- 1.7 million cars built in the UK in 2016, an increase of 8.8% and the highest output for 17 years.

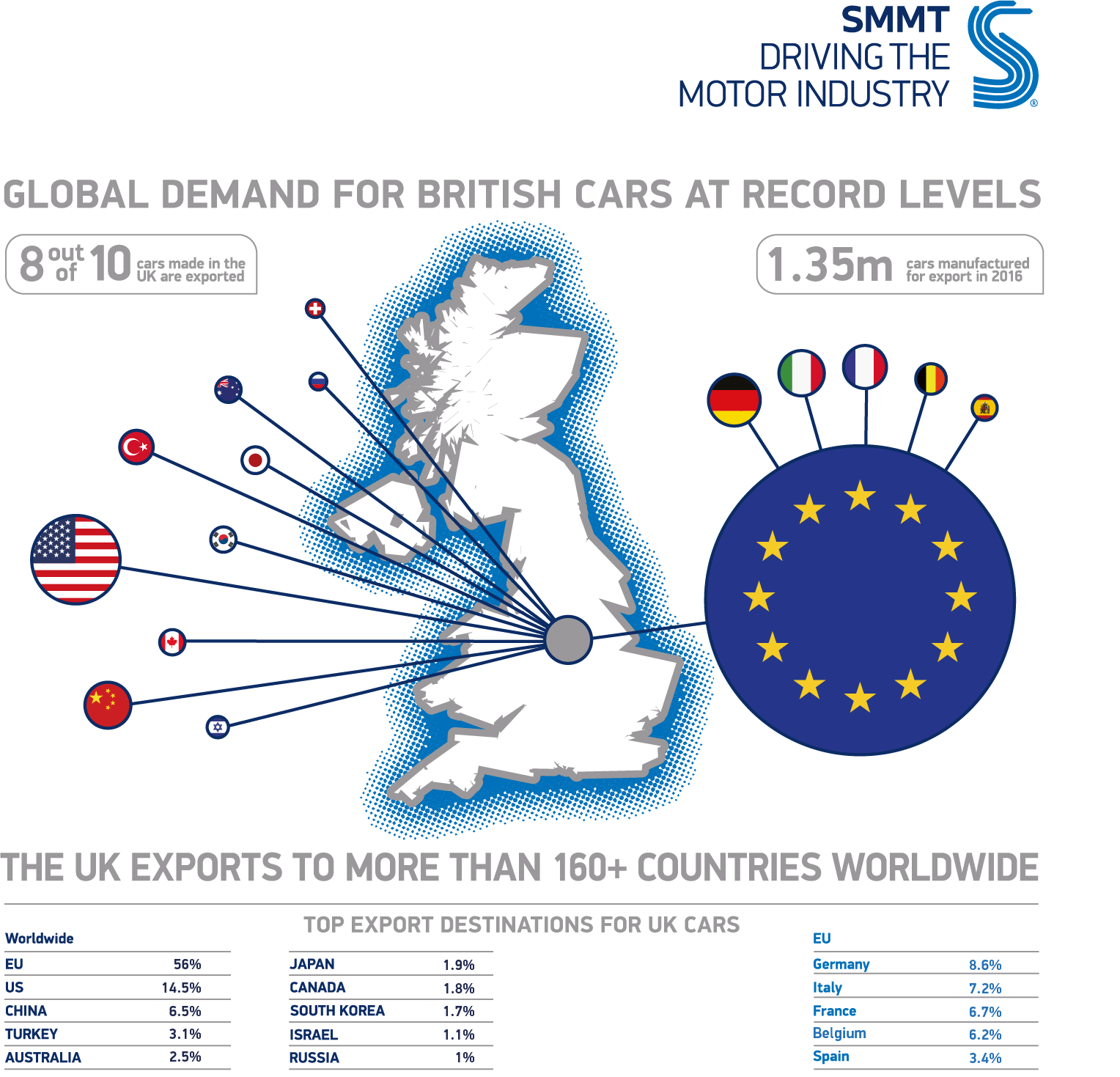

- Exports at record levels for the second consecutive year as more than 1.35 million cars shipped worldwide.

- More than one in two cars exported to Europe, our single biggest trading partner, with demand up 7.5%.

- Demand in India for UK cars rises 15.8% as more buyers opt for British luxury brands.

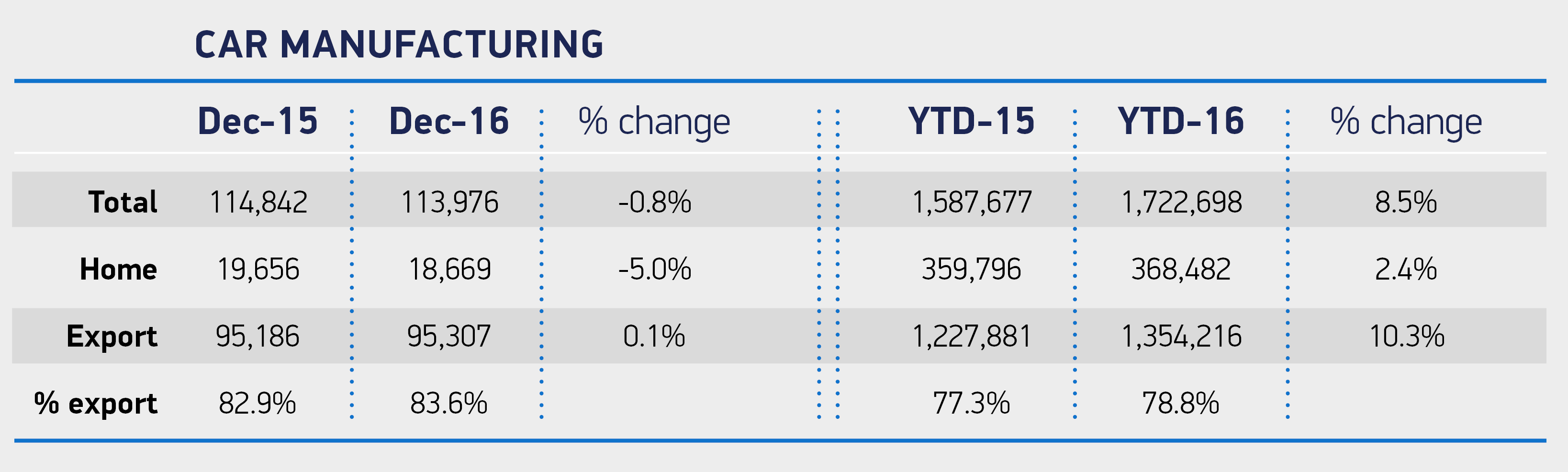

Thursday 26 January, 2017 UK car production achieved a 17-year high in 2016, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 1,727,471 vehicles rolled off production lines last year from some 15 manufacturers, an 8.8% uplift on total production 2015 – and the highest output since 1999.

More cars are now being exported from Britain than ever before, the result of investment made over recent years in world-class production facilities, cutting-edge design and technology and one of Europe’s most highly skilled and productive workforces. Ten brand new car models began production in the UK last year, nine of them from premium brands which has helped make the UK the second biggest producer of premium cars in Europe, after Germany and the third biggest car producer.

Production growth was predominantly driven by overseas demand, with global appetite for British-built cars rising by 10.3% to an all-time high of 1,354,216 – a second consecutive annual record. Around eight out of every 10 cars manufactured in the UK is now exported, bound for one of 160 markets worldwide.

India is now the eighth biggest Asian market for UK car exports, with demand rising at a rapid rate as an increasing number of affluent buyers take advantage of a range of all new premium and luxury British-built cars. UK car exports to the country grew 15.8% to 3,372 in 2016.

Growth was also strong across a number of other key markets, notably the US – the UK’s biggest export destination after the EU – where demand rose by almost half (47.2%) meaning it now accounts for around 14.5% of all UK car exports. Notable uplifts were also seen in Turkey, Japan and Canada, while China, third on the list of export markets, grew by a more modest 3.1% with 88,610 vehicles exported last year.

It was continuing economic recovery across Europe, however, that accounted for the bulk of the growth. Exports to the rest of the EU grew 7.5% to 758,680 and accounted for more than half of all UK car exports. EU countries make up exactly half of the UK’s top 10 individual global markets, with Germany leading, followed by Italy, France and Belgium. Furthermore, Europe supplies the majority of components (65%) within UK-built vehicles, underlining the critical importance of tariff and barrier-free trade to future UK automotive production.

Domestic demand for UK built cars also grew last year, up 3.7% in the year, and the UK remains the second largest car market in Europe, again after Germany. One in seven new cars registered by UK buyers is now made in Britain, up from one in eight three years ago. Meanwhile, last year Indian-built models accounted for 31,535 new car registrations in the UK, an uplift of more than 12.6% on 2015.

Mike Hawes, SMMT Chief Executive, said,

“The tremendous growth in UK production is testament to the global competitiveness of the UK automotive sector. High class engineering, advanced technology and a workforce committed to quality have helped turn around the industry, making the UK among the most productive places in Europe to make cars. India and the UK have a great history of collaboration in the automotive sector and it is essential we secure a mutually beneficial trade relationships in the future.”