- Securing a Brexit deal to protect Britain’s biggest exporter must be next leader’s top priority, urges SMMT, as first-ever UK auto trade report highlights importance of £101bn trading powerhouse.1

- New calculations reveal potential £50,000-a-minute cost of hard Brexit border delays to UK automotive manufacturers.

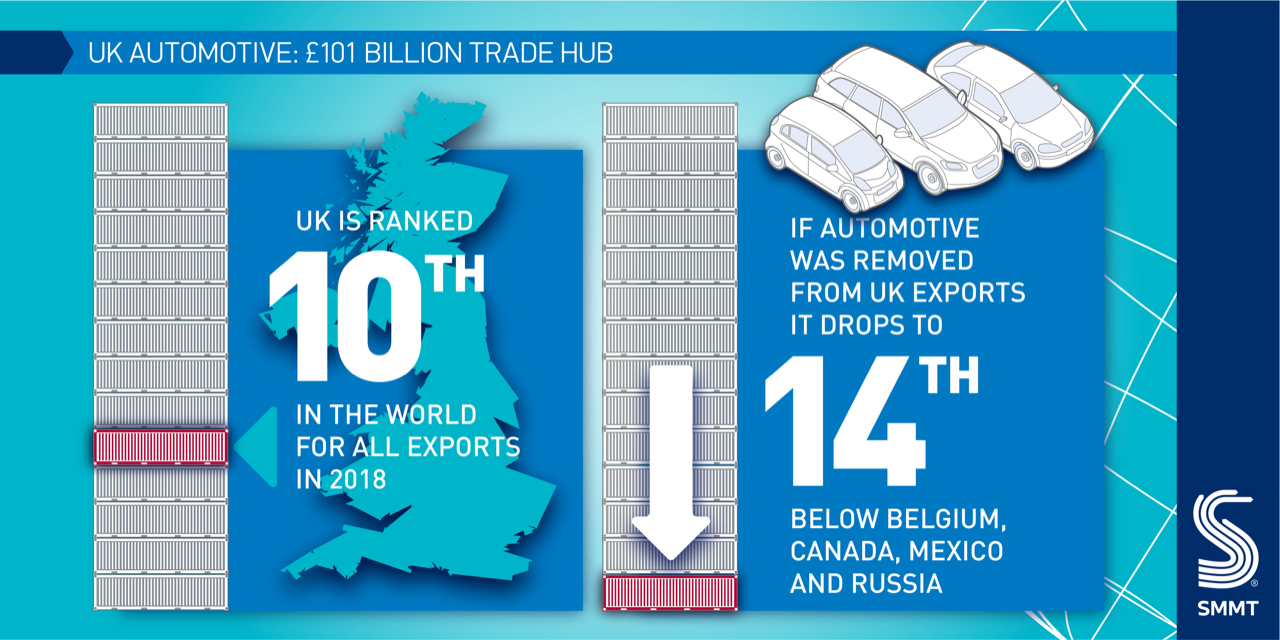

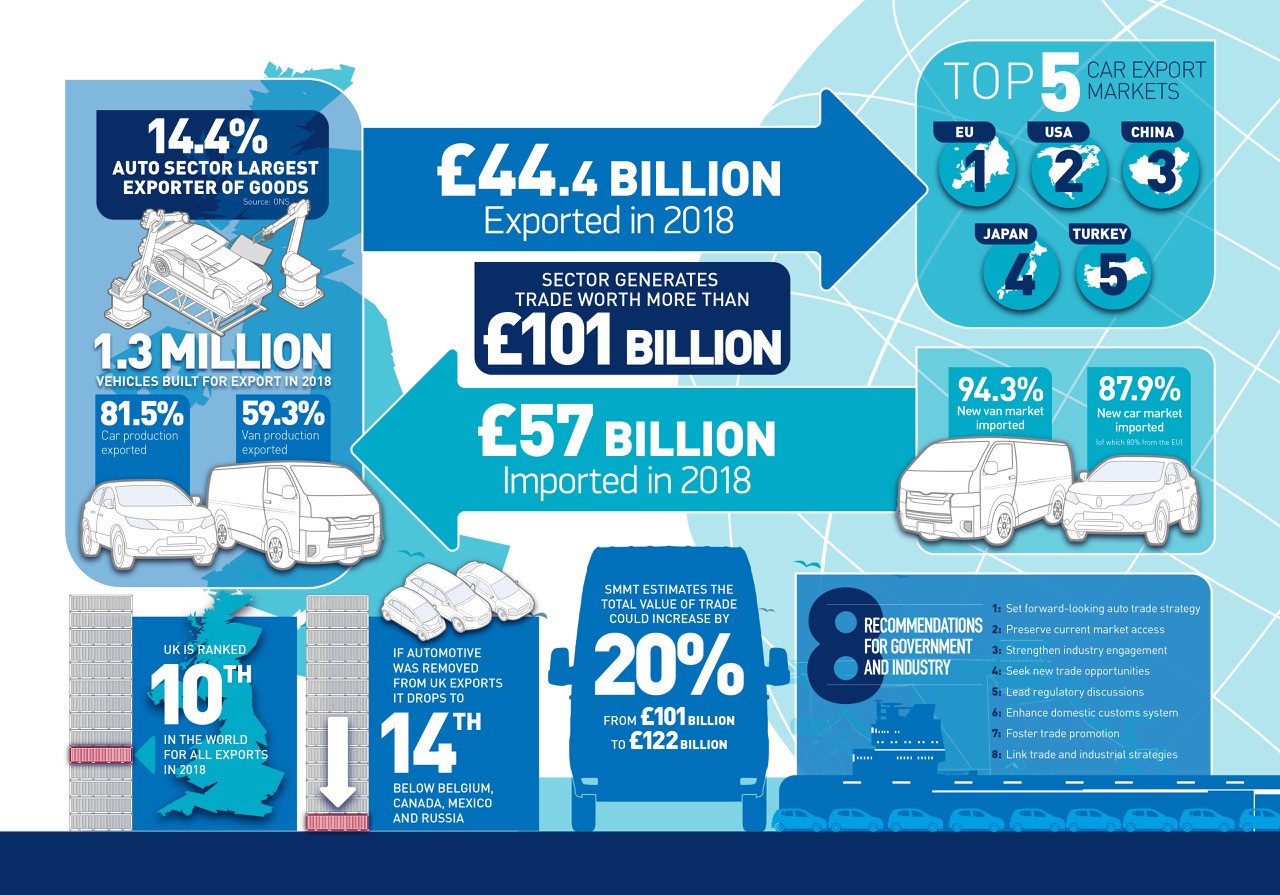

- Loss of Automotive would force UK out of Top 10 global exporter rankings behind Belgium, Mexico, Canada and Russia.

- But, the right deal, the right business environment and auto-friendly trade strategy could deliver £20bn boost as industry maximises potential.

The Society of Motor Manufacturers and Traders (SMMT) today issued a plea to the UK’s next prime minister to secure a favourable Brexit deal as his number one priority on taking office. The call came as the trade body published a new report highlighting the importance of automotive trade to the UK economy and the high stakes of a ‘no deal’ Brexit. SMMT’s 2019 UK Automotive Trade Report calculates that delays to production caused by friction at the border could add up to £50,000 a minute for the sector.1

Leaving the EU without a deal would trigger the most seismic shift in trading conditions ever experienced by automotive, with billions of pounds of tariffs threatening to impact consumer choice and affordability. The end to borderless trade could bring crippling disruptions to the industry’s just-in-time operating model. Delays to shipments of parts to production plants are measured in minutes, with every 60 seconds costing £50,000 in gross value added – amounting to some £70 million a day in a worst case scenario.

Combined with WTO tariffs, which for trade in passenger cars alone amount to £4.5 billion a year, this would deliver a knockout blow to the sector’s competitiveness, undermining a decade of extraordinary growth.

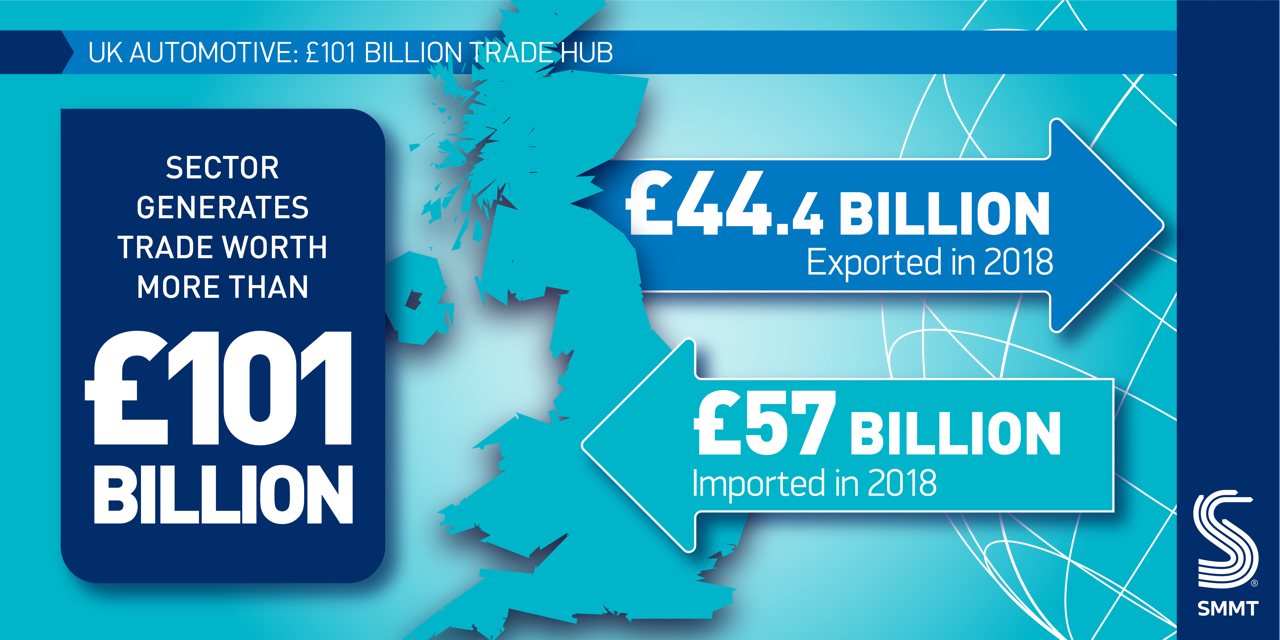

Thanks to the free and frictionless trade afforded by the customs union and single market, automotive trade value has risen by 118% since the global financial recession, from £47 billion in 2009 to £101 billion last year. Over the same period, car production increased by more than half, with more than eight in 10 vehicles bound for export – the majority to the EU. 3.3 million new cars are traded between the UK and EU each year, while the UK exports some £5.2 billion worth of components and £2.9 billion of engines to help build vehicles across the continent.

Addressing an audience of business leaders and government officials at the industry’s annual International Automotive Summit in London today, Mike Hawes, SMMT chief executive, said,

Automotive matters to UK trade and to the economy, and this report shows that, if the right choices are made, a bright future is possible. However, ‘no deal’ remains the clear and present danger. We are already seeing the consequences of uncertainty, the fear of no deal. The next PM’s first job in office must be to secure a deal that maintains frictionless trade because, for our industry, ‘no deal’ is not an option and we don’t have the luxury of time.

Automotive is the UK’s single biggest exporter of goods, trading with some 160 countries worldwide, and accounting for more than 14% of total exports. The sector is one of the country’s most valuable economic assets, directly employing 168,000 people,2 supporting communities and delivering an annual £18.6 billion to the public purse. Leaving the EU without a deal would jeopardise this, hampering government’s ambitions to boost global exports and GDP. Without automotive, the UK would lose its hard-won status as the world’s 10th biggest exporter of goods, falling to 14th place behind Belgium, Canada, Mexico and Russia.

However, the report also calculates that the right deal, backed up by ongoing collaboration to create a competitive business environment and thriving market, and combined with an ambitious automotive-focused trade strategy, could trigger a 20% uplift in the industry’s global trade value – worth £20 billion, if the sector can maximise its full capacity.

SMMT’s first-ever UK Automotive Trade Report charts the rise of the sector over 40 years, outlining current and future challenges and opportunities for trade with Europe and globally. It sets out clear set of recommendations to government and industry to help boost competitiveness, promote frictionless trade with existing markets and unlock new business between the UK and key export destinations around the world.

Eight recommendations for government and industry

- Set a positive, modern, automotive-friendly trade agenda and exercise thought leadership in shaping national, regional and global trade rules applicable to new-generation vehicles and automotive technologies

- Ensure no new barriers are introduced to trade between the UK and EU, as well as maintaining existing trade terms for preferential access to major markets beyond the European regions, while also working to diffuse international trade tensions

- Strengthen engagement with industry and ensure trade policy and automotive specialists are part of senior management and negotiating teams

- Seek new trade opportunities in key global markets, through the removal and reduction of tariff and non tariff barriers

- Remain at the forefront of global automotive rule making, preserving the UK’s role in UNECE discussions and increasing the UK’s efforts to bridge gaps between regulatory superpowers and reduce regulatory barriers

- Collaborate with industry to enhance the domestic customs system to ensure legitimate trade does not face costly delays and invest in physical and digital infrastructure and incentives that promotes non-burdensome trade and assists with up-skilling of suppliers

- Foster trade promotion by helping UK companies to explore distant and risky markets, and continue to support international events to raise the UK’s profile and open up opportunities

- Link trade and industrial strategies and investment plans to ensure the UK’s strategic interests in a strong, modern and innovative automotive sector are prioritised and sustained by future policies.

- Based on ABS and SMMT signatories’ data for 2018 and revised ABS data for 2017. Revised data shows 174,000 jobs were supported in UK automotive manufacturing in 2017, falling 3.5% to 168,000 in 2018. In 2018, 823,000 people were employed across the wider industry, down 1% on 2017 (831,000) – ABS data.