- June sees 34,363 vans join UK roads, up 14.4% on last year, but still -13.9% short of 2019 performance.1

- Third best year-to-date performance for LCV registrations, up 1.8% on 2015-2019 average.2

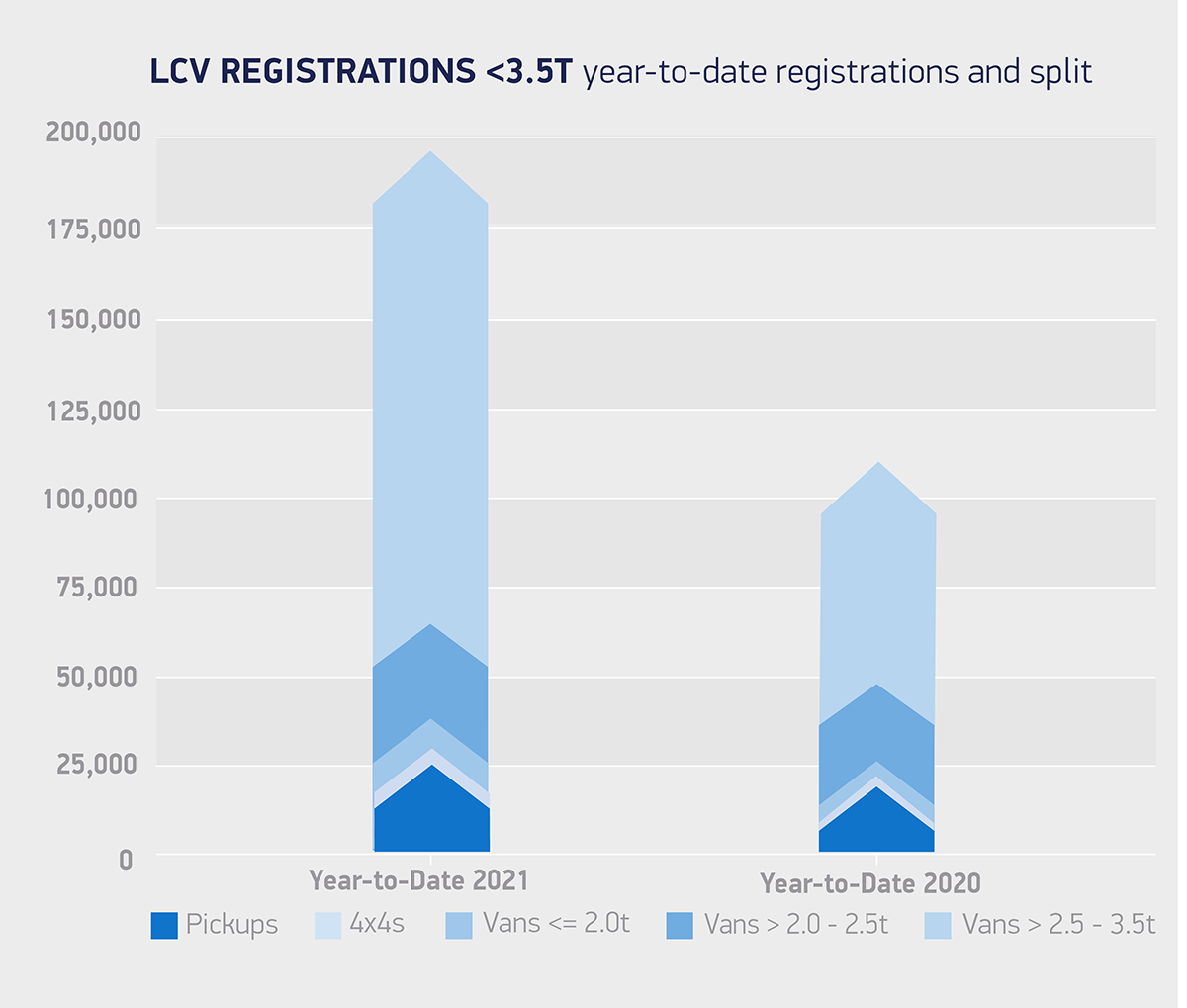

- Heavier vans drive van market growth year to date, up 88.1% to 128,495 units.

SEE LCV REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

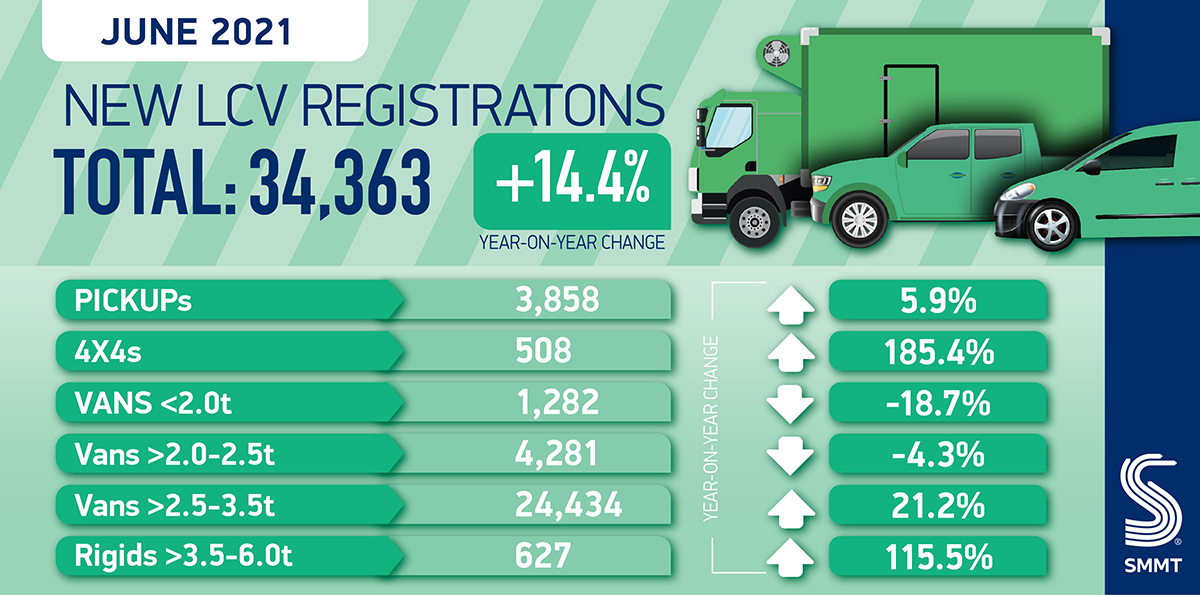

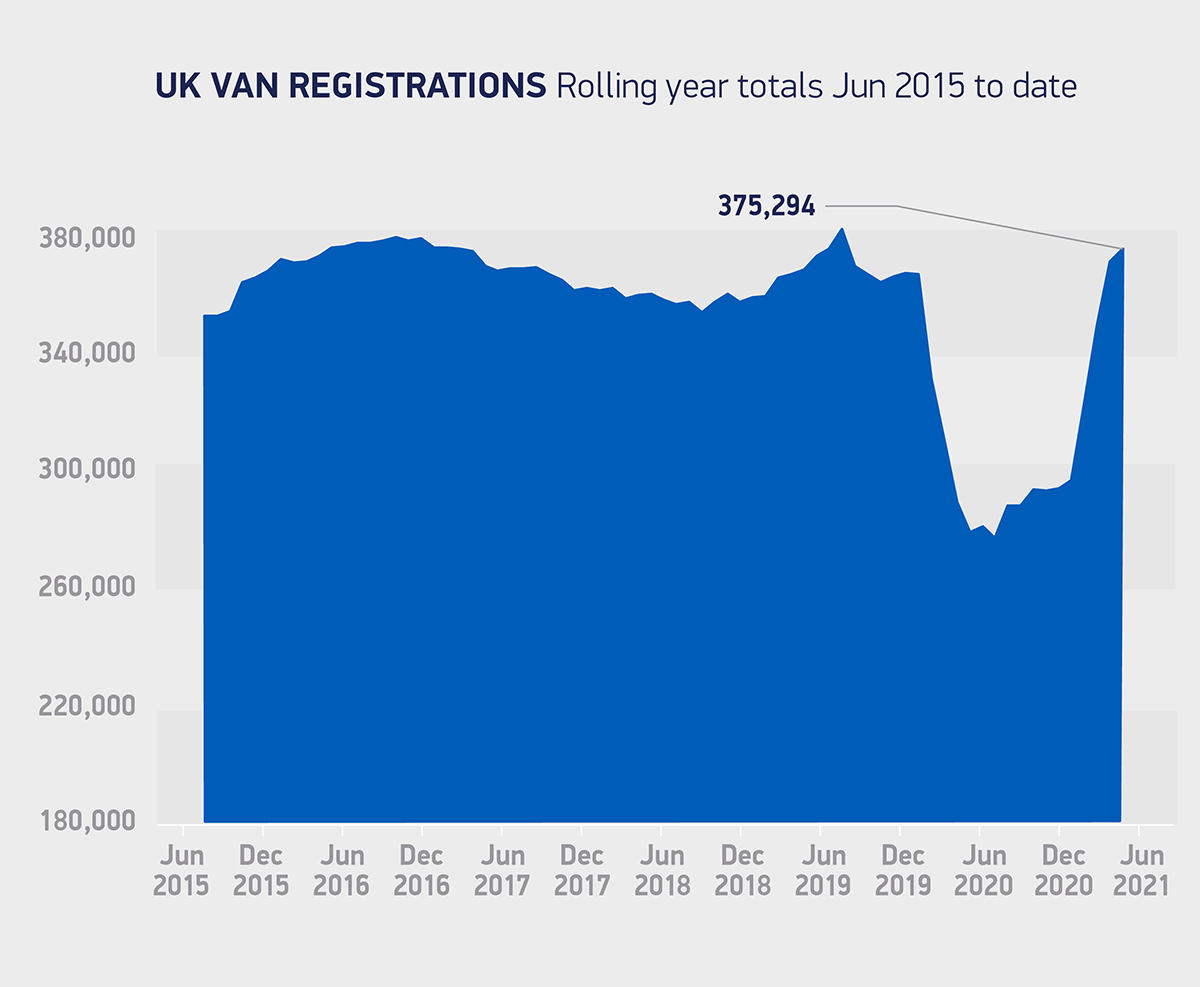

The light commercial vehicle (LCV) market growth was tempered after a bumper recovery in April and May, with 34,363 vans registered in the month, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). The month’s performance was down -13.9% on 2019, a shortfall of some 5,566 units as supply shortages – notably of semi-conductors – affected production volumes and caused delays in the market. Nevertheless, van registrations remain up 14.4% on Covid-impacted 2020.

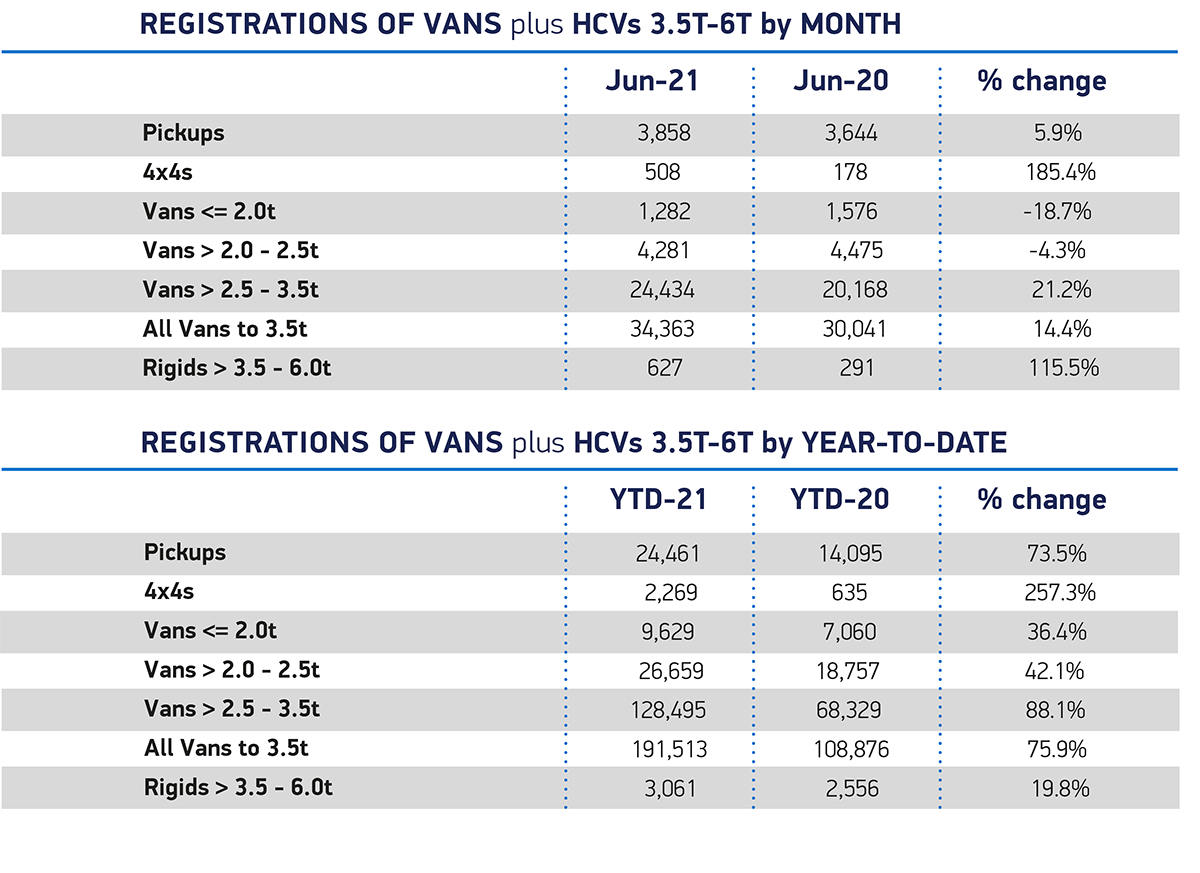

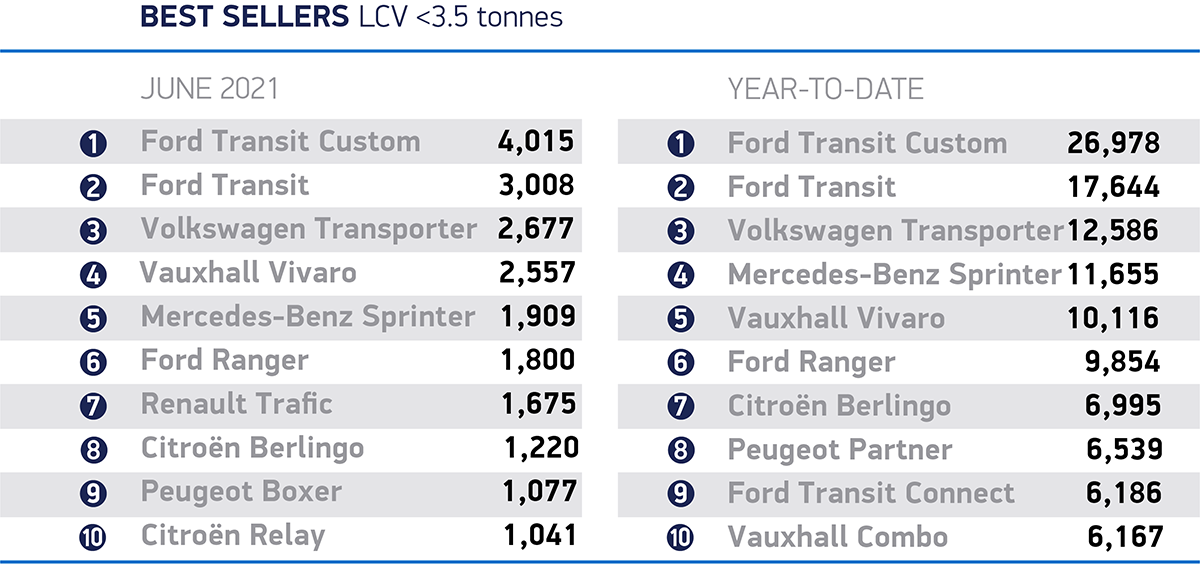

Year-to-date figures were up 75.9% on last year, and up 1.8% on the pre-pandemic 2015-2019 five-year average. In total 191,513 new vans have exchanged hands, meaning that 2021 is currently the third best year for van uptake since records began. Demand for vans was particularly bolstered by operators looking to renew and expand their fleets to meet rising online delivery business and demand from the construction sector.

Demand for larger 2.5-3.5 tonne vans drove the increase in June, comprising the majority (71%) of all registrations in the month, some 24,434 vans. Other van segments saw drops in demand compared to 2020, with registrations of lighter vans weighing less than or equal to 2.0 tonnes down -18.7% and those of vans weighing more than 2.0-2.5 tonnes down -4.3%.

Mike Hawes, SMMT Chief Executive, said,

It’s good to see the van market continue to perform well, with pent up demand, online retail and the construction sectors all on the rise. Semi-conductor supply issues have extended lead times, but business confidence is growing and fleets are embarking on decarbonisation programmes. Full market transition, however, still depends on the creation of nationwide charging infrastructure to support society and maintain commercial vehicle momentum.

Notes to editors

1. June 2019 – 39,929

2. YTD June 2019 – 196,418, YTD June 2016 – 191,966 YTD average 2015-2019 – 188,082