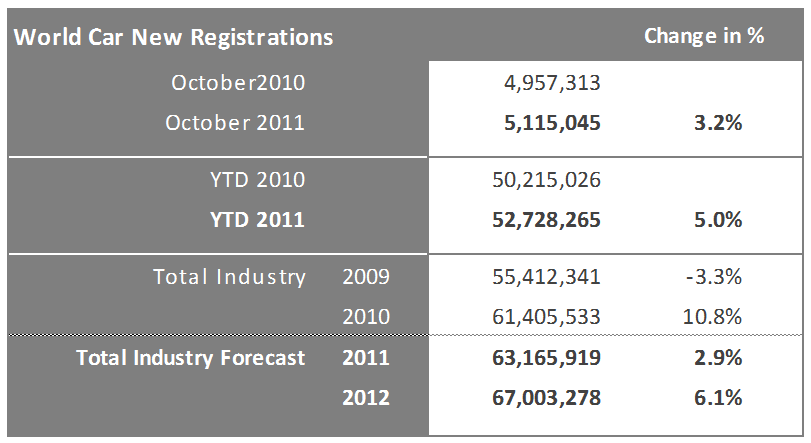

Based on data which is preliminary in some cases, global demand for passenger vehicles (NAFTA: including light trucks) was up 3% in October over the year before, as the uptrend we have seen in recent months continued, and global demand is now up 5% over the year before on the year.

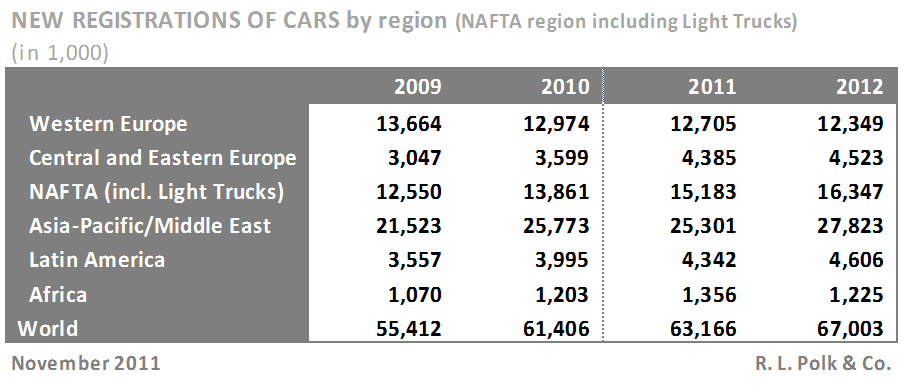

The strongest growth, 13%, came in the NAFTA region, particularly the US, where the restoration of the supply chains of the Japanese manufacturers stimulated the market. The German brands also posted strong gains.

The Asia/Pacific region was once again able to post a gain, albeit just a small one (up 0.2%), following the disaster in Japan, as slight losses in some countries, including China, were more than made up for by clear growth in Japan (up 28%).

Eastern Europe was also up by almost 9%, with Russia gaining another 13%. Latin America was down 4% from the year before last month. Brazil in particular was down 16% from the year before as a result of last year’s inflated results and the current market slowdown.

Western Europe was down more than 1% from the year before in October. There were extreme variances between the performance of the various individual markets: while France (up 2%), Germany (up 1%) and the United Kingdom (up 3%) posted gains, Spain (down 7%) and Italy (6%) reported steep losses. In those countries, the uncertainty created by the current European crisis seems to have already infected the automotive markets.

The global passenger vehicle market continues to grow, but the forecasts for 2012 involve a great deal of risk

New registrations in the Asia/Pacific region will be down about 1.8% from the year before in 2011 as a whole. This decline is attributable to the situation in the Japanese passenger vehicle market and the stagnation in China.

The strongest growth is expected in the NAFTA and Eastern Europe regions. Both of these regions will post the highest growth in 2011 due to an improvement in economic conditions. In Eastern Europe, growth will be further boosted by the Russian scrappage scheme, which will have an impact through the end of the year.

Western European passenger vehicle demand should be down slightly in 2011 as well, although the performance will vary sharply from country to country. Of the Big 5 markets, only Germany is expected to post significant growth in new registrations. All other key markets will be down, some of them significantly.

The current debate regarding the stability of the Euro Zone will leave its mark on the international markets as well in 2012. Polk is currently expecting a more or less soft landing, but forecasts worldwide have been revised by 775,000 units. The most drastic forecast

adjustments were naturally made in Western Europe, but expectations for the NAFTA region and Asia were also decreased slightly. However, there will not be another slump in global demand such as was seen in 2008 and 2009. Rather, demand will climb to about 67 million units.

Data: Copyright R.L. Polk Europe Holding Ltd, all rights reserved. No reproduction allowed without prior written consent from Polk – www.polk.com.

For more detailed data on the UK vehicle market, contact SMMT Automotive Information Services (AIS).