- New research shows almost half of would-be EV buyers will now wait until after 2030 to switch – compared with just one in 10 last year.

- Third of motorists most concerned with upfront cost as private EV uptake down -19% year on year in 2023 after end of consumer incentives.

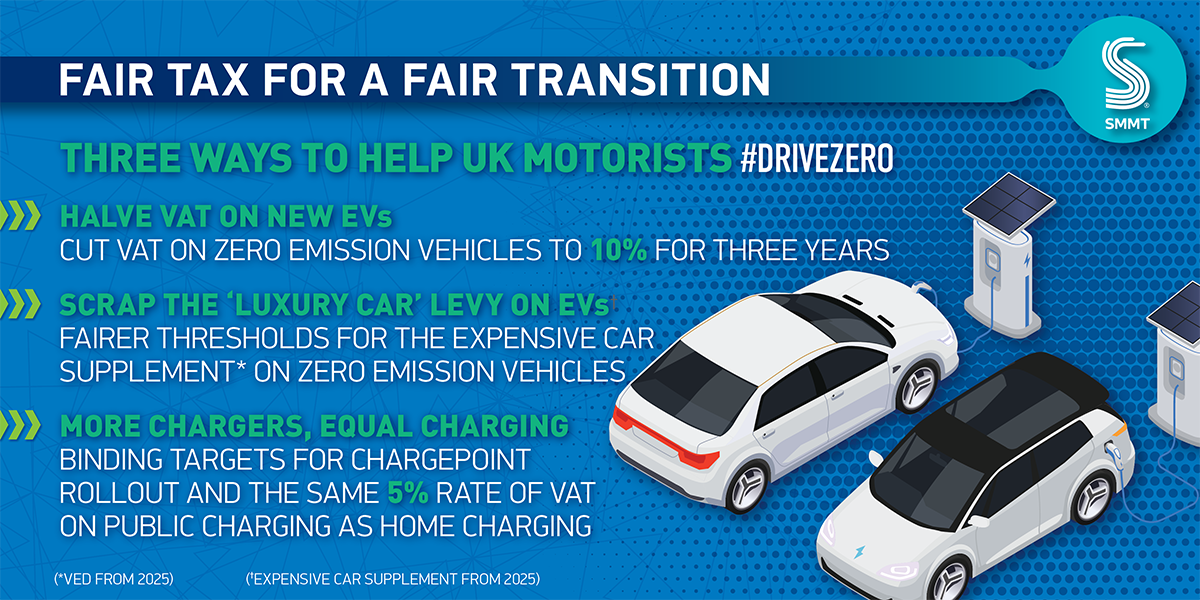

- Industry urges EV tax breaks to boost demand – with 50% VAT cut most popular incentive for drivers to switch.

- Vehicle Excise Duty reform also needed to avoid disincentivising EVs, while public chargepoint VAT cut needed to reassure motorists.

The automotive industry is calling for the Chancellor to use the upcoming Budget to put the UK’s shift to electric vehicles back in the fast lane, with fair taxes for a fairer transition.

New research commissioned by the Society of Motor Manufacturers and Traders (SMMT) from Savanta has revealed that rising numbers of would-be EV drivers are now likely to delay their switch to a battery electric car – but a three-point plan of tax reform would recharge the market and accelerate the UK’s progress towards net zero.1

The survey found that last September’s decision to delay the UK’s end of sale of new petrol and diesel cars and vans, from 2030 to 2035, has led to almost one in four drivers (24%) delaying their plans, while one in seven (14%) say they now won’t ever make the switch.

While the UK remains Europe’s second largest new electric car market by volume with the actual number of EVs on UK roads rising, the rate of growth has slowed and EV market share has stabilised.2 Growth in the market is being sustained by fleets and businesses, which benefit from compelling tax incentives. Private retail uptake, however, has been in decline since 2022 – with these buyers now accounting for fewer than one in four new EV registrations, compared with one in three previously.3

This change in sentiment puts delivery of the UK’s net zero goals in jeopardy. When the same survey was conducted in early September 2023 – just before the government announced a delay to the end of sale of petrol and diesel cars and vans – only around one in 10 (11%) survey respondents interested in driving electric said they would wait until after 2030.4 That has now risen to almost half (46%). Responding to the latest survey, almost three quarters (73%) of consumers named vehicle affordability, chargepoint availability, or chargepoint costs as being their biggest barrier to going electric.5

The upcoming Budget is an opportunity to put Britain’s electric switch back on track, supporting drivers to go green by halving VAT on new EVs, changing upcoming Vehicle Excise Duty rates so EVs are treated as essentials, not luxuries, and giving drivers more affordable public charging.

SMMT’s research shows that a VAT cut on EVs is the single most effective measure that would encourage drivers to go electric sooner. Almost four in 10 drivers (37%) interested in going electric said a VAT cut would accelerate their plans – and even a quarter of drivers (26%) who weren’t interested in switching named it as the option most likely to change their mind.

Buyers of other CO2-saving technologies such as heat pumps and solar panels benefit from VAT incentives, but motorists pay the full 20% regardless of whether they buy a zero emission or fossil-fuel powered car.6 With EVs having typically higher purchase costs, this discrepancy has seen Treasury reap a VAT windfall of around £1.7 billion over the past half-decade, as EV uptake has risen almost 20-fold.7

Halving VAT on new EV purchases would save the average buyer around £4,000 off the upfront purchase price – yet cost the Treasury less than the scrapped Plug-in Car Grant.8 Such a step would deliver an additional 270,000 EVs – instead of petrol or diesel – to the road over the next three years, bolstering supply to the in-demand used EV market, where uptake rose 90.9% in 2023.

Vehicle Excise Duty (VED) also needs to ensure fairness. Forthcoming changes to VED due in 2025 – announced before the pandemic, economic downturn and weakening of EV demand – will result in around seven in 10 currently sold EVs being subject to an ‘expensive car’ VED supplement from next year.9 This would mean EV purchasers would effectively be penalised a total of £1,950 for choosing to buy an electric car – a choice which new mandated EV sales targets are intended to encourage.10

Industry also wants to see an end to the unfairness of taxation on public charging, with VAT reduced from 20% to 5%, in line with home charging. Britain’s net zero goals are dependent on everyone going electric but the current system actively discourages drivers without access to a home charger – such as those in housing with no off-street parking – from moving to an EV, by charging them four times more tax than homeowners with driveways.

Mike Hawes, SMMT Chief Executive, said,

The Budget is a crucial opportunity to re-energise the EV market, with fair tax for a fair transition. The Chancellor must end the perverse fiscal system that discourages drivers from moving away from fossil fuels and send a clear signal that the time to go electric is now. Success will see our economy powered up by zero emission mobility, delivering cleaner air, quieter roads and cheaper running costs, ending the uncertainty we are seeing amongst motorists.

Notes to editors

1 Data was collected by Savanta who interviewed 2,127 UK adults aged 18+ online on 16-18 February. Savanta is a full member of the Market Research Society and British Polling Council and abides by all their rules.

2 UK Battery Electric Vehicle (BEV) registrations 2023: 314,687; Germany BEV registrations: 524,219. UK new BEV registration growth: 40.1% in 2022 vs 17.8% in 2023. UK new BEV market share: 16.6% in 2022 vs 16.5% in 2023

3 Private share of BEV market: 33.3% in 2022 vs 22.9% in 2023

4 SMMT news release: Consumer support key to faster and fairer EV transition as market enters new phase, 18 September 2023

5 Breakdown from February 2024 survey: Higher purchase price:36%; Concern over chargepoint availability: 26%; High cost of public charging: 11%

6 VAT incentives on heat pumps, insulation, solar panels, water and wind turbines for residential use: HMRC, Energy-saving materials and heating equipment (VAT Notice 708/6)

7 Based on SMMT analysis New BEV registrations: 15,510 in 2018, 314,687 in 2023

8 Based on SMMT analysis and an average JATO BEV purchase price of £47,471 (1H 2023)

9 BEV exemption from Vehicle Excise Duty Expensive Car Supplement (applied to vehicles with list price of or exceeding £40,000) ends in 1 April 2025. Supplement rate will be £390pa on top of standard VED rate, payable from second to sixth year inclusive after first vehicle registration

10 The Vehicle Emissions Trading Schemes Order came into force in January 2024 and mandates that zero emission vehicles must comprise a set minimum proportion of each manufacturer’s new registrations each year (22% for cars in 2024)