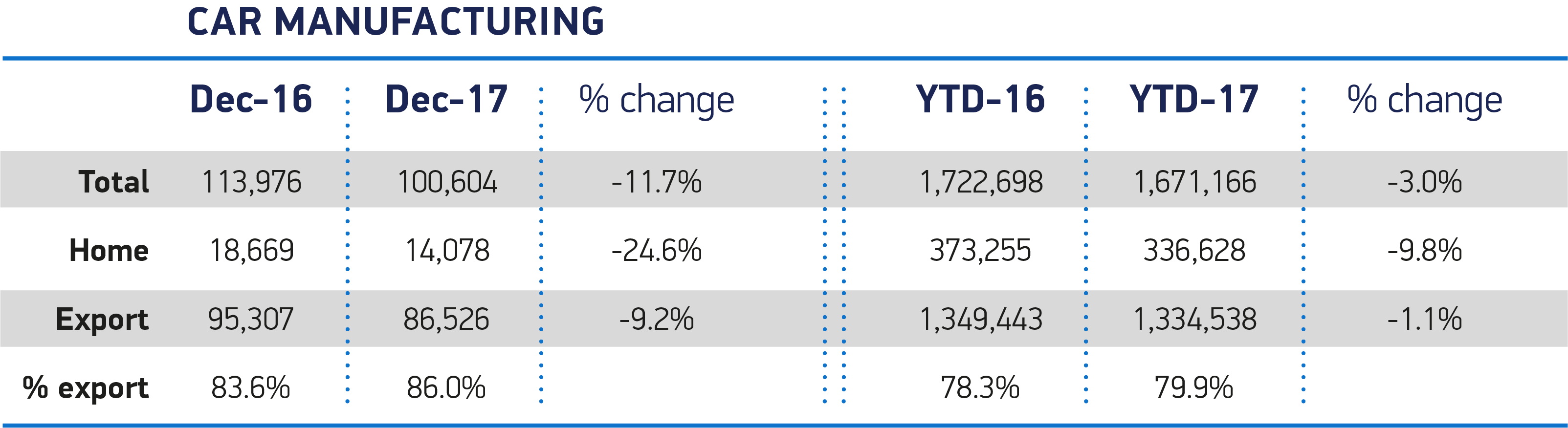

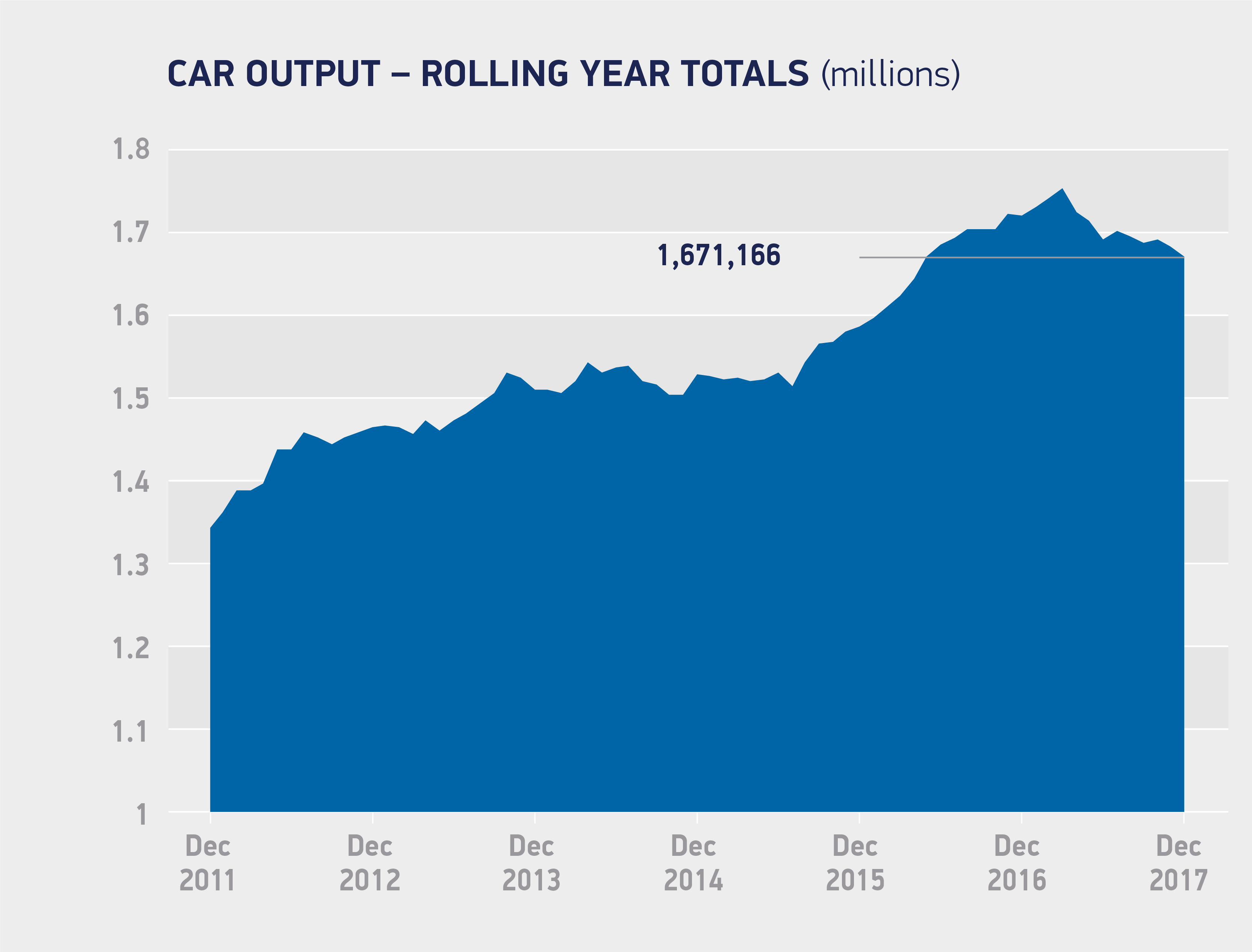

- 1.67m cars built in the UK in 2017, a decline of -3.0% with production for domestic demand down -9.8%.

- UK car exports remain at historically high level, down just -1.1% with 1.34m shipped worldwide – 79.9% of total production.

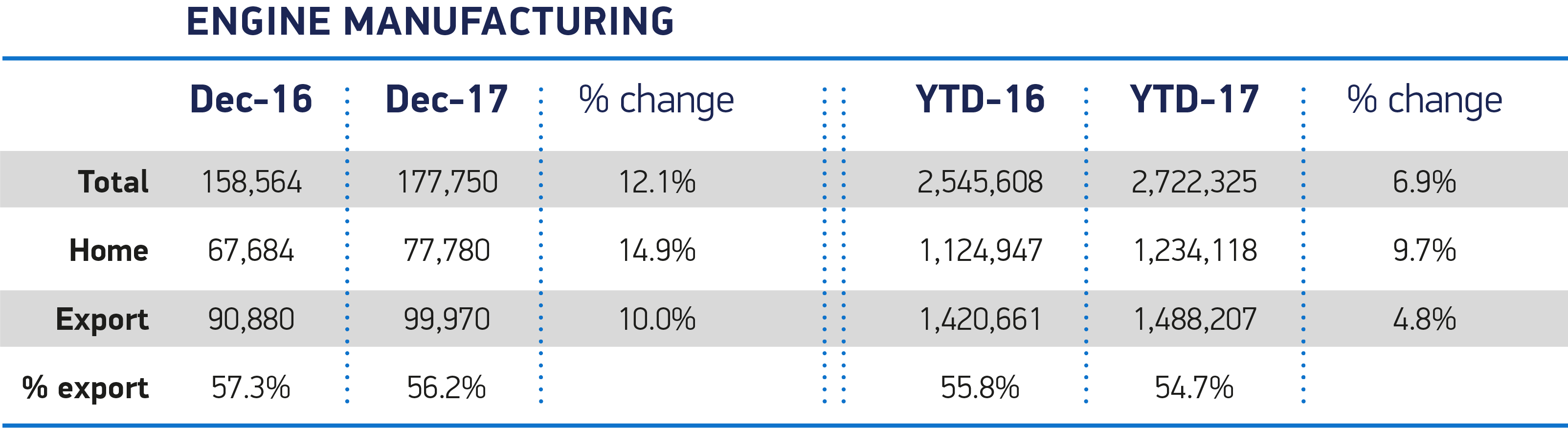

- British engine manufacturing at record-ever levels, with 2.72m produced, up 6.9% on 2016.

- SMMT restates need for urgent clarity on Brexit transition, as new calculations show over 10% of exports could be at risk on 30 March 2019 unless we secure all current trading arrangements.

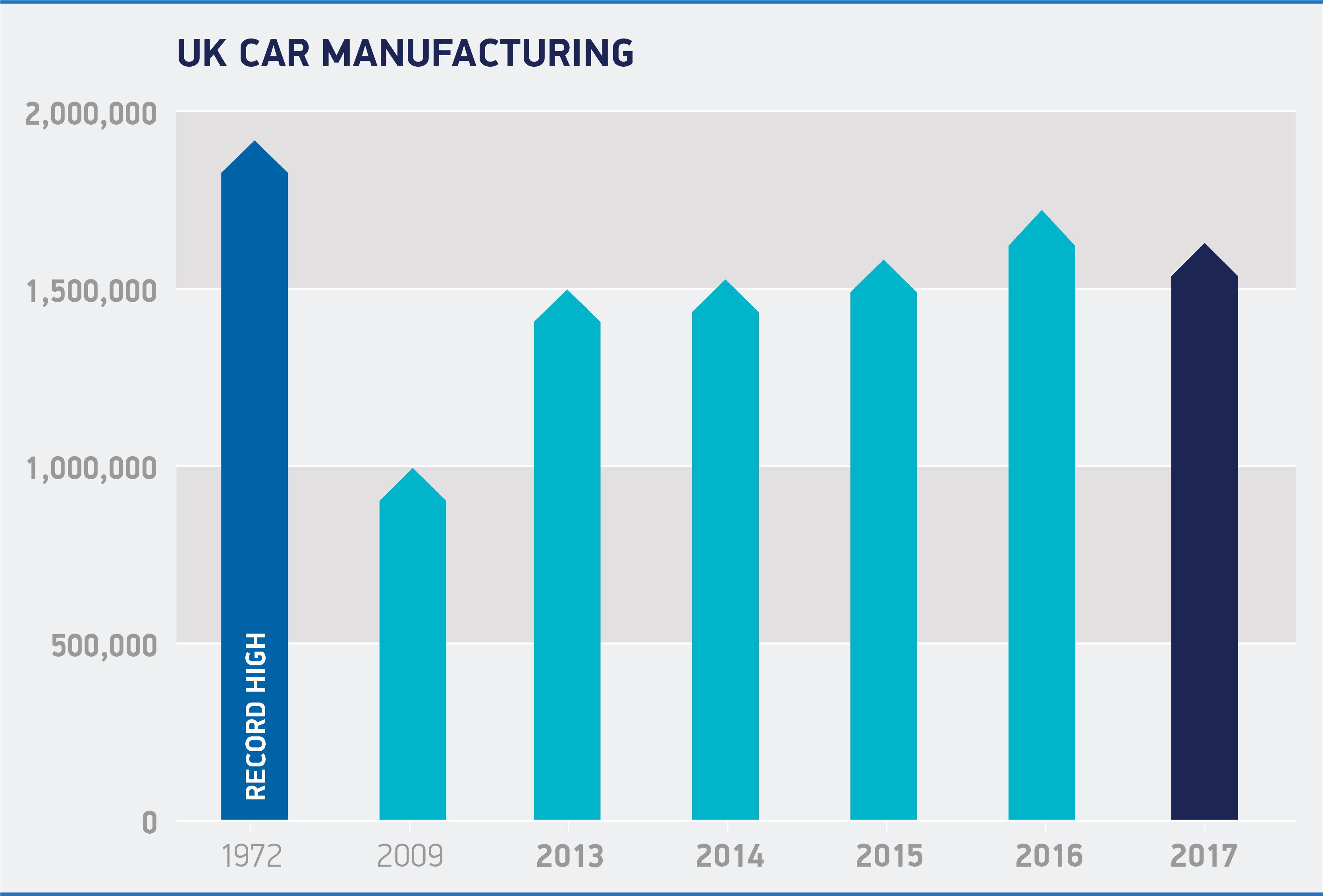

UK car production declined in 2017, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). 1,671,166 vehicles rolled off production lines last year, a -3.0% decrease on 2016 and the first decline for eight years – but still the second highest output in 17 years.1

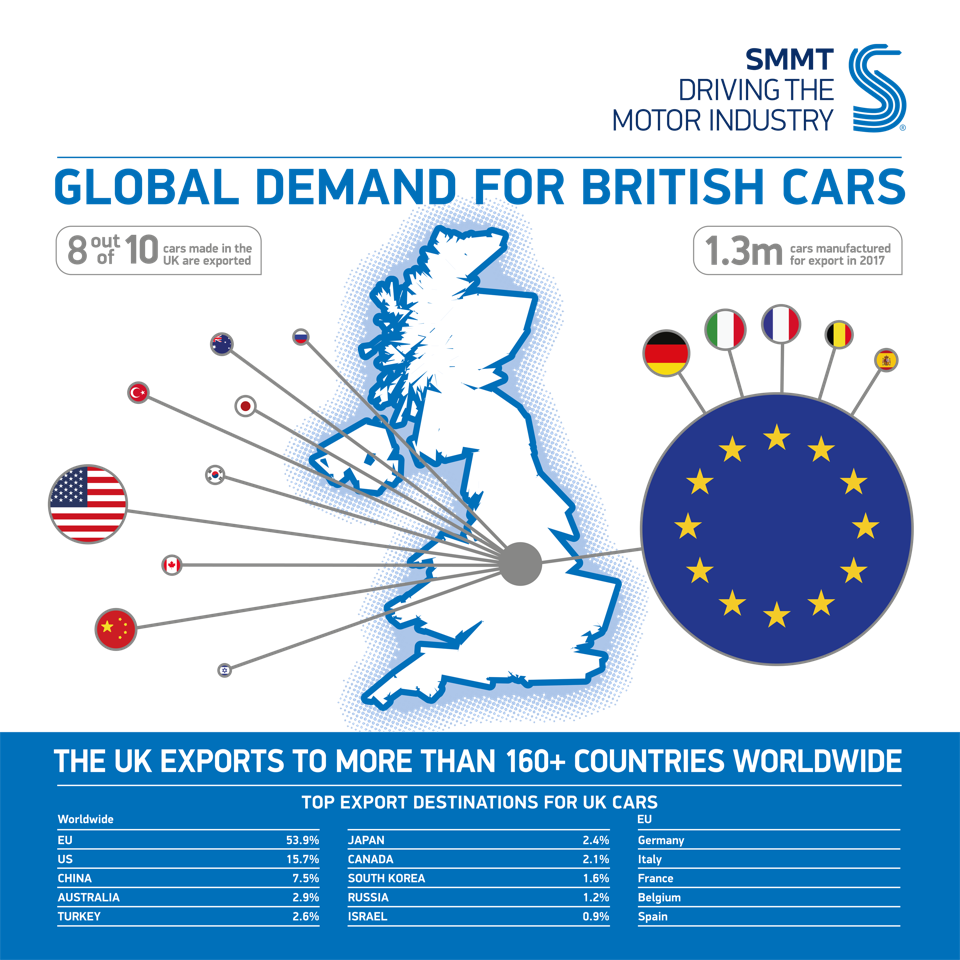

A -9.8% fall in output for the domestic market drove the overall decline, as the market responded to declining business and economic confidence and confusion over government’s policy on diesel. Exports also fell, though at a much lower rate, by -1.1%. Overseas demand continued to dominate production, accounting for 79.9% of all UK car output – the highest proportion for five years.2 The EU remained the UK’s biggest trading partner, taking more than half (53.9%) of exports, while the appetite for British-built cars rose in several key markets, notably Japan (+25.4%), China (+19.7%), Canada (+19.5%) and the US, where demand increased 7.0%.

Nevertheless, the latest figures is approximately 130,000 units below the mid-year forecast, given lower than expected demand primarily in the domestic market. This significant decline in production underscores the importance of government and industry working together to ensure the right conditions for the sector. The Industrial Strategy and, in particular, a Sector Deal for automotive are important but must be supported across government ensuring all policies align to the goal of a vibrant and growing industry.

The UK’s growing reputation as a centre for excellence in powertrain design and manufacturing, meanwhile, helped drive engine production to record levels. Demand for UK-built engines grew at home and overseas, with overall output up 6.9% to more than 2.7 million – with 54.7% destined for car and van plants around the world, the majority in the EU. The growth is the result of significant investment in plants now producing high tech, low emission petrol and diesel engines. Last year, more than 1 million diesel and 1.7 million petrol units were built in Britain, delivering £8.5 billion to the economy.3 These latest figures highlight the importance of diesel and petrol engine manufacturing in the UK – with some 8,000 people employed in engine production and 3,350 directly employed in diesel engine production.4

The news comes as UK Automotive restates the need for an urgent agreement on the terms of a post-Brexit transition deal. This must be comprehensive, result in no change and allow business to continue as usual until a new trading relationship with the EU is in place. This means maintaining the UK’s membership of the single market and customs union and addressing critical details that, if ignored, could have a damaging effect on the industry’s competitiveness.

The agreement must include guarantees that the UK will continue to benefit from EU Free Trade Agreements (FTAs) and Customs Union arrangements with third countries, for the full duration of transition. Latest SMMT calculations show more than 10% of UK car exports go to countries with which the EU has advantageous trading arrangements including South Korea, Canada, Turkey and, soon, Japan.5 Secondly, vehicle certifications that have been issued in the UK must remain valid at home and abroad so that vehicles can continue to be sold across the EU. Finally, no new customs checks, which would add cost, cause delays and disrupt manufacturing, should be applied during the transition.

Mike Hawes, SMMT Chief Executive, said,

The UK automotive industry continues to produce cars that are in strong demand across the world and it’s encouraging to see growth in many markets. However, we urgently need clarity on the transitional arrangements for Brexit, arrangements which must retain all the current benefits else around 10% of our exports could be threatened overnight.

We compete in a global race to produce the best cars and must continue to attract investment to remain competitive. Whilst such investment is often cyclical, the evidence is that it is now stalling so we need rapid progress on trade discussions to safeguard jobs and stimulate future growth.

Hawes spoke as SMMT also released new figures showing that UK automotive investment fell by 33.7% in 2017. Some £1.1 billion of investment earmarked for vehicle and supply chain manufacturing was publicly announced last year, down from £1.66 billion in 2016.

Notes to editors

Notes to editors

- Annual car production last declined in 2009. Total output was higher in 2016, and prior to that, in 1999

- In 2012, exports as a proportion of production was 82.7%

- SMMT calculations

- SMMT data

- Taking into consideration EU-wide trade deals in force and yet-to-be-ratified agreements, the UK automotive industry benefits from bilateral trade pacts between the EU and several of the sector’s top 10 export markets, including Turkey, Japan, Canada, South Korea and EFTA countries (Switzerland, Norway, Iceland and Lichenstein). Taken together, these countries cover more than 10% of UK automotive exports.