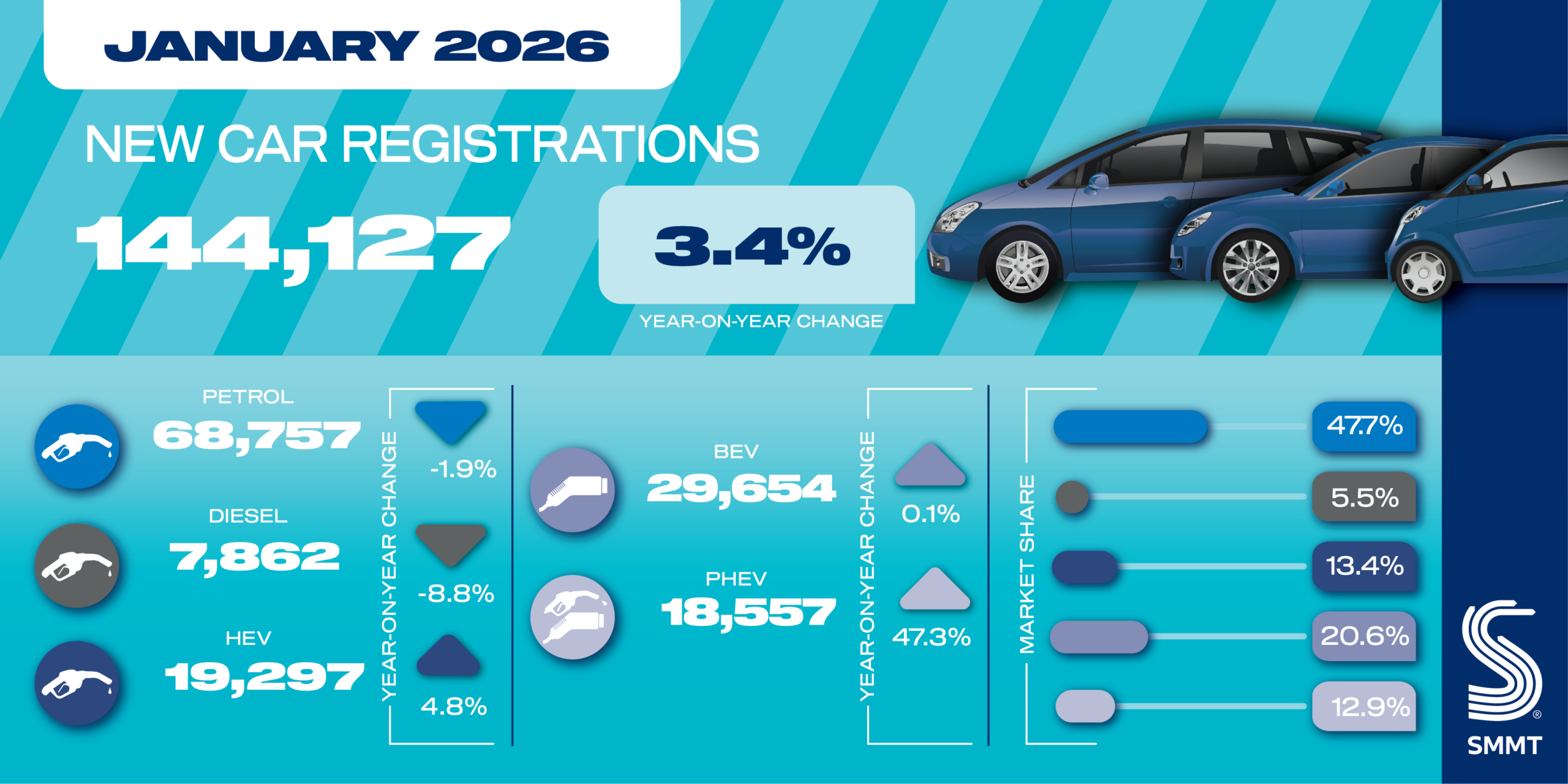

- New car market rises 3.4% in January to 144,127 units.

- Battery electric car volumes rise slightly but lose share compared with last year.

- New outlook anticipates market to grow 1.4% in 2026, with EV share expected to rise to 28.5%.

Data download

New car registrations data January 2026

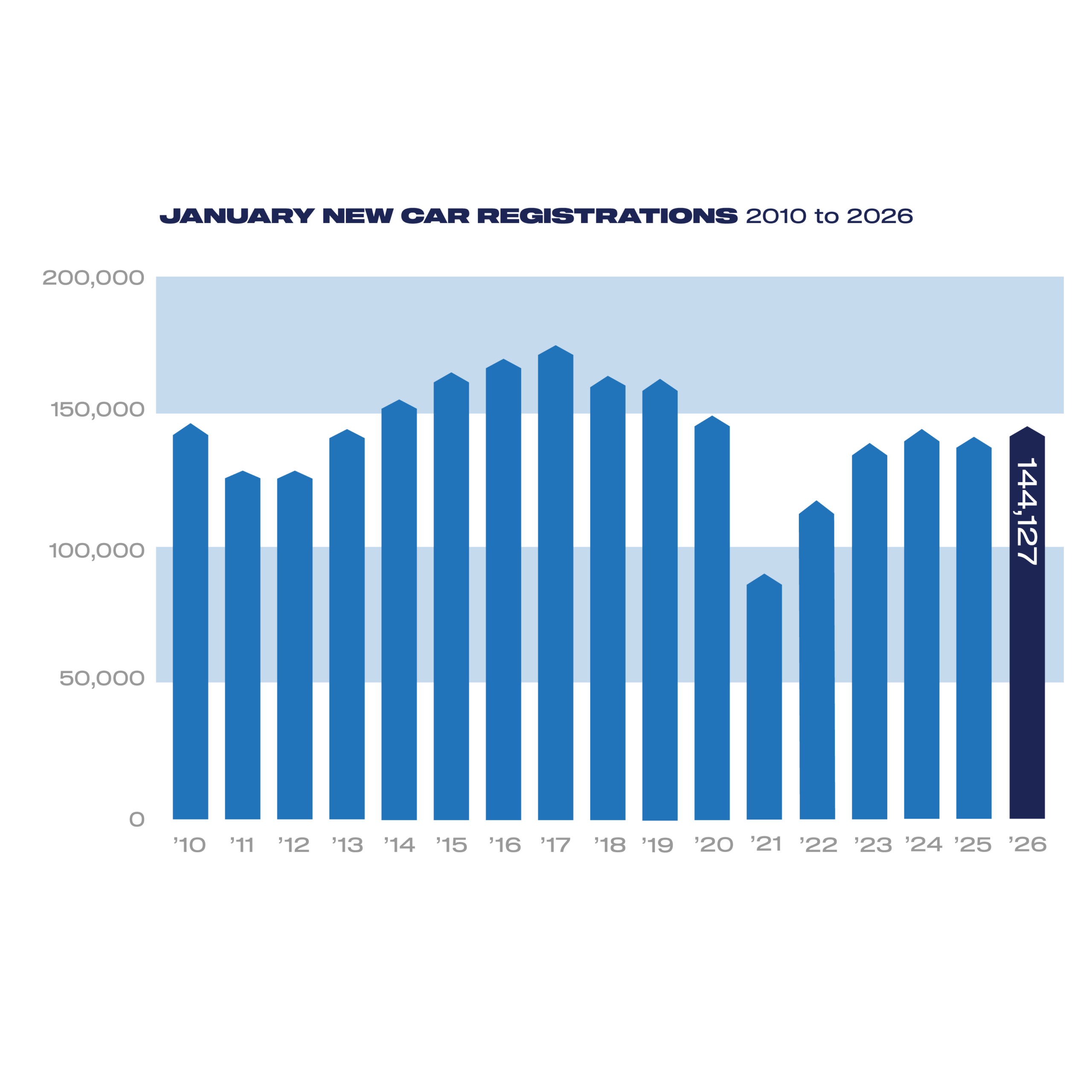

The UK new car market grew by 3.4% in January to reach 144,127 units, according to the latest figures published by the Society of Motor Manufacturers and Traders (SMMT), resulting in the best start to a year since pre-pandemic 2020.1

Growth was recorded across all buyer types, with registrations by private retail buyers up 4.5% and fleets increasing by 1.6%, while the low-volume business segment rose 46.5%. Fleets remained by far the largest source of new car registrations, accounting for 61.2% of the market.

Uptake of battery electric vehicles rose just 0.1% to 29,654 units – delivering a 20.6% market share, the lowest since April 2025.2 The decrease follows a strong 2025 January performance when uptake was pulled forward as buyers sought to avoid April’s introduction of new tax rates on BEVs. Furthermore, the strong BEV performance at the end of 2025, with manufacturers pushing to meet regulatory targets, will also have affected the January market.

The largest growth was again recorded in plug-in hybrids (PHEVs), rising 47.3% to account for 12.9% of registrations. Rounding off electrified vehicle uptake, hybrid electric vehicles posted a 4.8% increase, comprising 13.4% of the market.

With January typically a lower volume month and not necessarily indicative of the full year trend, the latest market outlook forecasts new car registrations to grow 1.4% over 2026 to reach 2.048 million units – a more optimistic outlook than that previously published in October.3

Increasing model choice, improved range and the re-introduction of government support through the Electric Car Grant has helped strengthen the 2026 outlook for BEV uptake, with these vehicles now expected to comprise 28.5% of the market.4 Although this would represent tangible progress on 2025, it would still be significantly short of the 33% mandated target for the year.

This shortfall exists despite billions invested by manufacturers in model development and discounts, and an improving the charging network, highlighting the fact that the assumptions behind the creation of the mandate have not borne out. Given the differing economic, political and industrial situation the sector now faces, a holistic review of the transition is needed. This must be completed urgently, as demand is predicted to be further suppressed with the proposed introduction of eVED from 2028.

Mike Hawes, SMMT Chief Executive

Britain’s new car market is building back momentum after a challenging start to the decade. It is also decarbonising more rapidly than ever and, despite a January dip in EV market share, the signs point to growth by the end of the year. The pace of the transition, however, may be slowing and is certainly behind mandated targets. With sales of new pure petrol and diesel cars planned to end in less than four years, there needs to be a comprehensive review of the transition now, to ensure ambition can match reality.

Notes to editors

- January 2020: 149,279

- March 2025 BEV share: 20.4%

- October 2025 outlook for 2026: 2.032m units, with 1.0% growth

- October 2025 outlook for 2026 BEV share: 28.2%

SMMT Update

Sign up

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields