- New car registrations passed the one million mark in June, growing 10% in the first half of 2013 to 1,163,623 units.

- The UK new car market saw the 16th successive monthly rise in June, growing 13.4% to 214,957 units.

- Private, fleet and business sectors grew from January to June, but private demand increased the most over the first half of the year, up 17.1%, after a 21.3% rise in June.

- Motorists switching to more fuel-efficient cars have helped reduce average new car CO2 emissions to 129.1g/km in first half 2013, down 3.7% on a year ago.

“Boosted by consistently strong private demand and further growth in June, half-year new car registrations have topped the one million mark,” said Mike Baunton, SMMT Interim Chief Executive. “June secured the 16th month of consecutive growth, a clear indicator that manufacturers and dealers are delivering desirable new products with tangible cost savings from the latest fuel-efficient technology coupled to a wide variety of competitive finance offers. While there are still potential challenges ahead, recent robust growth suggests that the market is on course to perform well ahead of 2012 levels.”

| June | Total | Diesel | Petrol | AFV | Private | Fleet | Business | ||||||||||||

| 2013 | 214,957 | 104,671 | 107,155 | 3,131 | 96,931 | 107,883 | 10,143 | ||||||||||||

| 2012 | 189,514 | 97,722 | 89,311 | 2,481 | 79,900 | 101,674 | 7,940 | ||||||||||||

| % change | 13.4% | 7.1% | 20.0% | 26.2% | 21.3% | 6.1% | 27.7% | ||||||||||||

| Mkt share ’13 | 48.7% | 49.8% | 1.5% | 45.1% | 50.2% | 4.7% | |||||||||||||

| Mkt share ’12 | 51.6% | 47.1% | 1.3% | 42.2% | 53.6% | 4.2% | |||||||||||||

| Year-to-date | Total | Diesel | Petrol | AFV | Private | Fleet | Business | ||||||||||||

| 2013 | 1,163,623 | 570,743 | 577,453 | 15,427 | 557,498 | 555,561 | 50,564 | ||||||||||||

| 2012 | 1,057,680 | 541,241 | 501,813 | 14,626 | 476,273 | 537,173 | 44,234 | ||||||||||||

| % change | 10.0% | 5.5% | 15.1% | 5.5% | 17.1% | 3.4% | 14.3% | ||||||||||||

| Mkt share ’13 | 49.0% | 49.6% | 1.3% | 47.9% | 47.7% | 4.3% | |||||||||||||

| Mkt share ’12 | 51.2% | 47.4% | 1.4% | 45.0% | 50.8% | 4.2% | |||||||||||||

| Best sellers | June | Year-to-date | |||||||||||||||||

| 1 | Fiesta | 11,332 | 1 | Fiesta | 63,040 | ||||||||||||||

| 2 | Focus | 9,128 | 2 | Focus | 47,675 | ||||||||||||||

| 3 | Corsa | 8,868 | 3 | Corsa | 46,147 | ||||||||||||||

| 4 | Astra | 7,074 | 4 | Astra | 33,731 | ||||||||||||||

| 5 | Golf | 5,875 | 5 | Golf | 32,131 | ||||||||||||||

| 6 | 3 Series | 5,432 | 6 | Qashqai | 27,112 | ||||||||||||||

| 7 | Polo | 4,703 | 7 | Polo | 23,287 | ||||||||||||||

| 8 | 1 Series | 4,678 | 8 | 3 Series | 21,588 | ||||||||||||||

| 9 | Qashqai | 4,507 | 9 | 208 | 20,815 | ||||||||||||||

| 10 | 208 | 3,649 | 10 | 1 Series | 20,007 | ||||||||||||||

Video Analysis

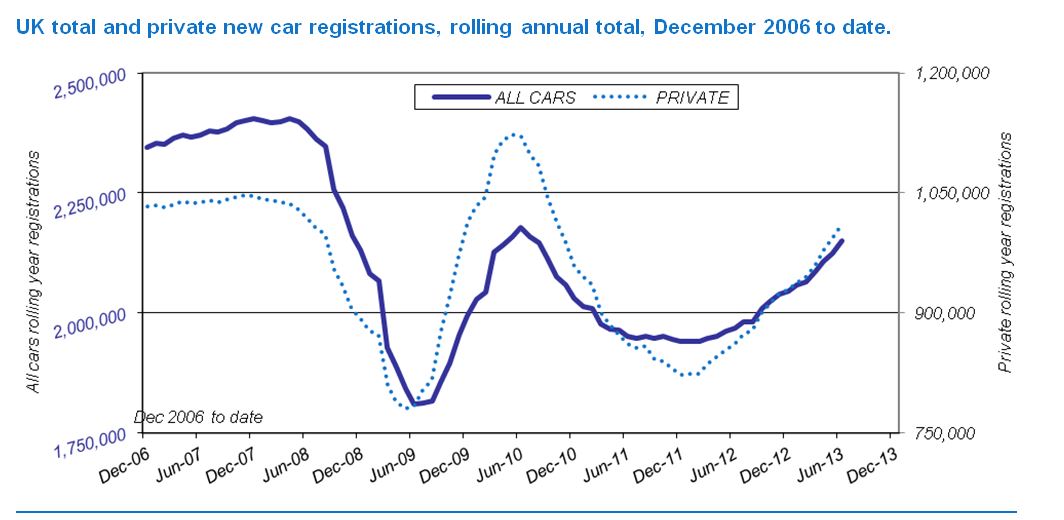

UK new car market continues to grow strongly in June, marking six successive quarters of growth

- UK new car registrations continued to rise across private, fleet and business sales types, although private demand has secured the most significant growth.

- Volumes in Q2 rose 13.0% this year, posting the strongest quarterly rise since Q3 2011.

- Registrations in June grew 13.4% securing a 16th successive month of growth and pushing half year volumes through the one million mark.

- The UK continues to buck new car market trends in some EU27 countries, with buyers returning to the market after a sustained hold-off from purchasing new vehicles, enticing finance deals and desire to switch to more fuel-efficient models driving market growth.

- Private new car registrations grew 17.1% during the first half of 2013, 24.4% in Q2 and 21.3% in June.

- Strong private demand has supported volume growth in the Supermini and Mini segments, although MPVs showed the largest growth in June, up by over a quarter.

- The Supermini Ford Fiesta remains the best selling model in both the month and year-to-date.

- The growth in the Supermini and Mini segments has contributed to the rise in petrol-powered car registrations, although in June alternatively-fuelled cars recorded a 26.2% rise.

- Average new car CO2 emissions continue to fall, down 3.7% to 129.1g/km in the first half of 2013.

UK outperforming eurozone market

- UK employment levels and more stable housing market supporting consumer confidence.

- Market specific factors helping boost new car volumes, eg return of buyers after period of postponement.

The UK new car market is one of few growing in the eurozone. Employment growth in the UK and accommodating monetary policy has boosted consumer confidence and encouraged buyers to return to the new car market after a sustained period of purchasing hold-off post recession and three years on from the scrappage scheme

Growth in jobs supports buyer confidence

- UK employment levels and housing market have supported buyer confidence.

- Attractive finance packages have encouraged motorists to buy new cars.

Industry sources suggest consumers have been enabled to buy through low interest rates and manufacturer support on finance packages.

Growth in Personal Contract Purchase schemes has given consumer access to new cars, especially for those with cash, collateral or use of PPI mis-selling windfall payments.

Warranty and service packages also give peace of mind to motoring with new cars.

Motorists switch to more efficient cars

- Consumers keen to reduce running costs.

- Growth in Mini and Supermini segments.

- Average new car CO2 emissions in first half at 129.1g/km, -3.7% on a year ago.

More efficient vehicles in every segment, improved sales of alternatively-fuelled vehicles and growth of the Mini and Supermini segments have helped to continue the impressive rate of reduction in average new car CO2 emissions.

In Q2, average new car CO2 emissions were 128.7g/km, down 3.5% versus 2012, and on par with recent annual gains.

Click through to download the full June 2013 new car registrations news release and data table.