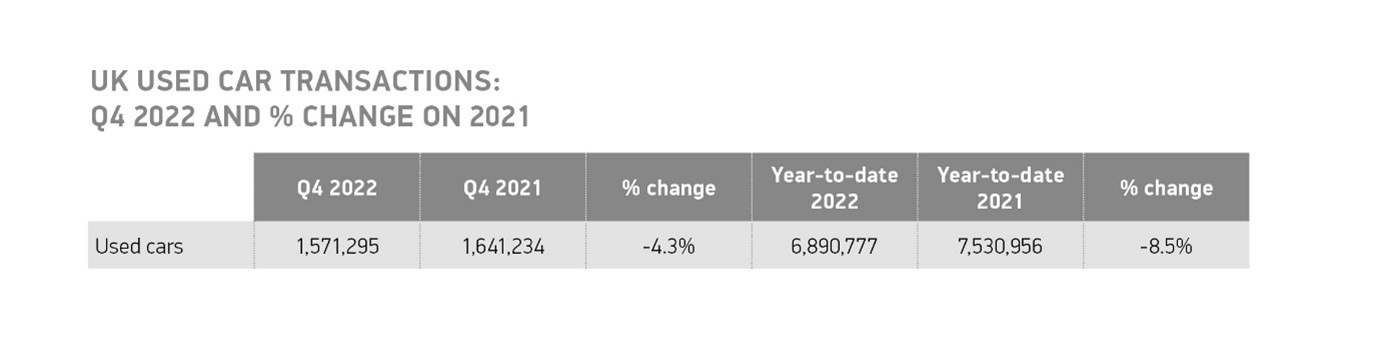

- Used car transactions fall -8.5% in 2022 with 6,890,777 units changing hands as supply chain restraints curtail market.

- Record demand for used electrified vehicles, as transactions of BEVs soar by 50.7%, HEVs rise 9.9% and PHEVs grow 2.2% against 2021 performance.

- Q4 decline moderates to -4.3%, with 0.8% growth in December, signposting recovery in 2023 as improving new car market adds stock

Friday 10 February, 2023 The UK’s used car market declined in 2022, down -8.5% to 6,890,777 transactions, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance saw 640,180 fewer vehicles changing hands than in 2021, and remains -13.2% off 2019’s pre-pandemic total, as the squeeze on new car supply – primarily due to the global shortage of semiconductors – restricted stock entering the second-hand market.1

Transactions increased by 0.8% in December in the first monthly rise since February, and while Q4 was down -4.3%, the third successive quarterly decline, it was not as steep as in quarters two (-18.8%) and three (-12.2%).2 This reflects the renewed growth seen in the new car market, helping more vehicles enter used car stock.

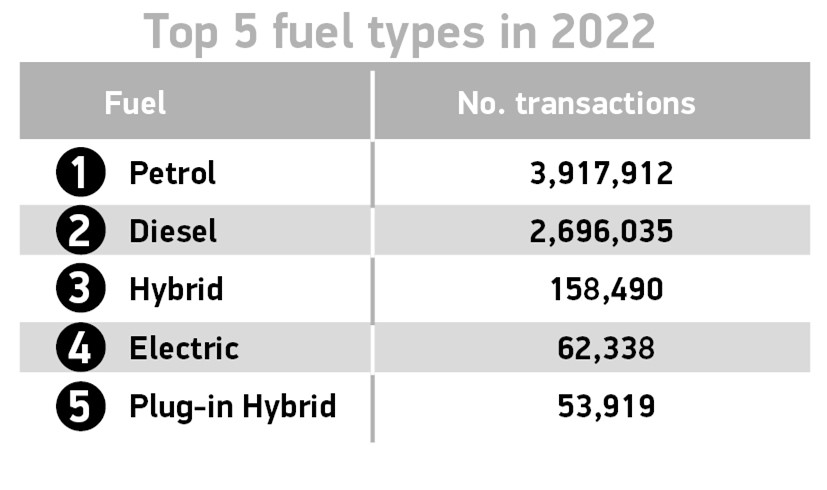

Used battery electric vehicle (BEV) transactions bucked the overall trend, recording their best-ever annual performance with a record 62,338 units finding new owners in 2022, a rise of 50.7%, and boosting their overall market share to 0.9%, from 0.5% in 2021. Robust demand for other alternatively fuelled vehicles continued, too, with sales of hybrid electric vehicles (HEVs) rising 9.9% and plug-in hybrid electric vehicle (PHEVs) transactions up 2.2%.3

Combined, however, electrified vehicles represented just 4.0% of the market (up from 3.2% in 2021) and while transactions of used diesel and petrol cars fell by -11.8% and -7.4% respectively, they remained the dominant powertrains with a combined 6,613,947 units changing hands.4

Mike Hawes, SMMT Chief Executive, said, “While the market headlines are negative, and reflective of the squeeze on new car supply last year, record electrified vehicle uptake is a bright spot and demonstrates a growing appetite for these models. With new car registrations growth expected this year, more of the latest low and zero emission models should become available to second owners. Accelerating uptake is key and will be dependent on drivers being assured of a positive ownership experience. This means ensuring charging infrastructure keeps pace with demand as more new and used car buyers make the switch to zero emission motoring than ever before.”

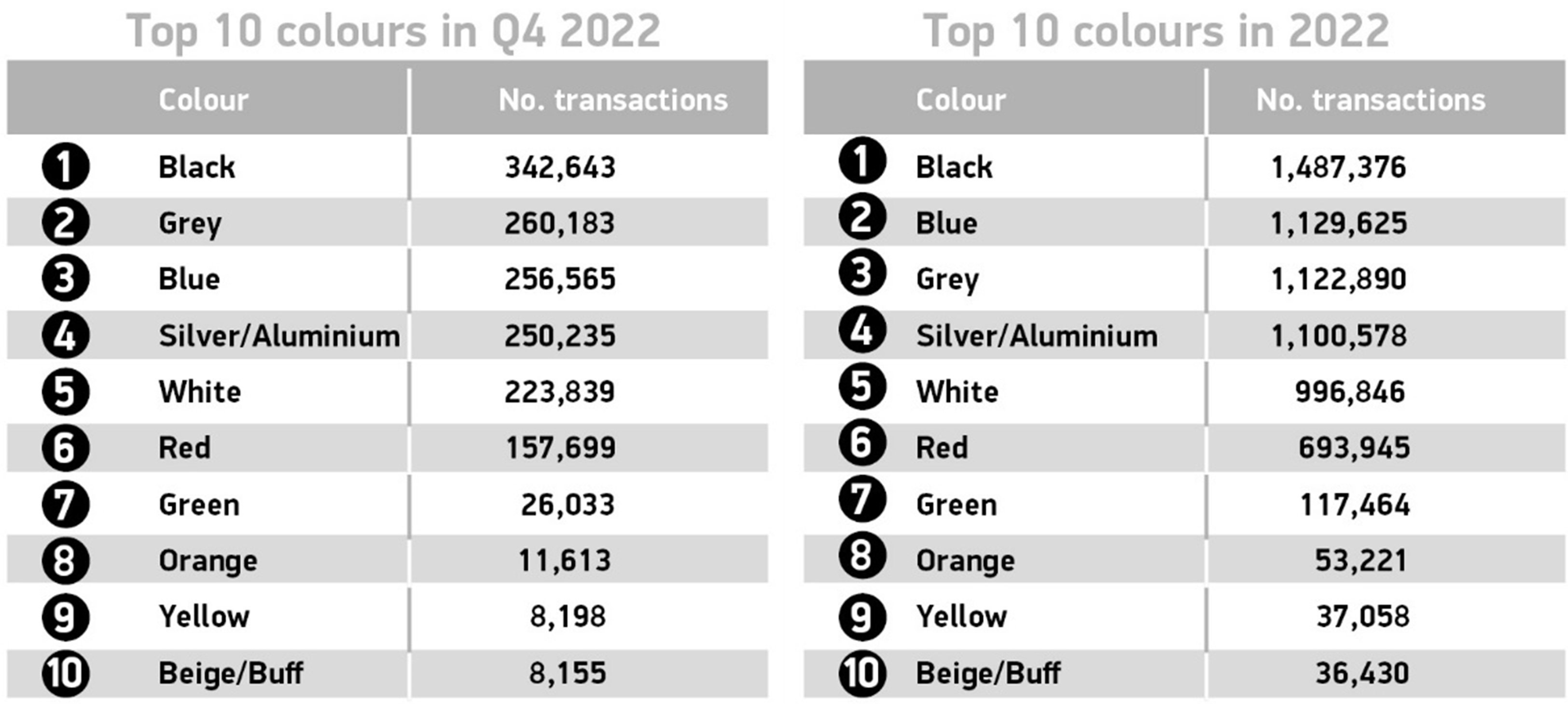

Used car buyers went back to black as it proved to be the most popular colour for the year, accounting for a fifth (21.6%) of the market. Blue ranked second, with 16.4% share, and, despite grey topping the new car market, it ranked third for used cars at 16.3% market share. Some buyers opted to add a splash of colour to their journeys, with 4,461 pink, 6,708 turquoise and 18,658 bronze used vehicle transactions during the year.

In terms of market segments, all sectors saw transactions decline aside from dual purpose, which was the third most popular body type, recording a small growth of 0.8% as just over a million changed hands. Superminis once again took the title for most popular segment, taking a third of the market (32.1%) despite recording a -9.0% fall in volumes. Following behind, lower mediums were the second most popular and were responsible for 26.5% of the market, but also noted a -9.6% decline. The smallest volume segment type was luxury saloons with a 0.6% market share.

Notes to editors

NB: Used car data is subject to periodical revision and is based on anonymised data from DVLA, and processed by SMMT. This release was updated to reflect revisions in February 2024.

1 2019 FY performance – 7,935,105 transactions

2 December used car transactions: 415,036 units

3 BEV volumes: 2022: 62,338; 2021: 41,370; HEV volumes: 2022: 158,490 2021: 144,228; PHEV volumes : 2022: 53,919 ; 2021: 52,771

4 Petrol volumes: 2022: 3,917,912; 2021: 4,233,104; Diesel volumes: 2022: 2,696,035; 2021: 3,058,191

About SMMT and the UK automotive industry

The Society of Motor Manufacturers and Traders (SMMT) is one of the largest and most influential trade associations in the UK. It supports the interests of the UK automotive industry at home and abroad, promoting the industry to government, stakeholders and the media.

The automotive industry is a vital part of the UK economy and integral to supporting the delivery of the agendas for levelling up, net zero, advancing global Britain, and the plan for growth. Automotive-related manufacturing contributes £67 billion turnover and £14 billion value added to the UK economy, and typically invests around £3 billion each year in R&D. With more than 182,000 people employed in manufacturing and some 780,000 in total across the wider automotive industry, we account for 10% of total UK goods exports with more than 150 countries importing UK produced vehicles, generating £77 billion of trade.

Some 25 manufacturing brands build over 50+ models of vehicles in the UK, plus an array of specialist small volume manufacturers, supported by some 2,500 supply chain businesses and some of the world’s most skilled engineers. Many of these jobs are outside London and the Southeast, with wages that are around 14% higher than the UK average. The automotive sector also supports jobs in other key sectors – including advertising, finance and logistics.

More detail on UK Automotive available in SMMT’s Motor Industry Facts publication at www.smmt.co.uk/reports/smmt-motor-industry-facts/

Broadcasters: SMMT has an ISDN studio and access to expert spokespeople, case studies and regional representatives.

SMMT media contacts

Paul Mauerhoff 07809 522181 pmauerhoff@smmt.co.uk

James Boley 07927 668565 jboley@smmt.co.uk

Rebecca Gibbs 07708 480889 rgibbs@smmt.co.uk

Scott Clarke 07912 799959 sclarke@smmt.co.uk

Emma Butcher 07880 191825 ebutcher@smmt.co.uk