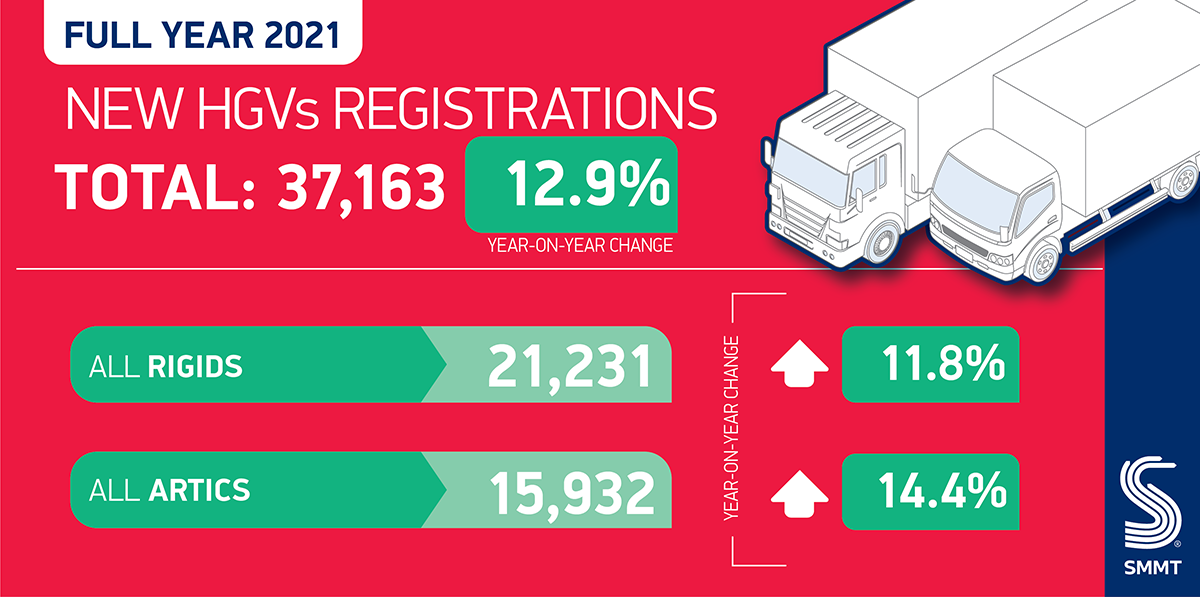

- UK new HGV registrations increase to 37,163 (+12.9%) as market gains ground after locked down 2020.

- Supply chain constraints see market end -16.9% down on pre-pandemic average.

- Industry calls for clear plan to drive transition to zero emission vehicles and maintain fleet operator confidence.

SEE HGV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

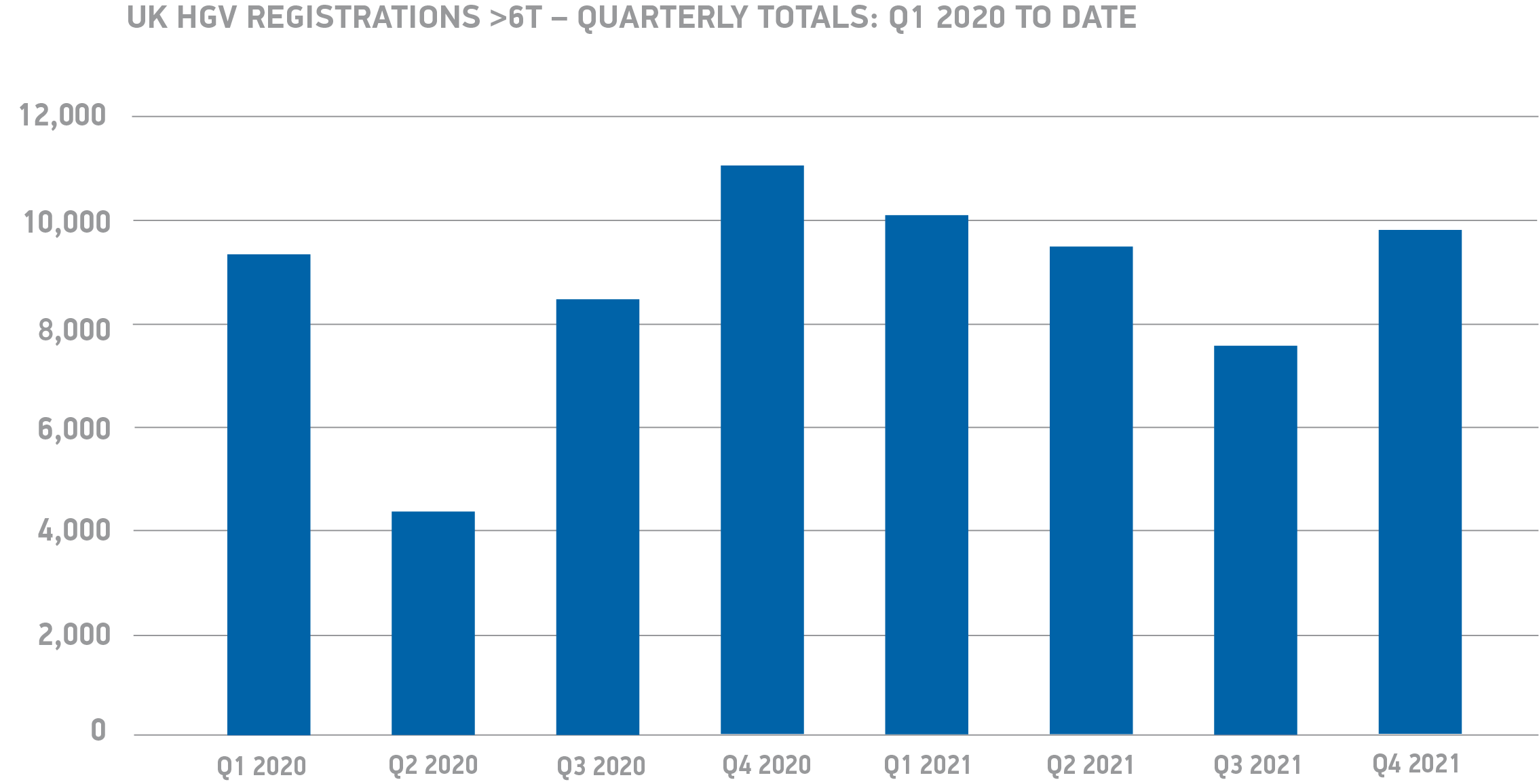

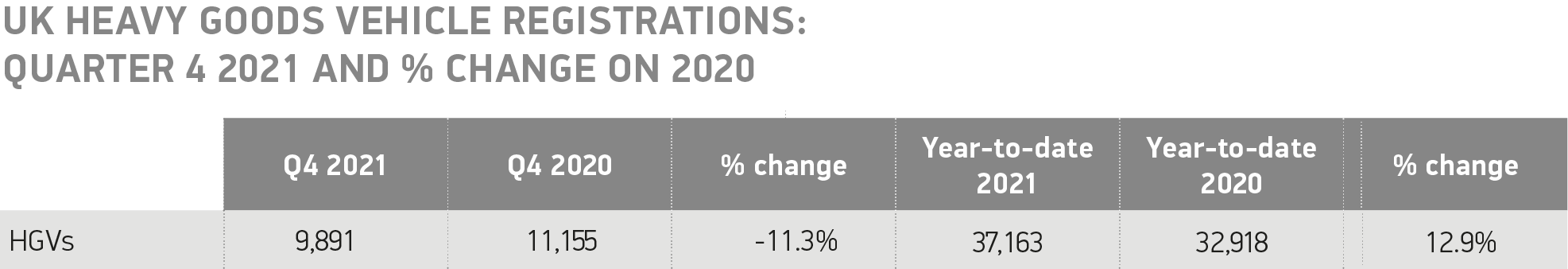

New heavy goods vehicle (HGV) registrations rose by 12.9% year-on-year in 2021, according to new figures released today by the Society of Motor Manufacturers and Traders (SMMT). Growth in key industry sectors such as construction saw demand outstrip supply, with truck registrations surging from a locked-down 2020 fall of -32.2%. However, the global semiconductor shortage, as well as supply constraints affecting steel and aluminium, impacted availability, resulting in 7,571 fewer (-16.9%) HGV units registered compared with the pre-pandemic average.1

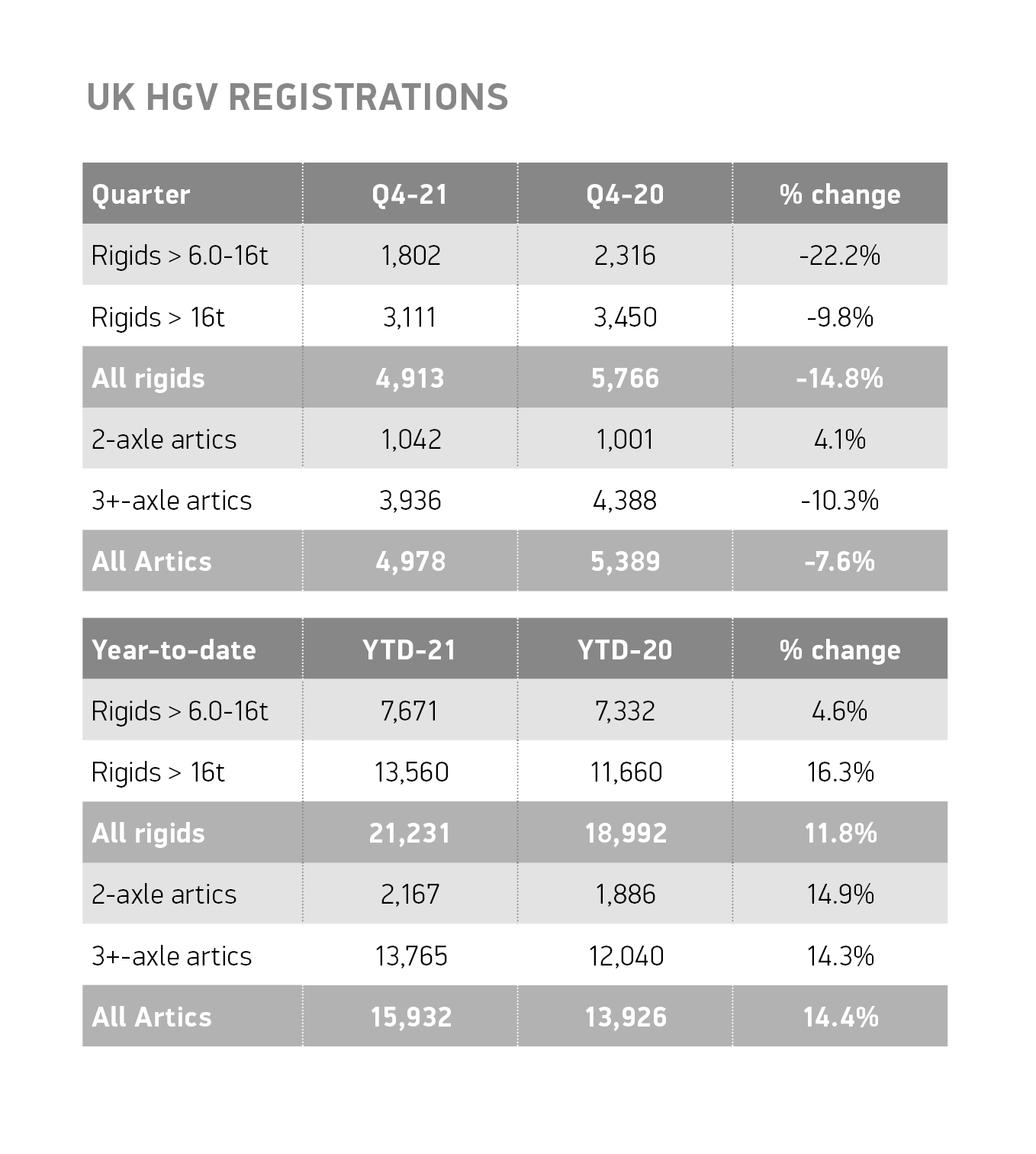

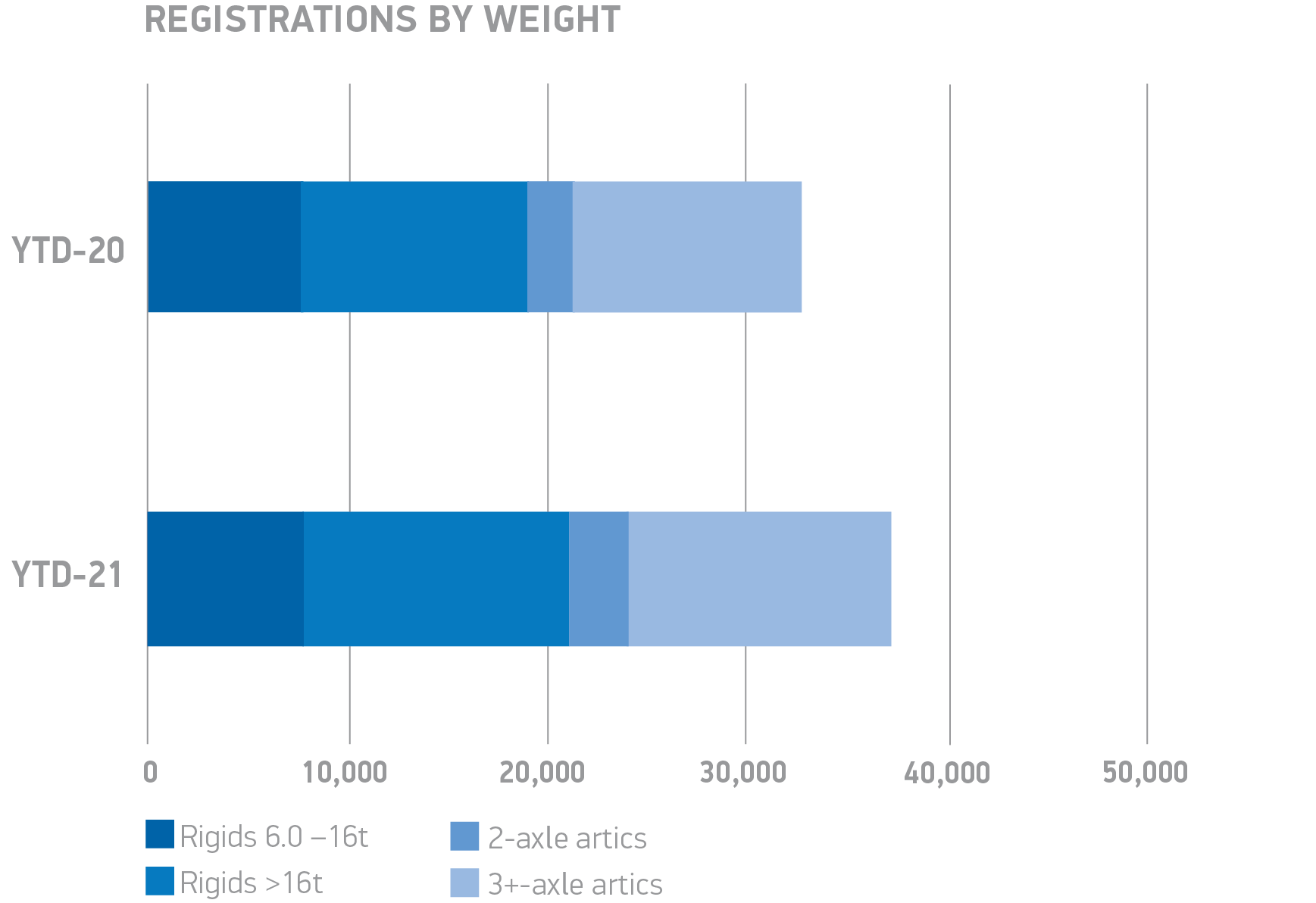

Some 37,163 units were registered last year, 57.1% of which were rigids, while 42.9% were articulated trucks, in line with market splits seen in previous years, though both segments grew with 2,239 more rigids (+11.8%) and 2,006 more artics (+14.4%) registered than 2020.

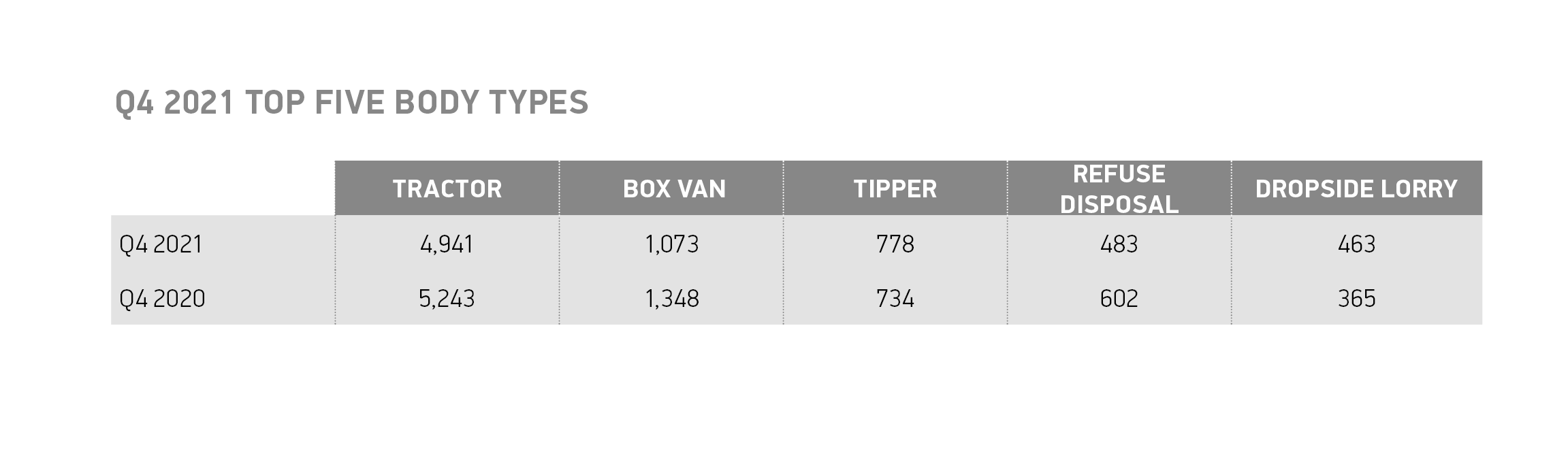

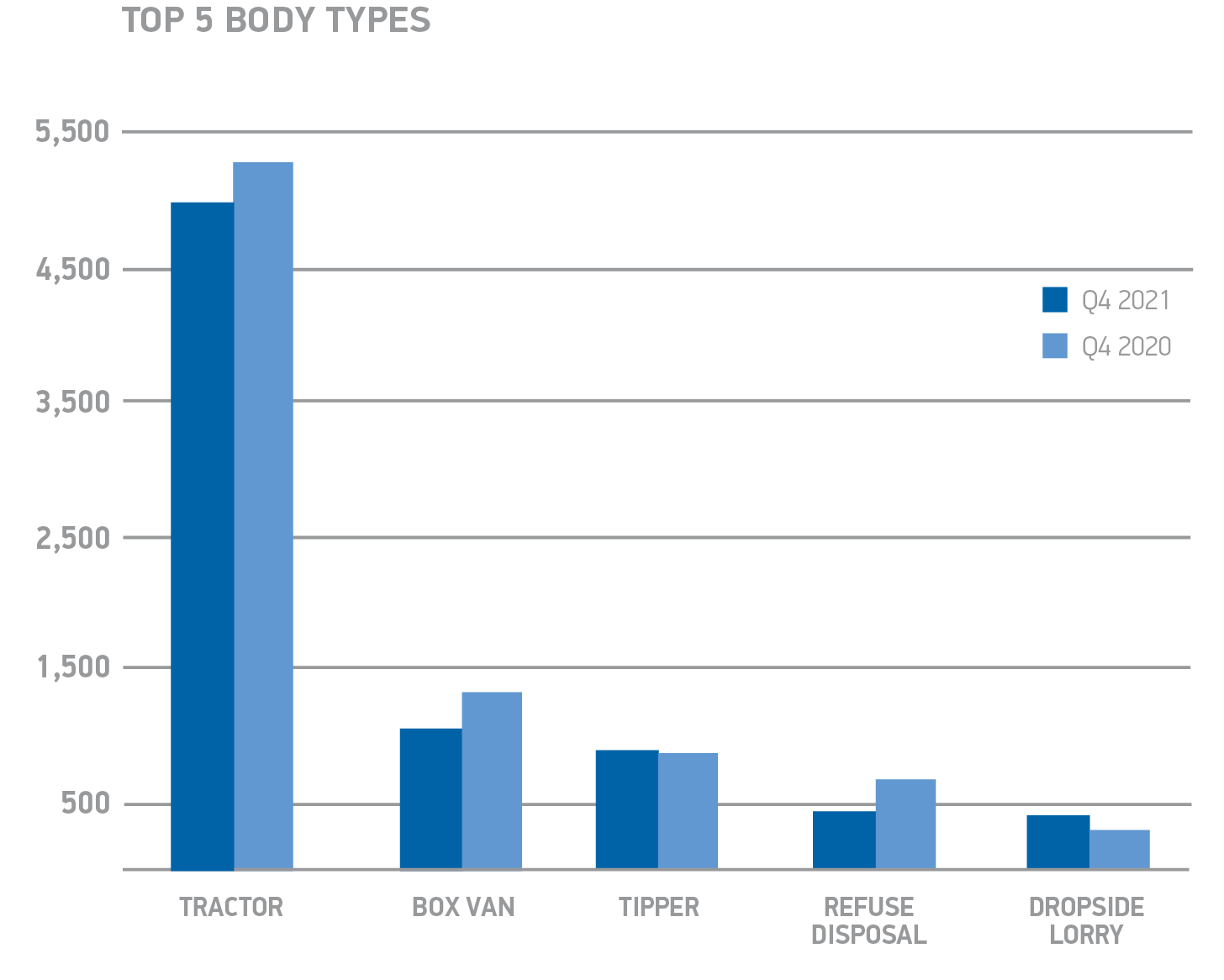

As construction began to bounce back during the year, tipper demand rose by 32.5% to 3,808 units. Tractor units were the most popular type of HGV, with 15,679 units (+16.0%) representing a market share of 42.1%, while refuse trucks increased by 2.0% to 2,067 units. Conversely, box van registrations fell slightly, by -1.2% to 4,054 units, while curtain-sided lorries declined by -6.3% to 2,452 units.

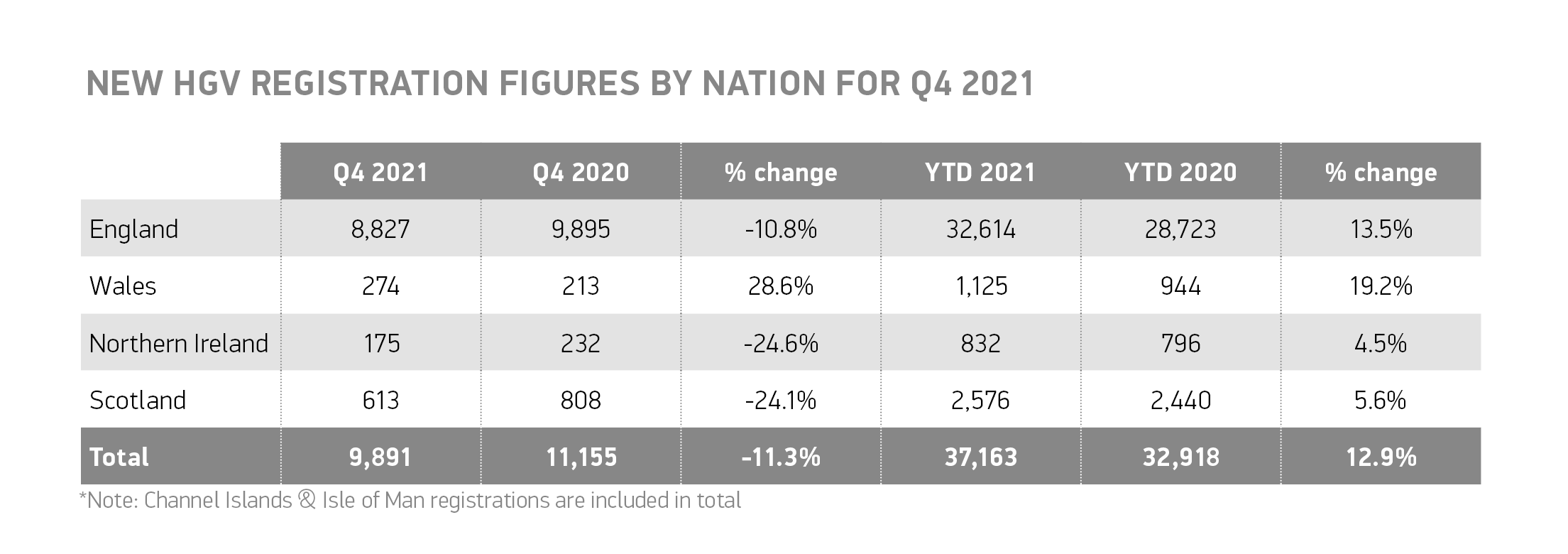

In terms of UK nations, the majority of registrations were recorded in England (87.8%), followed by Scotland (6.9%), Wales (3.0%) and Northern Ireland (2.2%). Regionally, most registrations were made in South East England (23.2%), North West (12%), West Midlands (12%) and Yorkshire & Humberside (11.9%).

Maintaining and growing demand will be vital to fleet renewal – getting more of the latest, greenest trucks on the road – but operators need long-term certainty to make investment decisions. New non-zero emission HGV sales will end in 2040 – just five years after the end of sale date for non-zero emission new cars and vans. While the passenger car market is largely focused on one technology – electric – to meet driver needs, with a massive choice of models already available, there is no single zero emission technology appropriate for all HGV use cases. Furthermore, there is no plan to create the necessary public recharging or refuelling infrastructure specifically for HGVs and drivers to enable the transition. As a result, fossil fuel vehicles still accounted for 99.8% of HGVs in use in 2020, a proportion last seen in the car parc in 2007.2

Mike Hawes, SMMT Chief Executive, said,

With so much of our economy dependant on HGVs, the market’s return to growth is good news as getting more of the latest, high tech and low emission trucks onto the roads is critical to both air quality and climate change improvements. However, the sheer variety of functions HGVs perform, in logistics, construction and waste collection to name but three, illustrates how a range of technologies may be necessary to decarbonise road transport. Manufacturers are investing billions in such technologies, including battery electric, hydrogen and other alternative fuels but operators will need clarity, affordability and evidence on an infrastructure plan dedicated to their needs if this transition is to be delivered on time.

Notes to Editors

1. 2015-2019 average: 44,734 units

2. 0.2% of HGVs were alternatively fuelled, based on SMMT analysis of 2020 motorparc data; Fuelling the Fleet: Delivering Commercial Vehicle Decarbonisation