- New report confirms UK’s low volume, high value car manufacturing sector is world’s largest – and growing.

- Annual production to hit 52,000 vehicles by 2020 – a 60% rise – provided right conditions prevail.

- Industry calls for certainty over post-Brexit trade and regulation to ensure future competitiveness and growth.

- Exports outside EU continue to rise, with growing demand for high performance vehicles in markets such as US and Asia key to low volume sector’s future growth.

MP Claire Perry (L) joins Andy Palmer (C), CEO, Aston Martin and Mike Hawes (R), Chief Executive of the Society of Motor Manufacturers and Traders (SMMT), at an event to celebrate specialist car manufacturing in the UK

The UK’s specialist, low volume car manufacturing industry is set to enjoy a 60% production boost by 2020, thanks to increasing global demand, according to new analysis published today by the Society of Motor Manufacturers and Traders (SMMT).1

The UK Specialist Car Manufacturers Report 2017 confirms Britain is home to the largest and most diverse specialist car manufacturing sector in the world, with some of the most globally recognised and iconic brands.2 The sector is a global leader in engineering, design and craftsmanship, producing a wide range of cutting-edge products, from high performance sports cars, luxury grand tourers and SUVs, to electric taxis and wheelchair accessible vehicles.

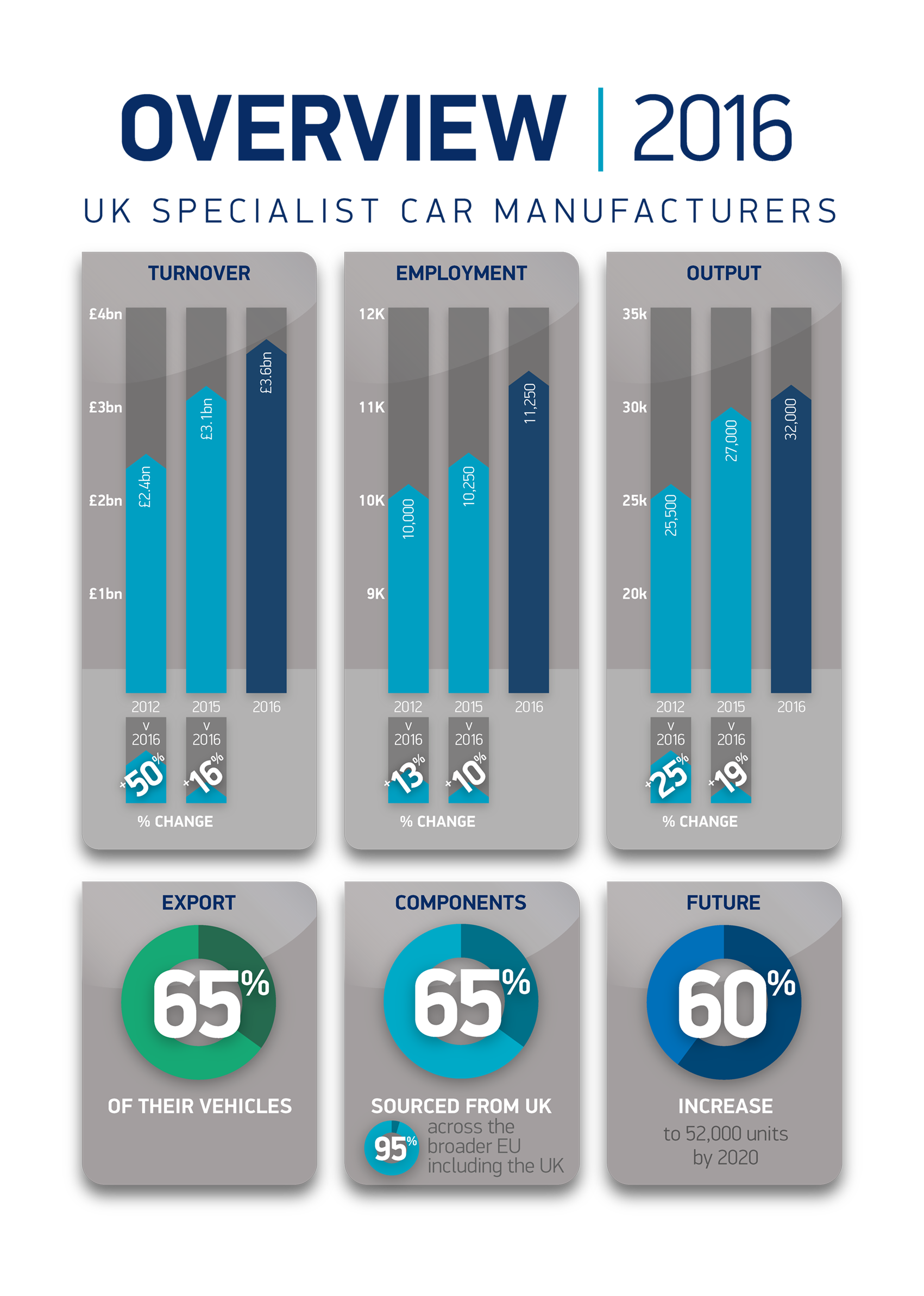

Latest figures show that in 2016 these car makers turned over a collective £3.6 billion, up 52% from 2012. In addition, they employed 11,250 people – an 11.5% increase on five years ago – the majority in highly skilled, specialist roles, while also supporting tens of thousands additional jobs across the supply chain. Thanks to an increasing number of affluent buyers and new markets taking an increasing interest in performance driving and luxury models, production is on an upward trend. Output has risen by a quarter (25%) since 2012 and, by 2020, it is forecast to surge 60%, from the current 32,000 units to some 52,000.

The sector is an important contributor to the UK economy, with 65% of the vehicles it produces exported to markets worldwide, including the EU, US, China, Japan and the Gulf States. Meanwhile, it supports an equally diverse UK supply chain, sourcing, on average, two thirds (65%) of vehicle content from local tier one companies and a further 30% from across the wider EU.

The industry therefore needs political leadership that delivers a competitive environment, globally, and a future relationship with the EU that safeguards as many of the benefits that we currently enjoy as possible.

The ability to influence global industry standards and regulations post Brexit is also of significant concern. Major advances in light-weighting, including the use of carbon fibre and composites, as well as aerodynamics and powertrain electrification, have often been led by specialist car brands in the UK. To support this high-tech innovation, specialist car manufacturers need regulations that recognise their specific requirements such as limited production runs, investment levels and niche skills, which differ from those of brands making cars for the mass market.

Some EU regulations already provide for these considerations but it is crucial that this sector’s specific needs are recognised globally. This means early and effective consultation, suitable lead times and, where appropriate, flexibility in how specific objectives are delivered. Global harmonisation of technical regulations would also help as brands typically build a single model and sell it into as many markets as possible. Reducing international regulatory complexity would lower the administrative burden and maximise investment.

Mike Hawes, SMMT Chief Executive, said,

Our specialist car manufacturing sector is one of the UK’s global success stories – making world-leading products and pioneering next generation technologies that benefit everyone. For this to continue we need certainty on Britain’s future trading relationships, including customs plans, market access, regulations governing the design, production and approval of vehicles, and rules around movement of skilled workers. This will provide the assurance the sector needs to remain competitive and make investment decisions that enable it to continue to develop innovative, exciting and desirable products that are the envy of the world.

The sector’s current growth forecast is based on increasing demand from consumers in key global markets, but also previously announced investment in new facilities from the likes of Aston Martin and London Electric Vehicle Company (formerly London Taxis), and new entrants such as Alcraft and TVR. Aston Martin and TVR are establishing new manufacturing facilities in Wales, with an SUV from Aston Martin and TVR’s new sports car both starting production in 2019. Meanwhile, also in 2019, McLaren Automotive’s new McLaren Composites Technology Centre in Rotherham will build the carbon fibre chassis for future products.

Notes

1. Specialist car manufacturers in this release and accompanying report produce around 10,000 or fewer vehicles globally. This includes a diverse array of manufacturers, from those as large as Bentley through to companies producing only a handful of cars every year such as Dare.

2. Download The UK Specialist Car Manufacturers Report 2017 here