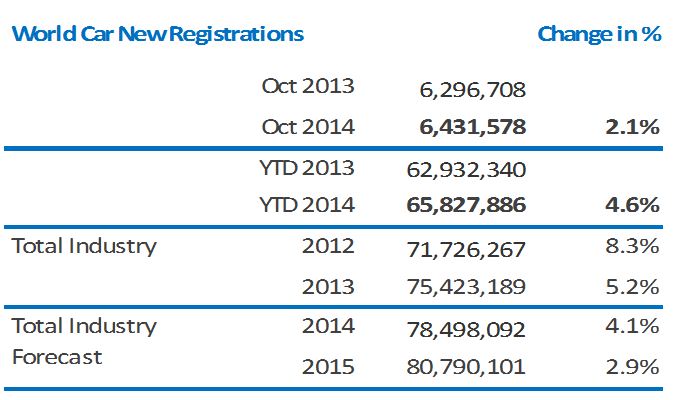

Based on results, which are preliminary in some cases, passenger vehicle sales in October were up around 2.1% from the year before. Most of this growth was generated in North America, but Asia and Western Europe also posted strong gains in October. However, vehicle sales were down once again in Eastern Europe and Latin America. YTD, sales in the first ten months of this year were up around 2.90 million units over the same period in 2013 (up 4.6%).

Low-cost financing and positive developments in the job market and disposable income once again contributed to strong performance in the NAFTA region (October: up 8.7%). Registrations are up 5.6% from the year before YTD.

The market in the Asia/Pacific region weakened in October (up 1.8% and 8.1% YTD), but still managed the second-highest sales growth in absolute terms. Chinese growth was unable to make up for declining sales in Thailand and above all Japan.

Sales in Latin America were down significantly once again (down 12.9% in October and 9.3% YTD). Sales in the region’s two largest markets, Argentina and especially Brazil were down sharply from the year before once again.

Sales in Western Europe were up by 4.2% in October (YTD: up 5.3%), due especially to strong demand in Spain (incentives) and Germany.

Russia’s sales incentive program has the potential to mitigate the sales slump in the Eastern Europe region, but not to stop it (October: down 5.9%; YTD: down 9.7%).

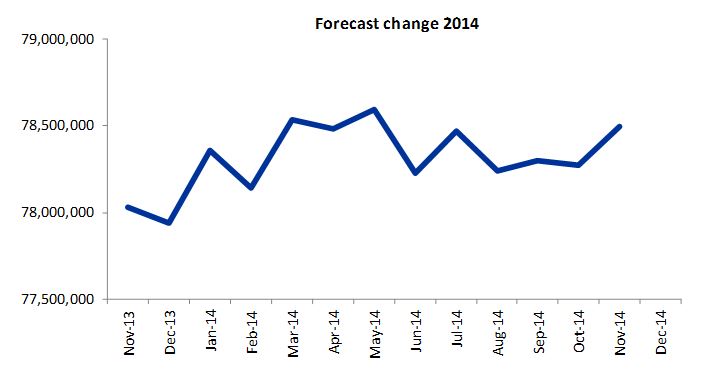

2014: New registrations expected to be 78.5 million units

Global new registrations will once again set a new record in 2014, growing by about 4.1% over 2013.

In order to account for the present rate of growth, the Chinese forecast for the final quarter has been raised by 200,000 units. The same was done, to a lesser extent, for Canada and some Southern European markets.

New registrations in the Asia/Pacific region will increase by 7.2% in 2014 compared to 2013. In China alone, sales in the current year will be up around 2.02 million units from the year before.

New registrations in the NAFTA region are expected to continue to climb to about 19.2 million units (up 5.7%). Sales in the Latin American markets, on the other hand, will fall to about 5.4 million units (down 9.3%).

Sales will actually be down by double digits in Eastern Europe as well (down 10.3%). The region’s largest market, Russia, is currently suffering from the impact of the Crimean crisis (flight of capital out of the country, sanctions), a weakening currency and low oil prices.

Passenger vehicle demand in Western Europe, on the other hand, will be up once again in 2014 (up 4.7%), as gains in markets like the United Kingdom and Germany, as well as in Southern Europe (especially Spain), will more than make up for losses in relatively small markets like the Netherlands, Switzerland and Austria (2014: new registrations of 12.1 million units).

Continued growth in Asia and the NAFTA region, as well as the progressing recovery in Western Europe, will push global passenger vehicle sales over the 80 million-unit mark for the first time in 2015. However, sales in Latin America will grow at just a slow pace for the time being and passenger vehicle sales in Eastern Europe will actually be down next year.