Supply Chain KPIs

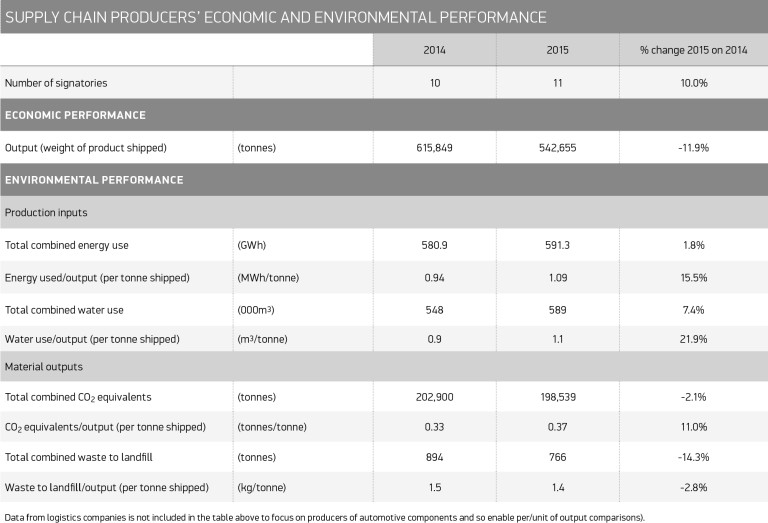

The number of supply chain signatories to this report continues to grow, with this year’s addition of Pritex, a manufacturer of acoustic and themo-acoustic insulation products. The number of supply chain signatories has now reached 11 and represents a diverse range of activities, from component production to freight and logistics management.

Supply chain signatories recorded an overall drop in production levels. The automotive industry is particularly time-sensitive, and the fall is linked to a slowdown in orders due to customers overstocking during the previous year. In addition, one signatory setting up a production facility abroad to enable them to supply export markets more efficiently, and reduce shipping costs and environmental footprint reduced output in the UK. The net impact resulted in a decline in UK efficiency, because energy and water consumption remained unchanged, while production volumes dropped. However, waste production, both in absolute and relative terms, reduced further.

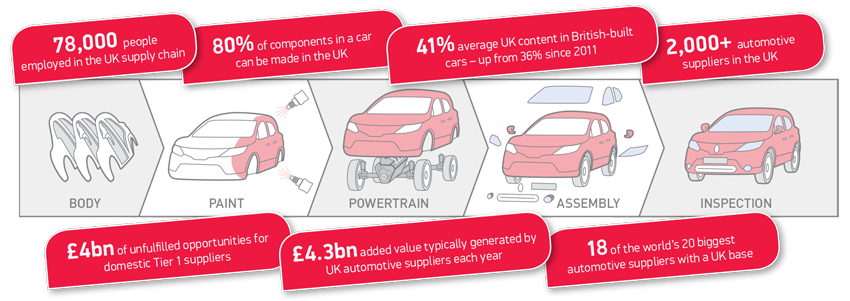

As vehicle manufacturers continue to streamline operations, drive productivity and minimise risk, there has been a rise in opportunities for domestic suppliers, highlighted by an increase in the average local content in UK manufactured vehicles. This now stands at 41%, up five percentage points from 36% in 2011. With car production volume growth factored in, this suggests UK Tier 1 supplier sales have grown by 32% over the same period. Compounded growth rates are expected to increase throughout 2016 and beyond as the UK’s production of passenger cars edges towards the 2 million mark (1).

Despite a positive year, there are a still several underlying issues that pose challenges to the UK supply chain. Companies face increasing global competition from rivals in countries with more competitive labour and business rates, although the UK does perform well in terms of labour productivity and flexibility(2).

The Automotive Council has also identified a significant skills gap in the UK, with 5,000 job vacancies in UK automotive manufacturing. Further, with 37,000 new jobs forecast to be needed by 2020 to support increased production levels, skills shortages are likely to have an impact on the UK supply chain’s ability to grow. This underlines a critical need to attract more young people into the industry(3).

In order for the UK supply chain to capture the opportunities available now and in the coming years, these issues will need to be addressed.

The 2015 Automotive Council report Growing the Automotive Supply Chain – The Opportunity Ahead, identified Tier 1 re-shoring opportunities worth £4 billion-per-year over the next four to five years(4).