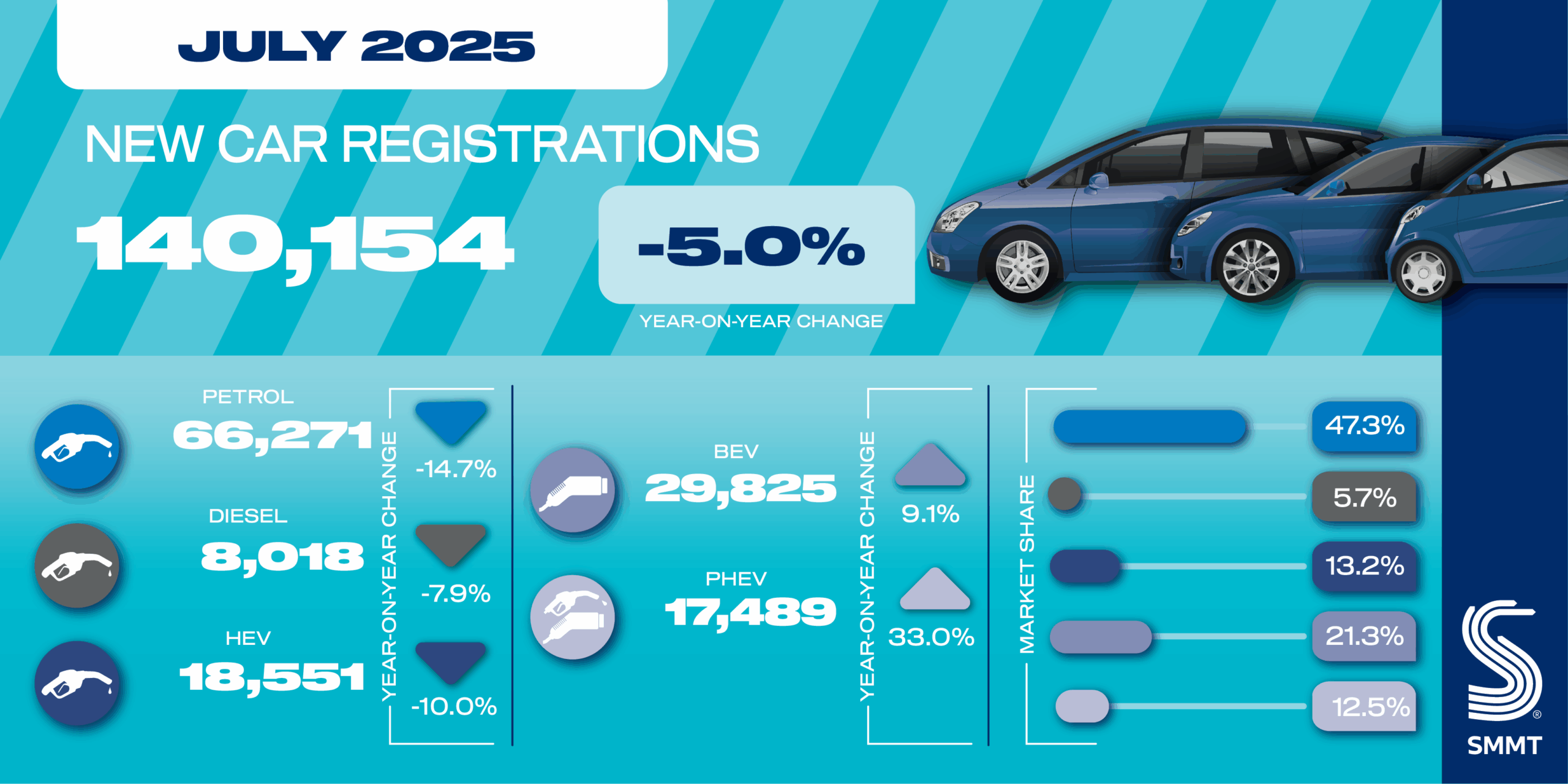

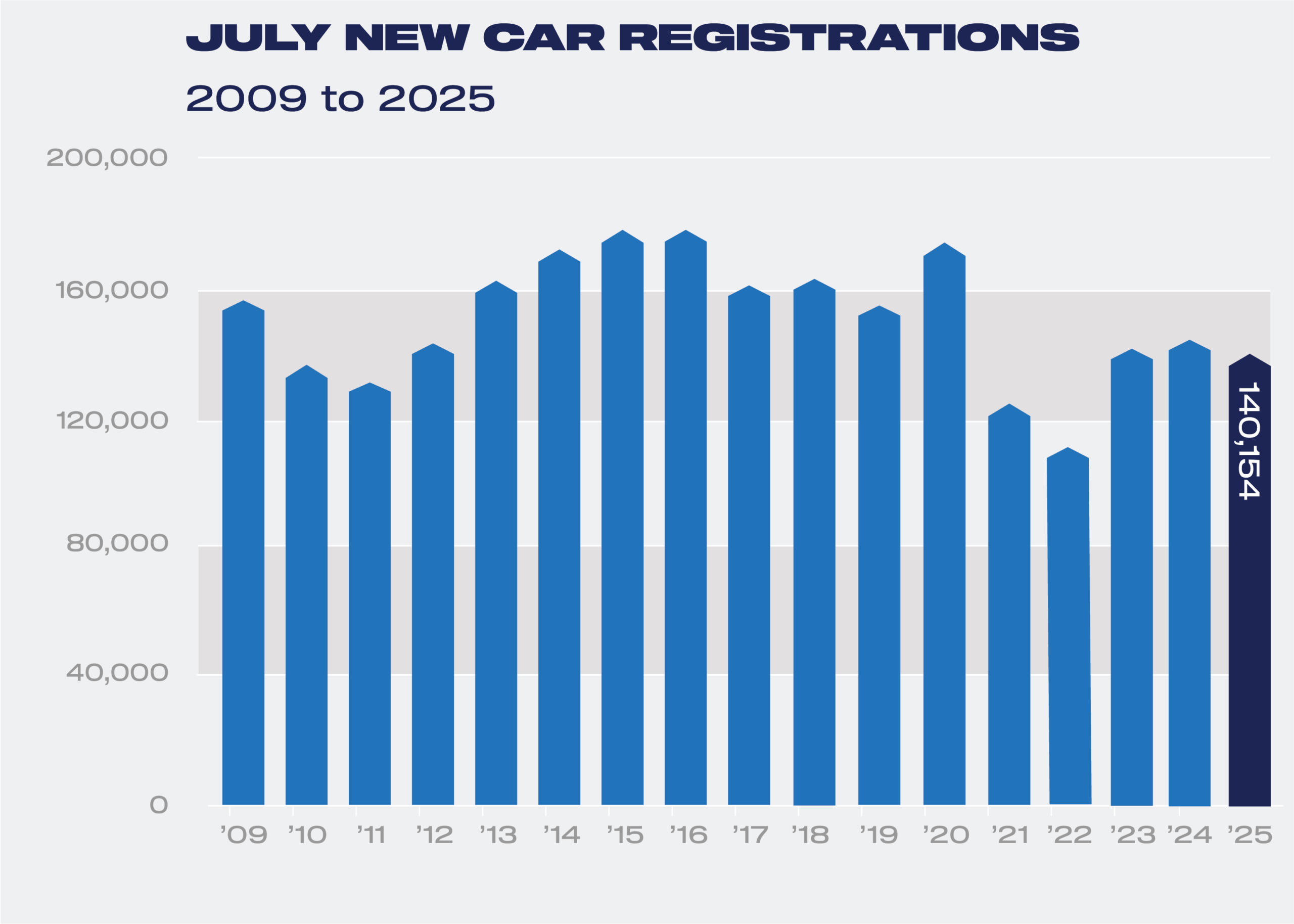

- New car market declines -5.0% in July to 140,154 units following two months of growth.

- Battery electric vehicle registrations rise again but growth moderates to 9.1% as full Electric Car Grant eligibility urgently needed.

- Market year-to-date up 2.4% to 1.18 million units as 2025 outlook revised upwards to 1.9 million.

Data download

New car registrations data July 2025

The new car market stalled in July with registrations falling -5.0% to 140,154 units, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance was the weakest for the month since 2022 and some -10.8% lower than in pre-pandemic 2019, demonstrating the market’s volatility and wider economic setting.1

Demand from private and fleet buyers fell -3.2% and -6.5% to 51,646 and 85,594 units respectively, while registrations in the much smaller business sector climbed 10.4% to 2,914 units. Declines were seen across most segments, with only Dual Purpose, Mini and Luxury Saloon models recording growth.2

Bucking the wider market performance, registrations of plug-in hybrid electric vehicles (PHEVs) rose 33.0% and battery electric vehicles (BEVs) 9.1%, although the latter is modest in comparison with the 34.6% increase recorded for the first half of 2025. July was the second weakest month of BEV growth this year, after April’s tax changes distorted the market in that month.

The newly announced Electric Car Grant (ECG) provides a welcome and much-needed fiscal incentive for BEV uptake, but full model eligibility has yet to be confirmed, causing some buyers to hold off pending confirmation of which vehicles will qualify for a discount of up to £3,750. BEV market share reached 21.3%, up from 18.5% in the same month last year, but remains short of the 28% required by the ZEV Mandate, demonstrating the importance of accelerating uptake over the remainder of the year.

Hybrid electric vehicle (HEV) transactions declined -10.0% to 18,551 units while combined petrol and diesel deliveries fell -14.0% to 74,289 units, but still accounted for more than half (53.0%) of July’s market.

Year-to-date, the overall market remains up 2.4% at 1.18 million units, including more than a quarter of a million BEVs, thanks to a plethora of attractive new models and substantial manufacturer discounting. July’s decline is expected to be temporary, with the latest market outlook – undertaken before eligible ECG models were confirmed – revised up to 1.9 million units for 2025, with BEV volumes revised up marginally too and expected to take a 23.8% share.3

Mike Hawes, SMMT Chief Executive

July’s dip shows yet again the new car market’s sensitivity to external factors, and the pressing need for consumer certainty. Confirming which models qualify for the new EV grant, alongside compelling manufacturer discounts on a huge choice of exciting new vehicles, should send a strong signal to buyers that now is the time to switch. That would mean increased demand for the rest of this year and into next, which is good news for the industry, car buyers and our environmental ambitions.

Notes to editors

- 157,198 units registered in July 2019

- Mini registrations +14.7% to 1,767 units; Luxury saloon +114.6% to 382; Dual Purpose +13.9% to 54,603 (July 2025 vs July 2024)

- SMMT Outlook July 2025

SMMT Update

Sign up

Sign up to the SMMT Update Newsletter for weekly automotive news and data

"*" indicates required fields