- UK’s EV transition emerges from ‘early adopter’ market phase, with more than 800,000 EVs registered since 2018 and on track to reach almost 18% market share by year end.

- Fleets leading electric transition but end of private consumer incentives undermines mass market demand.

- New research shows two thirds of drivers want to go electric but are held back by lack of incentives and infrastructure – with nine in 10 who’ve switched stating they would never go back to a conventionally fuelled vehicle.

- To spur mass market adoption, car industry calls for support for private buyers in line with incentives for businesses.

UK automotive leaders today celebrate the battery electric car market’s emergence from the ‘early adopter’ phase and discuss the measures needed to shift the technology to mass market following a 21-fold growth in EV uptake since 2018.1

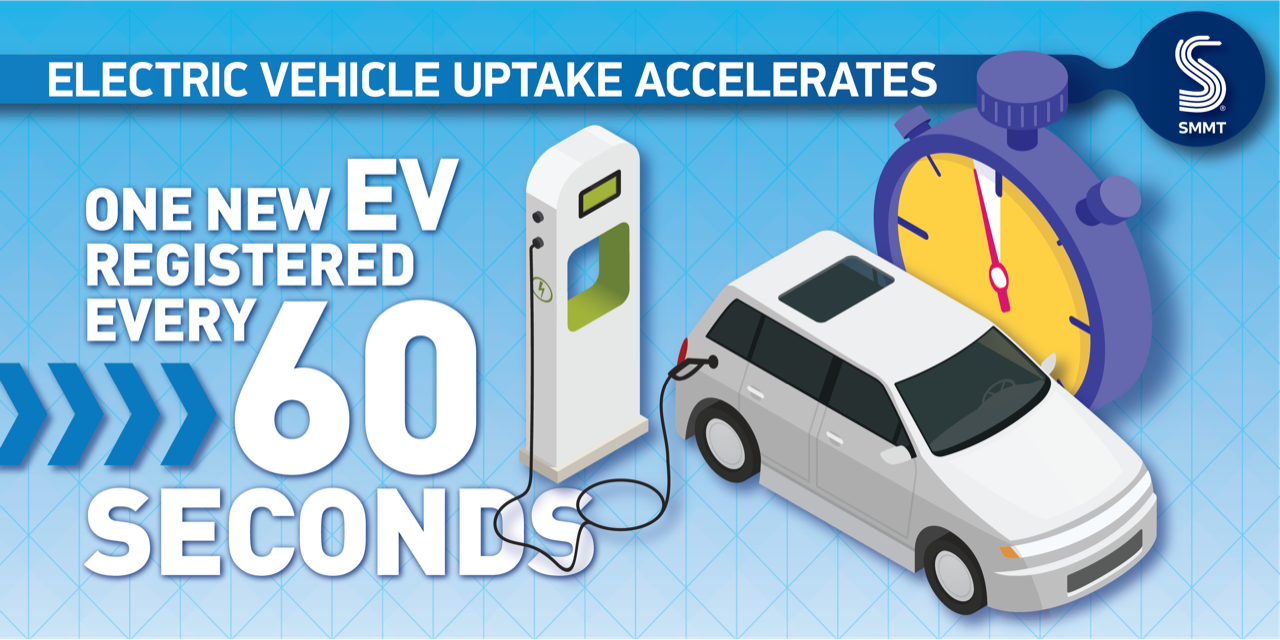

According to the latest data from the Society of Motor Manufacturers and Traders (SMMT), with one electric vehicle registered every 60 seconds2, they now account for more than 16% of overall sales, making Britain Europe’s second largest zero emission car market by volume.3 Delivering a faster and fairer mass transition, however, is threatened by the absence of support for private buyers, many of whom plan to go electric but are delaying due to concerns over affordability and uncertainty regarding the availability of a nationwide charging network.

Uptake of battery electric cars has soared over the past five years. In 2018, they comprised just 0.7% of the new car market, yet are anticipated to account for 17.8% by the end of the year – good progress, but the market must move even faster to meet net zero ambitions. While the shift was originally driven by private consumers, they have since been overtaken by fleets and business buyers. Following 2022’s removal of the Plug-in Car Grant – leaving Britain as the only major European market with no consumer EV incentives yet the most ambitious transition timeline – sales to private buyers have fallen from more than one in three, to less than one in four.4

Driving up demand is made more urgent by the proposed Zero Emission Vehicle Mandate which will compel the sale of these cars and vans, but has still to be finalised with barely 100 days to go until implementation.

Business demand has been boosted by fiscal incentives, proving that purchasing support powers up markets. Private drivers also want to make the switch from petrol to electric cars, as a new survey commissioned from Savanta shows. Two thirds (68%) of non-EV drivers surveyed said they want to make the switch, but just 2% plan to invest this year and 17% in 2024 – with more than half saying they will not be ready until 2026 or later.5

Manufacturers are committed to delivery, having invested heavily to ensure there is wide-ranging choice in the market, with performance to meet drivers’ needs. Getting consumers to buy sooner, however, depends on financial incentives (said 68% of respondents) and ready access to affordable, reliable public charging (said 67% of respondents).

The success of the business and fleet markets in switching must now be replicated in the private retail market. While manufacturers already provide attractive purchase incentives, these need to be complemented by government-backed incentives.

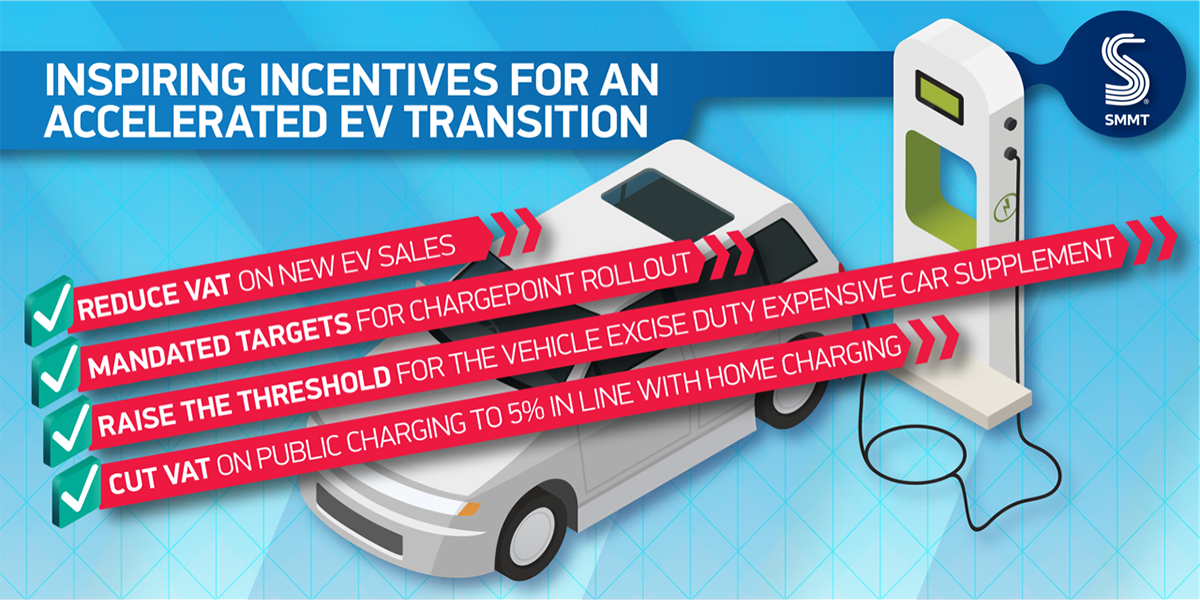

For example, reducing VAT on EV purchases would mirror existing discounts on other environmental products such as solar panels and heat pumps and improve Exchequer receipts. Raising the threshold for the Vehicle Excise Duty ‘expensive car supplement’ from its 2017 level to reflect today’s costs – or exempting EVs altogether – would also help. Taxation would also be fairer if VAT on public charging matched home charging at 5%, not 20%.

Furthermore, mandating targets for chargepoint rollout would help overcome the other issue holding back consumers – insufficient infrastructure. Such measures would improve the attractiveness of EVs to British consumers and flow through to the second hand market, increasing demand and helping address concerns about the residual value of these new technologies.

Once consumers make the change to an EV, they seldom go back. Nine in 10 electric car drivers say they wouldn’t go back to a conventionally fuelled vehicle, with most (57%) loving that they spend less on fuelling – although, overwhelmingly, those drivers have access to home charging (84%) – while half (49%) are delighted to have reduced their environmental impact.

Mike Hawes, SMMT Chief Executive, said:

We are entering a new phase in the UK’s EV transition, in which Britain can, and should, be a leader. We have the industry, the love of new technology and the scale to succeed. Government has recently demonstrated its commitment to EV manufacturing in the UK and that commitment must be extended to the consumer. With a new – and still to be finalised – Zero Emission Vehicle Mandate due to revolutionise the market in just over 100 days, supply must be matched by demand. A comprehensive package of measures would encourage households across the UK to go electric now, boosting an industry slowly recovering from the pandemic and delivering benefits for the Exchequer, society and the global environment.

SMMT Electrified, the UK’s pre-eminent summit on the zero emission vehicle transition, will today bring together more than 600 automotive industry leaders, plus stakeholders and representatives from government, the energy sector, chargepoint providers and fleets, to discuss and debate the key challenges and opportunities as Britain decarbonises its transport.

Notes to editors

1 BEV registrations Jan 2018-Aug 2023: 812,717; BEV registrations Jan-Aug 2018: 9,009; BEV registrations Jan-Aug 2023: 193,221

2 Summer surge as one new EV registered every 60 seconds, SMMT, 4 August 2023

3 ACEA: Fuel types of new cars, 1 February 2023

4 Private share of new BEV registrations Jan-Jun 2022: 36.3%; Jan-Jun 2023: 24.2%

5 Savanta interviewed 2,375 adults online in the UK, filtering to those who have access to a car, between 1-8 September 2023. Data weighted to be demographically representative of the UK by age, gender, region and social grade. Savanta is a member of the British Polling Council and abides by its rules www.savanta.com