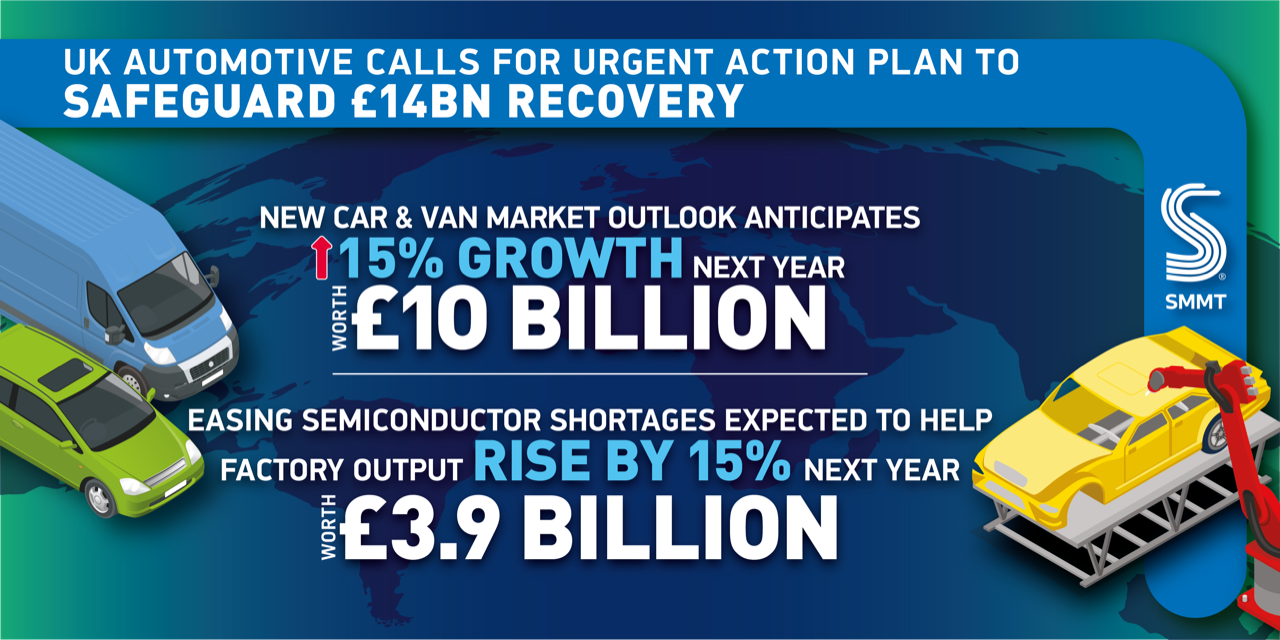

- Industry outlook highlights strategic importance of Automotive to Britain’s economic recovery, with growth worth £14 billion targeted in 2023.

- Window of opportunity to secure industry’s place in global race to net zero is closing fast with imminent deadlines for investment decisions, 2024 Rules of Origin and the UK ZEV Mandate.

- Sector calls for urgent action plan to ensure competitiveness, attract investment and drive skills, innovation and long-term growth.

The UK automotive industry has today urged government to take rapid action to secure the long-term future of one of the country’s most important assets, while accelerating its decarbonisation. The call comes as the sector finally begins to emerge from the pandemic-induced downturn, with new analysis from the Society of Motor Manufacturers and Traders (SMMT) suggesting its return to growth could be worth an additional £14 billion to the UK economy next year alone1.

Following five years of Brexit uncertainty, two years of lockdowns, and crippling global supply chain shortages, the sector’s recovery is expected to gain momentum in 2023. The new car and van market outlook anticipates 15% growth next year, worth £10 billion, with further potential in 2024, delivering a cumulative £25 billion win for the economy2. The manufacturing is equally promising. Easing semiconductor shortages are expected to help factory output rise by 15% in the next 12 months to 984,000 units, an uplift worth some £3.9 billion. By 2025, production volumes are projected surpass a million vehicles3.

To harness this growth, the sector is calling for a targeted government action plan to safeguard the future of advanced automotive manufacturing and the thousands of British jobs it sustains. Such a strategy should help attract investment in vehicle, battery and fuel cell production; support electrified supply chains, skills and innovation; and deliver the incentives and infrastructure critically needed to drive a healthy zero emission vehicle market.

The automotive industry is a critical contributor to the UK economy, driving growth and employment, providing hundreds of thousands of high-value, highly skilled jobs in every part of the country – and supporting thousands more in sectors from steel and plastics to logistics and finance. As Europe’s second largest market, and with home-grown vehicles shipped to almost every corner of the world, it is also a £77 billion global trading player, accounting for 10% of total UK goods exports.

But as the sector undertakes its biggest transformation in 120 years – upon which the UK’s net zero ambitions depend – it faces multiple threats. Economic instability, trade protectionism, regulatory change, a cost of living crisis, skills shortages and soaring energy costs already some 80% higher than the EU average, are all acting as a brake on its global competitiveness4.

A dedicated action plan with a package of measures to amplify Automotive’s competitiveness would help to overcome these challenges. These measures should include extended support on energy costs, help for cash-flow constrained SMEs, business rate reform to encourage rather than penalise investment, Apprenticeship Levy reform, the creation of a national skills platform, and investment to drive faster rollout of charging infrastructure5.

But the timeframe to act is closing. Indeed, 2024 is a looming milestone – with EU-UK Rules of Origin getting tougher and threatening tariff-free trade of these in-demand vehicles, the UK government’s Zero Emission Vehicle (ZEV) Mandate kicking in, and gigafactories coming online abroad but not yet in the UK, the urgency of action required is self-evident.

Addressing 1,000 members of industry and government at the sector’s Annual Dinner in London this evening, Alison Jones, SMMT President and Senior Vice President Global Circular Economy, Stellantis, said,

UK Automotive is an agile sector that doesn’t just embrace change and innovation, we lead it. But we face fierce global competition and in the global race to net zero we must be as attractive – more attractive – than rival countries against whom we will compete for investment. We have inherent strengths, but to play to them, we need the right competitive framework; a level playing field. We are not asking for support to survive, but demanding action so we can thrive.

Mike Hawes, SMMT Chief Executive, said,

In the most testing of times, growth finally beckons for the UK automotive industry, and as recession looms, that’s growth that should be nurtured. We need a framework that enhances competitiveness, enables investment and promotes UK Automotive’s strengths: innovation, productivity and a highly skilled workforce. We therefore need swift and decisive, action that addresses the immediate challenges and gives us a fighting chance of winning the global competition. That window of opportunity is open but is closing fast.

Notes to editors

1 Calculation based on SMMT Market Outlook (October 2022), Auto Analysis independent Production Outlook (November 2022) and Jato Dynamics vehicle pricing data

2 Based on SMMT Market Outlook (October 2022) and Jato vehicle pricing data

3 Based on Auto Analysis Production Outlook (November 2022) targeting production output of 852,709 cars and vans in 2022, 983,610 in 2023, 971,465 in 2024 and 1,040,700 in 2025

4 SMMT member survey (October 2022) on energy prices in the UK and EU-based sister plants, and SMMT Sustainability Report data

5 https://www.smmt.co.uk/reports/full-charge/ for SMMT’s Automotive Roadmap: Driving forward UK Automotive competitiveness to 2030