- Biggest-ever turnout for British automotive aftermarket firms at Automechanika Frankfurt – the world’s largest global automotive trade event.

- New report from SMMT sets out international opportunities for UK aftermarket companies in China, India and the Middle East.

- Export opportunities depend on expansion of competitive international trading conditions.

British companies will be out in force at Automechanika Frankfurt this year, with more than 150 UK exhibitors, the most in the show’s 45 year history. The record attendance comes as SMMT publishes a report identifying a £195 million opportunity for UK aftermarket firms to expand in three major emerging markets, as demand grows across the world.

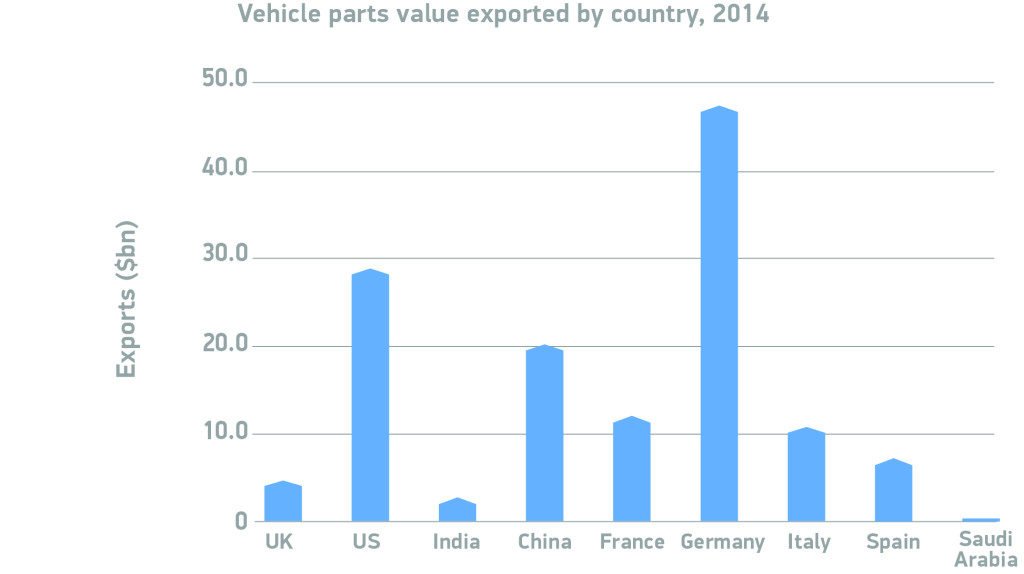

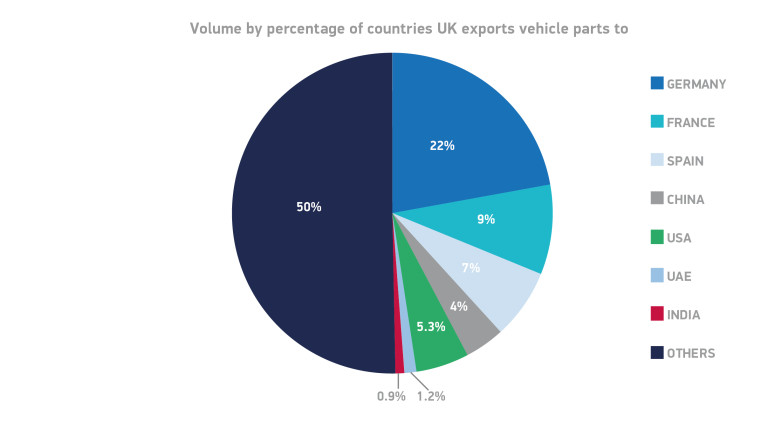

The UK automotive aftermarket is thriving, ranking fourth in Europe and ninth in the world in terms of size, and turning over an annual £21.1 billion. The sector supports 345,600 jobs and contributes £12.2 billion each year to the economy. And it is growing: in line with the UK’s increasing car parc, the sector’s value is set to rise to £28 billion by 2022.1 The UK also enjoys robust trade with other European countries, with Germany its largest market, followed by France and Spain. In fact, Germany purchases more components and accessories from UK-based parts suppliers than it does from any other country.

However, a new Frost & Sullivan report published by SMMT today, shows that international markets and in particular emerging markets, offer the biggest potential for growth. International Opportunities for UK Aftermarket Companies shows that suppliers exporting to these regions can grow their businesses at rates four to five times higher than the annual 3% they can expect in the UK. The total global opportunity stands at some £500 billion for aftermarket business.

The report explores the potential for growth in three key emerging markets: China, India and the GCC region of the Middle East.2 Together, these three aftermarkets are worth some £54 billion – so the potential for growth is significant. Just by keeping pace with these markets’ natural growth, UK aftermarket companies could double their income to £195 million over the next seven years.

The UK automotive aftermarket sector is part of a globally integrated industry which relies heavily on the tariff-freeflow of goods across borders,with component sub-assemblies often sourced from a diverse range of countries. Further growth into new markets would benefit from new trade agreements, but that should not give reason for delay.

Mike Hawes, Chief Executive, SMMT, said, “The UK’s aftermarket sector is one of the world’s most dynamic and the record attendance at Automechanika Frankfurt demonstrates the sector’s success and global ambition. To help companies exploit these opportunities, government must secure the competitive conditions that have allowed this export-led industry to thrive. This means tariff-free trade with our partners across Europe and further trade deals with emerging markets.”

According to the report, China offers the biggest opportunity for British aftermarket firms. Home to 151.6 million cars and light commercial vehicles, it is set to surpass the US as the world’s largest vehicle parc within the next decade. UK suppliers produced parts worth some £41.5 million for the Chinese in 2015 and with the right conditions Frost & Sullivan estimates that British companies could grow their business here by 15% every year.

India, where quality UK-made parts are particularly sought after, also offers growth potential, with UK suppliers currently accounting for £14 million of the £6.7 billion market. Similarly, in the Middle Eastern GCC, where car owners are almost completely dependent on imported parts, there is scope for significant expansion to meet regional demand, estimated to be around £5.8 billion. To take advantage of these opportunities, UK-based suppliers must navigate the unique cultural and regulatory aspects of these markets. The report sets out some of the challenges involved and how companies can meet them and grow their export business.

SMMT is hosting a delegation of 55 UK automotive companies3 on a UK Pavilion at Automechanika Frankfurt from 13 to 17 September, while a further 100 British firms are in attendance.

1 The Importance of the UK Aftermarket to the UK economy, Frost & Sullivan, June 2016.

2 The GCC (Gulf Cooperation Council) region of the Middle East covers Saudi Arabia, United Arab Emirates, Bahrain, Qatar, Oman and Kuwait.

3 The following companies are exhibiting their latest product innovations in Halls 5.1 and 4.1 at the Messe Frankfurt exhibition centre in Germany: 3G Truck and Trailer Parts Ltd; Advanex Europe Ltd; Allmakes 4×4 Ltd. The Autins Group; Autoenterprises Ltd; Autogem Invicta Ltd; Autopumps UK Ltd; B G Automotive; Bearmach Limited; BNL (UK) Limited; Border Holdings (t/a Britpart); Capus; Carchem Ltd; Cats and Pipes Ltd; CM Frost (t/a NoSmokeOil); Combine Auto Parts Ltd; Commercial Car Components Logistics Ltd (t/a Anglo Agriparts); Dynament (Status Scientific Controls Ltd); Eurocams Ltd; European Braking Systems; Fitsco Industries Ltd; Flettner Ventilator Ltd; G3 Concepts Limited; Global Industries Limited; Global Technologies International (UK) Ltd; GT Automotive England Ltd; Hotbray Limited; Jewelultra; John Bruce (t/a MEI Brakes); K.S International; Lubepack; Magnocrest (t/a Ranger Stork); MAM Software Ltd; Melett Ltd; MJ Allen National Autoparts Ltd (t/a National Autoparts Ltd); Moseley Brothers; Motive Components Ltd; Nelson Stokes Ltd; Nightsearcher Ltd; On Board Defence Limited; Permex Ltd; Premier Supply Ltd; Presco Radiator Caps Ltd; Ringback Ltd; Roadlink International Ltd; Rolling Components Limited; Silent Sensors Ltd; T P Engineering Ltd; Thos. Winnard & Sons Ltd (t/a Winnard); Tibbets Group Ltd; TISS Ltd; Turbo Technics Ltd; Unipart Autoparts; Wanray Europe Ltd and Yates International (t/a Yates Steels).