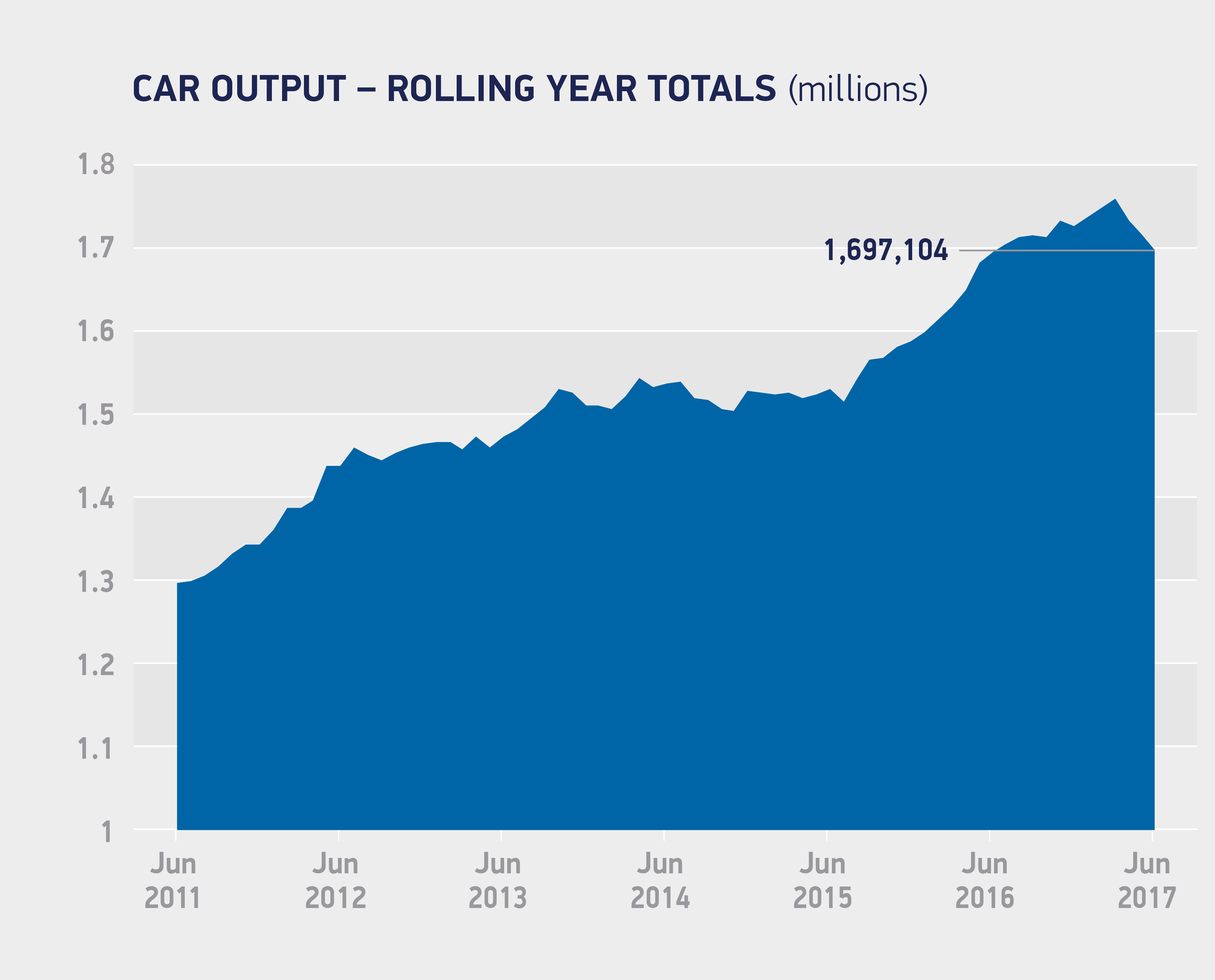

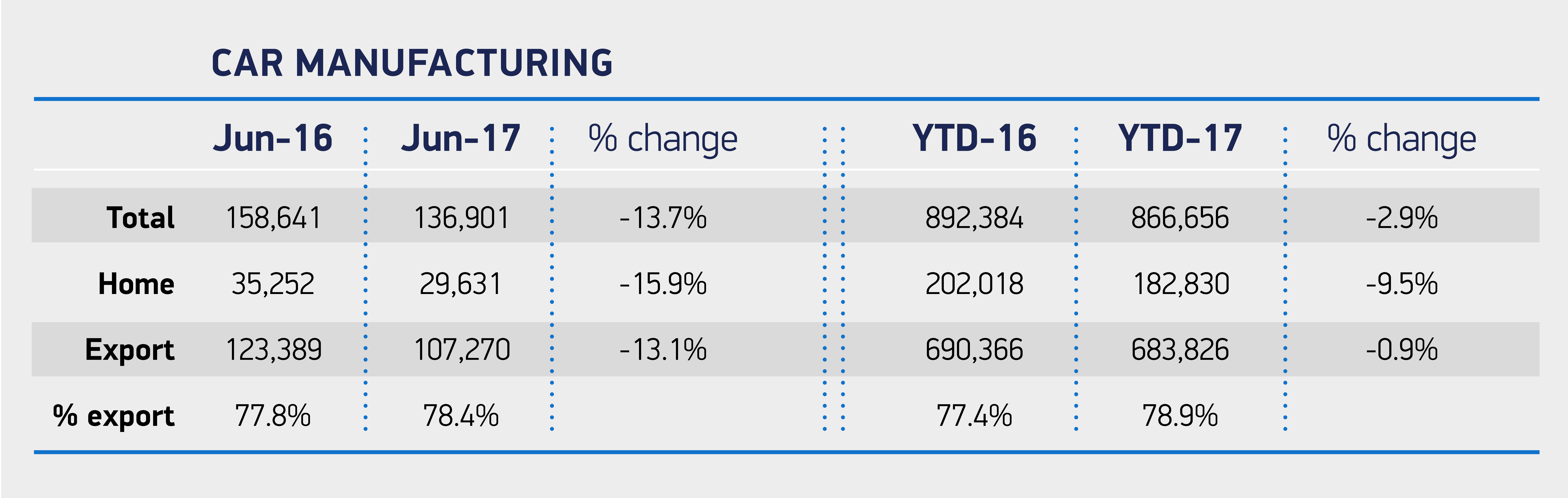

UK car production fell by -13.7% in June, with 136,901 cars rolling off production lines, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT). The third consecutive month of decline resulted in a -2.9% year-to-date dip in output. The performance is, however, still the second highest for 12 years.1

Production for export continued to underpin volumes in 2017 with overseas demand for British-built cars falling by only a marginal -0.9% in the first six months, with 683,826 cars shipped overseas. The percentage of cars for export now stands at 78.9% – the highest for five years.2 Meanwhile, demand from the home market declined -9.5% to 182,830 units, as the UK new car market cools in line with forecasts following a long period of record growth.

Production for export continued to underpin volumes in 2017 with overseas demand for British-built cars falling by only a marginal -0.9% in the first six months, with 683,826 cars shipped overseas. The percentage of cars for export now stands at 78.9% – the highest for five years.2 Meanwhile, demand from the home market declined -9.5% to 182,830 units, as the UK new car market cools in line with forecasts following a long period of record growth.

Although there is much uncertainty, production is forecast to rally in the second half of 2017, according to the latest independent forecast.3 The projection is based on some new models and updates planned for production later this year,4 many from premium brands, helping cement the UK as the world’s second biggest producer of premium cars after Germany. However, market softness both in the UK and certain key export markets may see the 2017 forecast revised. Looking further ahead, the base outlook (which assumes some sort of Brexit deal in place) has been revised such that, by 2020, the analysis forecasts the sector just missing the ambition of two million cars by 2020.5

As concerns mount over Brexit and the effect of the ongoing uncertainty on investment, the analysis also suggests that failure to secure a deal – or, at the very least, an interim arrangement maintaining current trading conditions – could cause output to fall in 2019. Supply chain disruption caused by ‘hard’ border controls as the UK leaves the customs union and price increases driven by WTO tariffs, could result in a 10% hit to production, taking volumes back to 2016 levels.6

Mike Hawes, SMMT Chief Executive, said,

World-class engineering, productivity, strong government collaboration and massive investment in the past few years have helped UK Automotive become a global success story. At the heart of this has been the free and frictionless trade we’ve enjoyed with the EU – by far our biggest customer and supplier. But Brexit uncertainty is not helping investment and growth is stalling. The government has been in “listening” mode but now it must put on the table the concrete plans that will assure the future competitiveness of the sector. Investors need certainty so, at the very least, the UK must seek an interim deal which maintains single market and customs union membership until we have in place the complex new agreement sought with the EU.

1. A record 897,157 cars produced January-June 2016; 873,660 in H1 2004.

2. 82.7% of UK-built cars exported January-June 2012.

3. The Production Outlook is an independent forecast of UK vehicle manufacturing commissioned from AutoAnalysis. It is updated up to four times a year to respond to market and production cycle fluctuations. The latest report, produced in May, forecasts 1.92 million units for 2017.

4. New and updated models include: Range Rover Velar; Nissan Qashqai (facelift); Aston Martin Vantage; Jaguar XF Sportbrake; Aston Martin V8 Vantage; Lotus Evora 400 Roadster.

5. Analysis suggests 1,993,750 units will be produced in 2020.

6. The Production Outlook report includes speculation on the potential outcome for UK car production in 2019 under three different post-Brexit scenarios:

- The cliff-edge scenario where there is no Brexit agreement or interim deal from April 2019 and the UK immediately reverts to WTO tariff arrangements and there are ‘hard border’ customs checks: 1,722,275 units.

- A ‘midway’ agreement is reached between the EU and UK whereby vehicles are subject to a 5% tariff with light touch customs checks for the automotive sector: 1,887,318 units.

- A transitional agreement is reached whereby there is no material change to current arrangements until 2021, at which point a 3.5% tariff on vehicles is applied and an electronic customs system is introduced: 1,918,775 units.