Driving the transition to a low-carbon future

-

New car average CO2

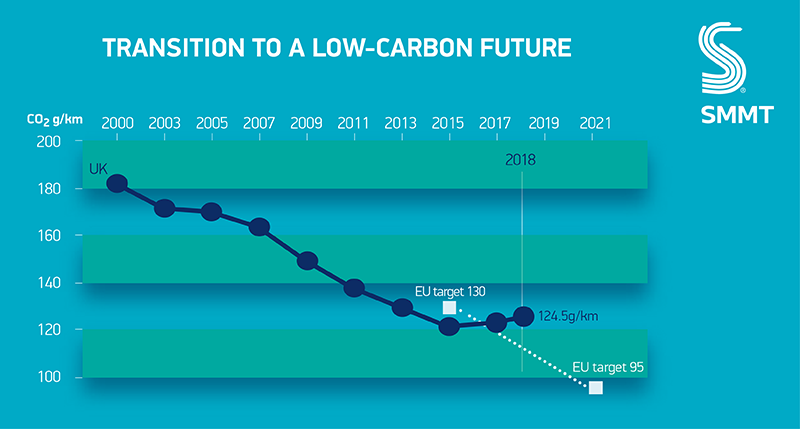

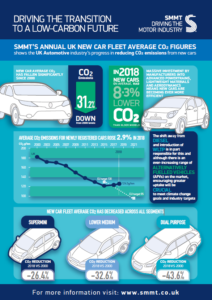

New car average CO2 has fallen significantly since 2000. The automotive industry has spent billions of pounds developing advanced engine, fuel and battery technologies to help drive down CO2 emissions. These ongoing improvements mean average CO2 is still a third (-31.2%) lower than in 2000.

Despite cars being ever more efficient, the average UK new car CO2 has risen 2.9% in 2018.

The shift away from diesel is in part responsible for this and although there is an ever-increasing range of alternatively fuelled vehicles (AFVs) on the market, encouraging greater uptake will be crucial to meet climate change goals and industry tar gets

New car technology

New car technology has improved efficiency. New cars on sale in 2018 emit -8.3% less carbon dioxide than the equivalent older models. Massive investment by manufacturers into advanced powertrains, lightweight materials and aerodynamics means new cars are becoming ever more efficient.

- Average new car CO2 emissions rose in 2018, up 2.9% to 124.5g/km.

- A 2018 car has on average CO2 emissions 31.2% lower than in 2000 and 20% lower than the average car in use.

- Industry is delivering even lower CO2 emitting products, and new models introduced in 2018 had CO2 emissions on average 8.3% lower than the model they replaced.

- The rise in 2018 reflected on-going market trends, notably consumer shift towards larger vehicles and the 29.6% drop in diesel registrations.

- Diesels typically emit 15%-20% lower CO2 emitting than petrol cars (with like-for-like performance).

- Zero emission battery electric vehicles took a 0.7% share of the market, plug-in hybrids a 1.9% share and conventional hybrid electric vehicles a 3.4% share in 2018.

- Alternatively fuelled vehicles (AFV) registrations continued to rise in 2017, up 20.9% to give them a 6.0% share of the market. AFVs emitted on average 45% lower CO2 than the market average.

- The average new light commercial vehicle (LCV, or van) emitted 166.9g/km in 2018, 0.9% below the 2017 level – in a significant pick up in the rate of improvement – and 15.9% down on 2011.

Click on the image of the report to view it as a pdf document.Download The Summary