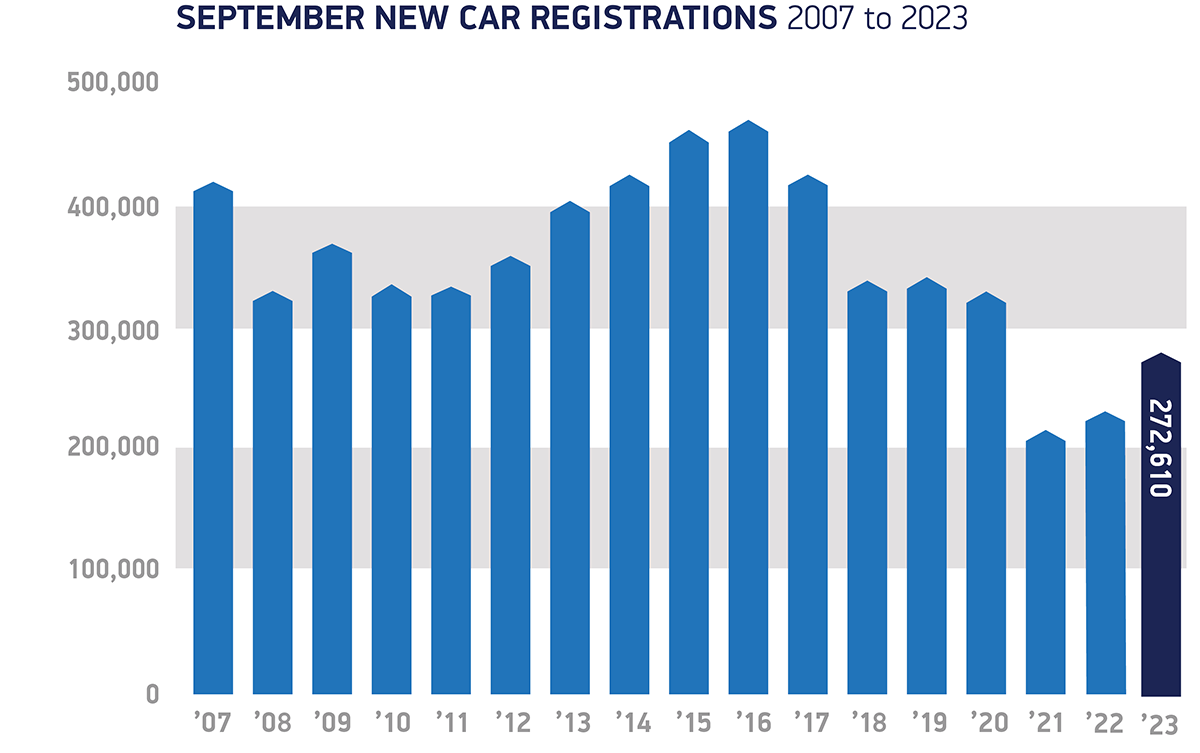

- 272,610 new cars registered in September as market rises 21.0% in 14th consecutive month of growth.

- Fleets drive expansion during ‘new plate month’ while overall private purchases add to uplift.

- Zero emission vehicle demand continues to grow, but industry calls for private motorist support as consumer uptake of battery electric cars declines.

SEE CAR REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

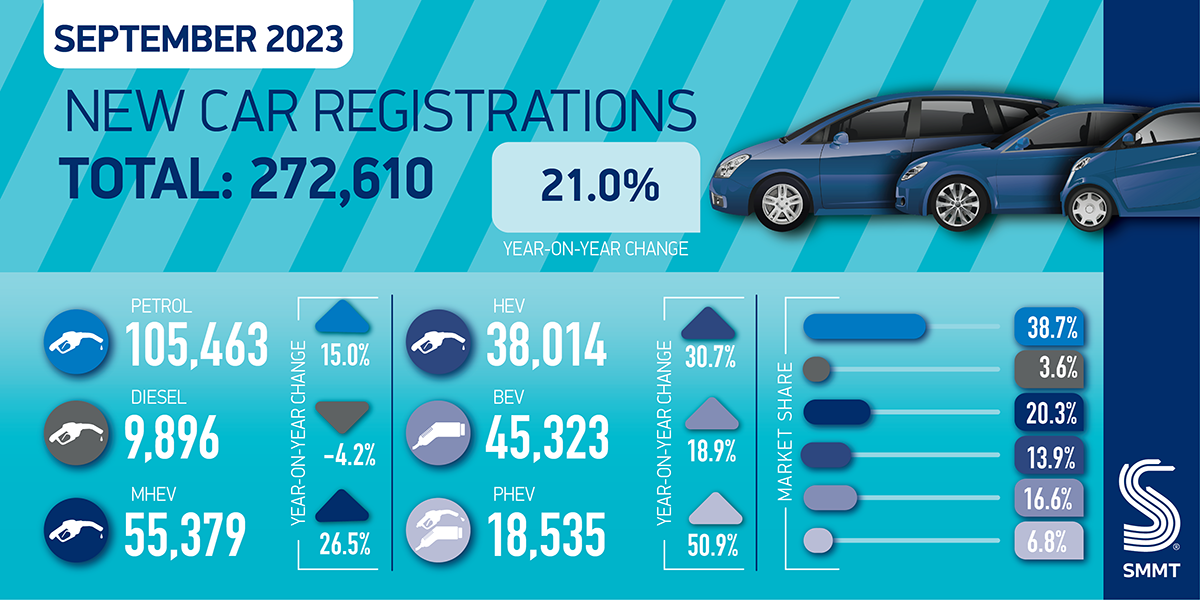

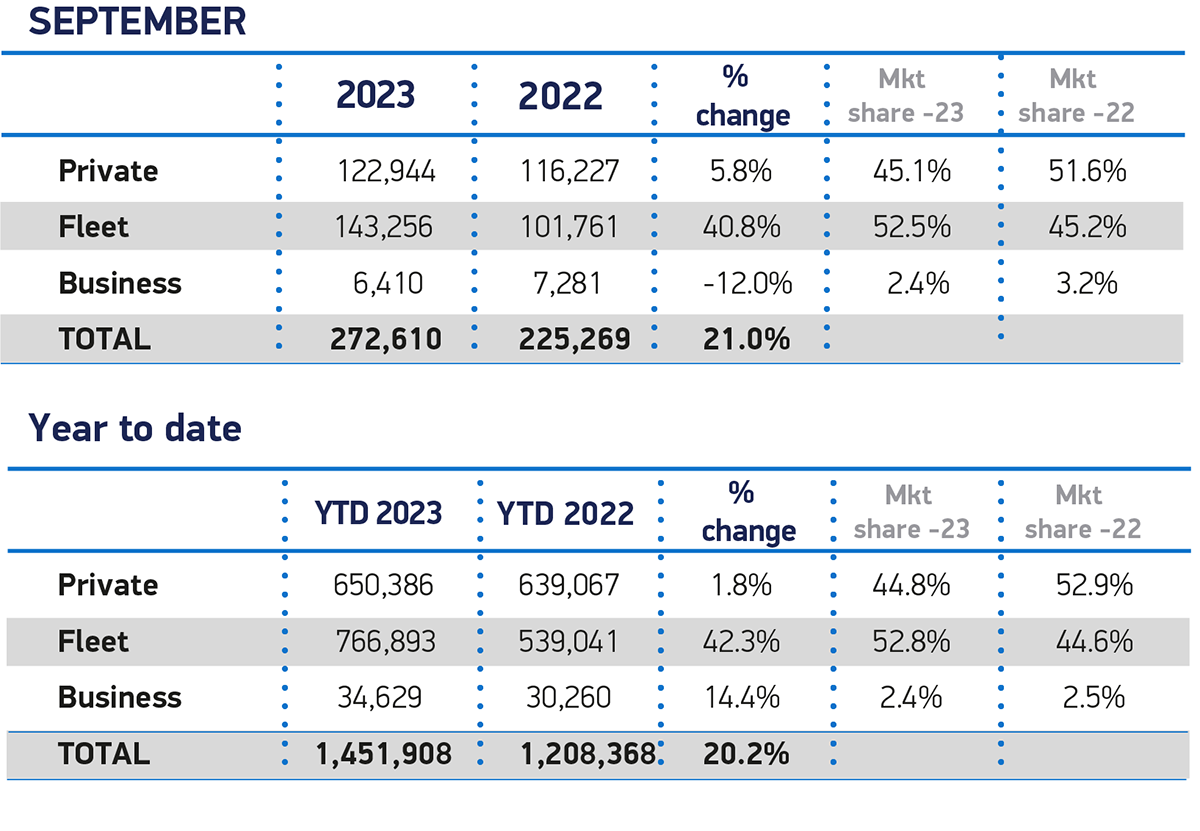

The UK new car market grew 21.0% in September with 272,610 registrations in the month, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). The 14th consecutive month of growth was also the second busiest of the year after March, with the new number plate delivering its traditional market surge despite a challenging economic backdrop.

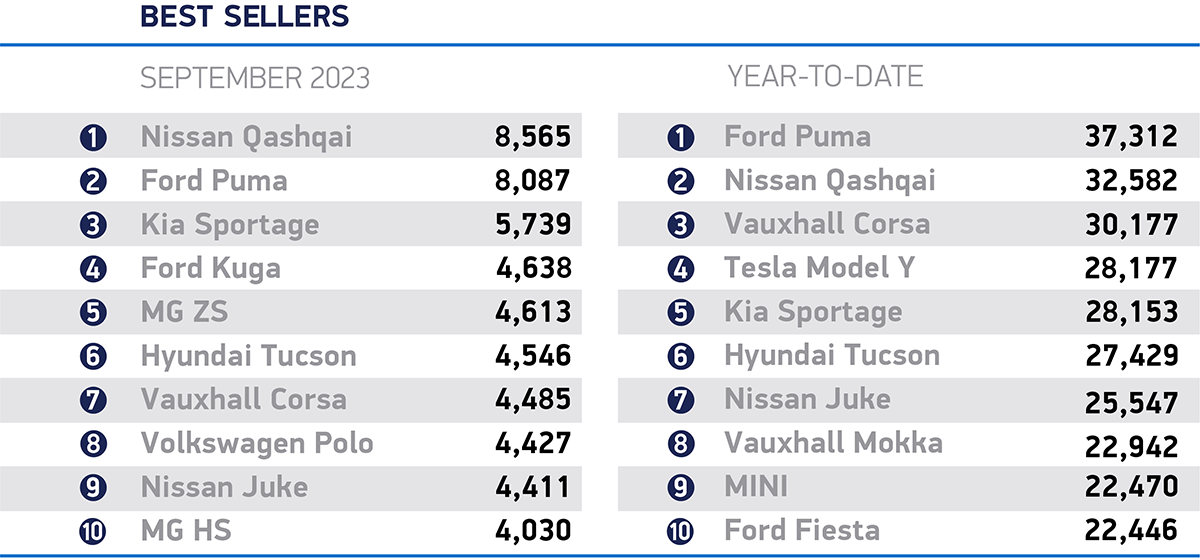

Growth continued to be driven by large fleets, which rose 40.8% to 143,256 units to reach a market share of 52.5%. This represents a market rebalancing after constrained supply in 2022 restricted deliveries to business and fleet customers. Private consumer demand, meanwhile, also grew, up 5.8% to 122,944 units. As a result, the industry enjoyed its best September since 2020,1 although registrations remain -20.6% below pre-pandemic levels.2

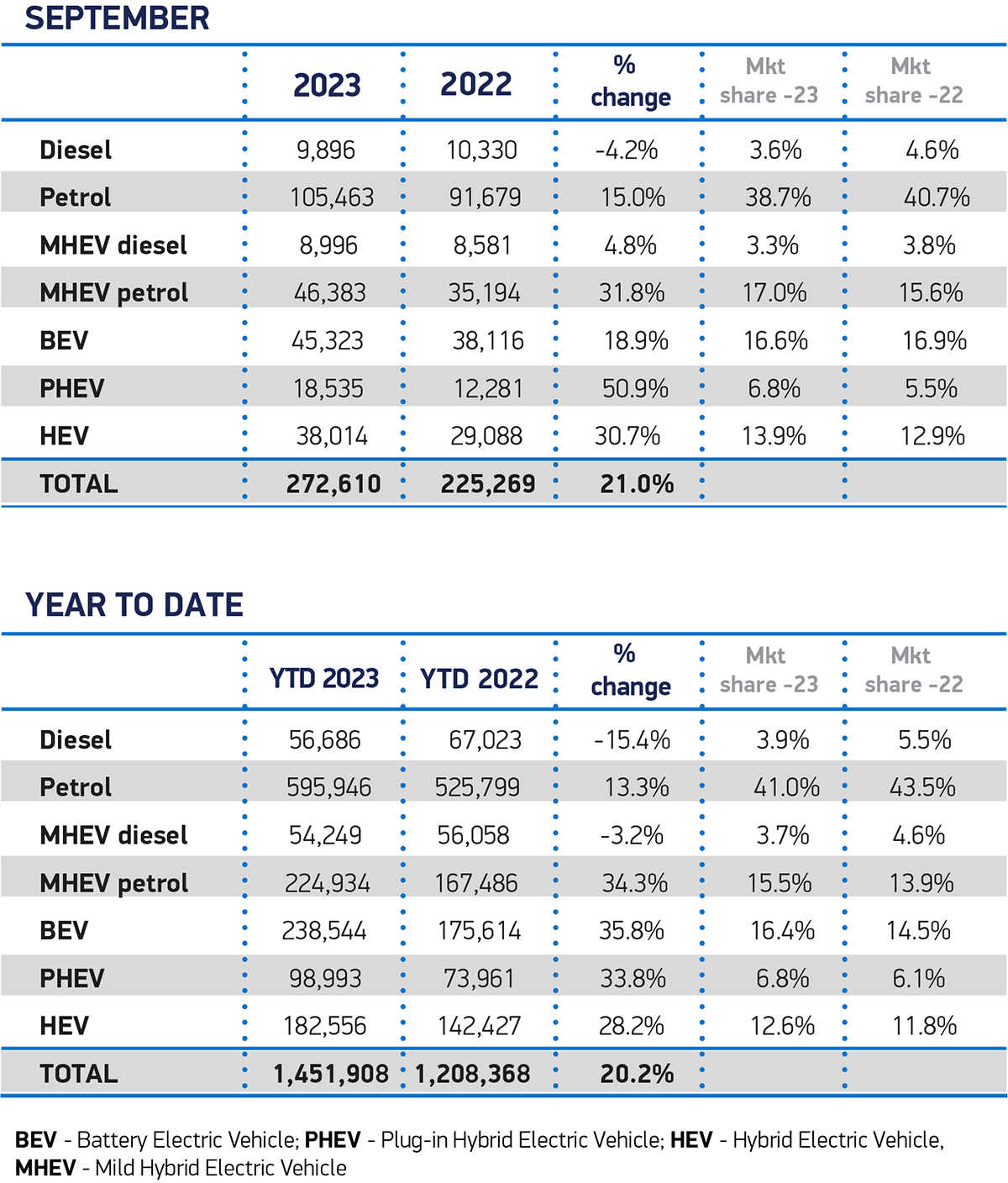

Electrified vehicle uptake continued to grow in the month, with plug-in hybrid vehicles (PHEVs) up 50.9% to take a 6.8% market share and hybrid electric vehicles (HEVs) up 30.7% to account for 13.9% of all registrations. Battery electric vehicles (BEVs), meanwhile, recorded their 41st consecutive month of growth – with 45,323 drivers making the switch, an 18.9% uplift. Given this growth was less than the overall recorded by the market, however, BEV market share slipped back slightly to 16.6% from 16.9% a year ago.

BEV volume increases were driven entirely by fleet purchases, which rose by 50.6% as buyers were drawn to the advanced technology, outstanding performance, reduced environmental impact and compelling tax incentives. Conversely, private BEV registrations fell -14.3% with less than one in 10 private new car buyers opting for electric during the month. Such a decline underlines the importance of providing these motorists with purchase incentives and other mechanisms to stimulate demand.

Despite an end of sale date now aligned with other major markets, the UK still has the most challenging zero emission vehicle (ZEV) transition timeline. The recently published Zero Emission Vehicle Mandate requires ZEVs to comprise half of each manufacturer’s new registrations within five years, and 80% by 2030. Achieving this will depend on private buyers making the transition, along with business and fleet customers. However, unlike in the other major markets working towards a 2035 end of sale date, UK private motorists have no purchase incentive to encourage them to invest in electric mobility.3

Mike Hawes, SMMT Chief Executive, said,

A bumper September means the new car market remains strong despite economic challenges. However, with tougher EV targets for manufacturers coming into force next year, we need to accelerate the transition, encouraging all motorists to make the switch. This means adding carrots to the stick – creating private purchase incentives aligned with business benefits, equalising on-street charging VAT with off-street domestic rates and mandating chargepoint rollout in line with how electric vehicle sales are now to be dictated. The forthcoming Autumn Statement is the perfect opportunity to create the conditions that will deliver the zero emission mobility essential to our shared net zero ambition.

Notes to editors

1 September 2020: 328,041

2 September 2019: 343,255

3 ACEA: Electric cars: Tax benefits and purchase incentives