- Used car transactions fall -14.9% in 2020 with 6,752,959 units changing hands as coronavirus lockdowns curb activity.

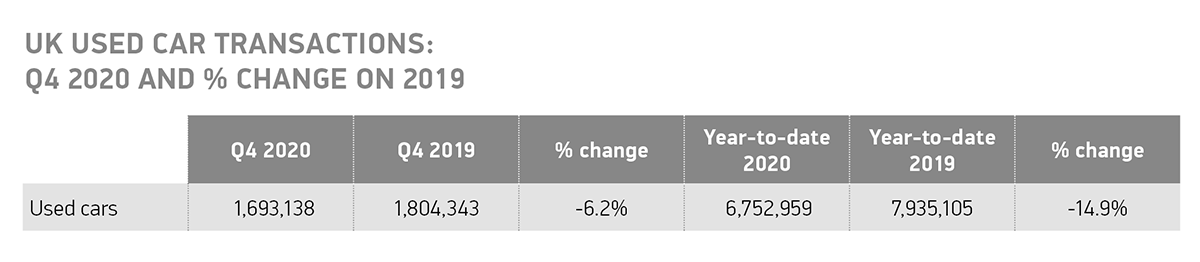

- Weak end to year with Q4 transactions down -6.2% to round off a turbulent 2020 for the UK used car market.

- Alternatively fuelled vehicle used transactions rise 5.2% to 144,225 taking 2.1% market share.

- News comes as industry calls for reopening of automotive retail as soon as possible to help protect jobs and economy.

Download the used car sales report for Q4 2020

Read the Q4 2020 press release

The UK’s used car market declined in 2020, down -14.9% according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT). 6,752,959 used car transactions took place, 1,182,146 fewer than in 2019, making 2020 the lowest performing year since 2012 as lockdown measures to tackle the coronavirus pandemic and turbulent consumer and business confidence dented sales.1

Despite used car transactions increasing 3.7% in October, a fourth consecutive month of growth, the combination of new lockdowns and tougher restrictions across the UK later in the year saw activity tail off, with declines of -18.3% and -4.2% in November and December respectively. Combined Q4 transactions fell by -6.2% to 1,693,138, rounding off a tough year for the sector.

Alternatively fuelled vehicles (AFVs) bucked the trend, however, with 144,225 of these models sold during the year, an increase of 5.2%, with their market share rising to 2.1%. Battery electric vehicles (BEVs) saw their transactions increase by 29.7% to 19,184 units, but still only a fraction of all activity at 0.3%. The market for hybrids (HEVs) also rose, by 4.7%, while demand for plug-in hybrids (PHEVs) fell by -5.0%. Used diesel and petrol car transactions also fell, by -15.5% and -15.2% respectively, yet combined were still equivalent to some 6.6 million units finding new owners.

Last year all used car segments experienced declines, however superminis remained the most popular choice with 2.2 million units purchased, accounting for 32.0% of all transactions. Lower medium cars were the next most traded segment, with 1.8 million sales to take 27.0% market share. Luxury Saloon (-5.8%), dual purpose (-7.2%) and specialist sports (-8.4%) saw more modest declines with a combined 1,084,504 transactions.

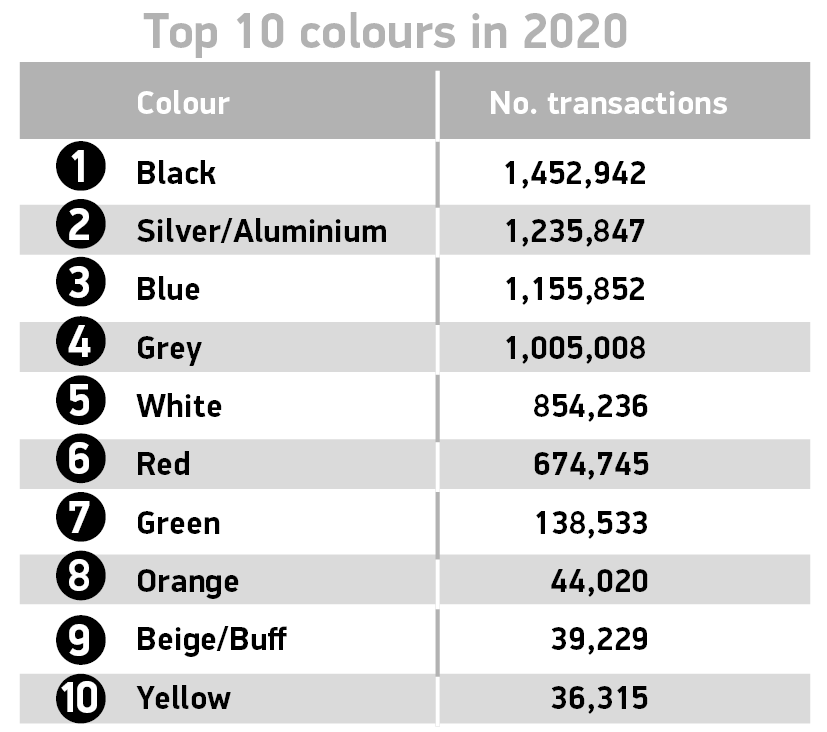

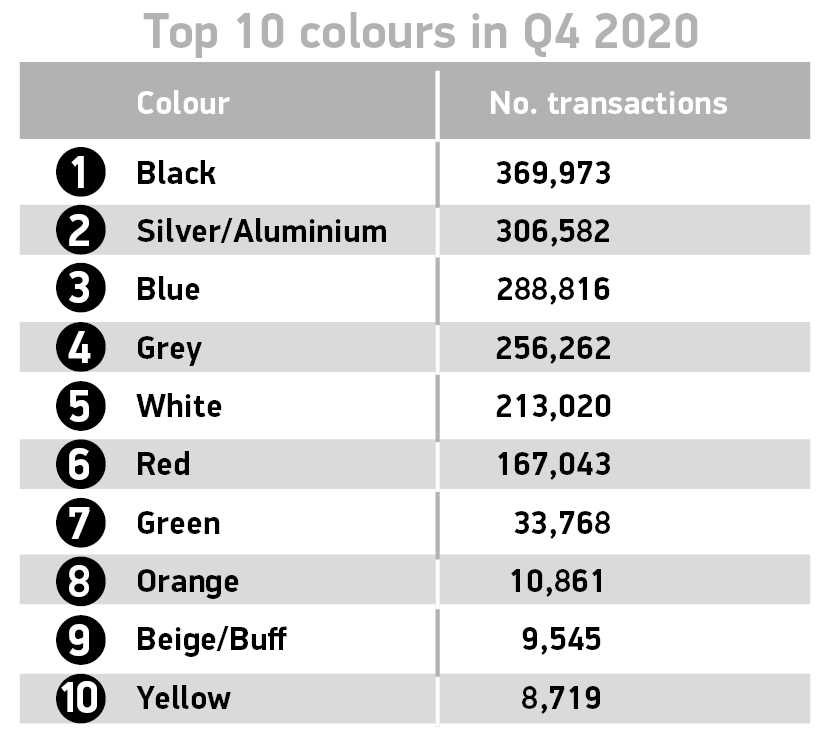

Black was number one in the colour charts, with just over 1.4 million models in the shade changing hands with silver and blue completing the podium line-up. Grey, which was the top selling new car colour in 2020, only managed fourth place. Some buyers looked to add a brighter note to their used purchase, with 4,018 pink, 6,510 turquoise and 23,427 gold cars snapped up during the year.

Mike Hawes, SMMT Chief Executive, said,

These figures are yet more evidence of the significant damage coronavirus has caused the automotive sector. Market growth at the start of the year was welcome but quickly stifled by the first lockdown as showrooms closed across the country, a picture that was repeated with the subsequent lockdowns in November and, indeed, into 2021. The priority now must be to allow car showrooms to re-open as soon as restrictions are eased. This will not only help the used market recover, supporting jobs and livelihoods and providing individuals with the personal mobility they need at a time when guidance is against using public or shared transport, but it will also enable the latest and cleanest vehicles to filter through to second owners and keep society moving.

Notes to editors

1. 2012: 6,743,080 transactions