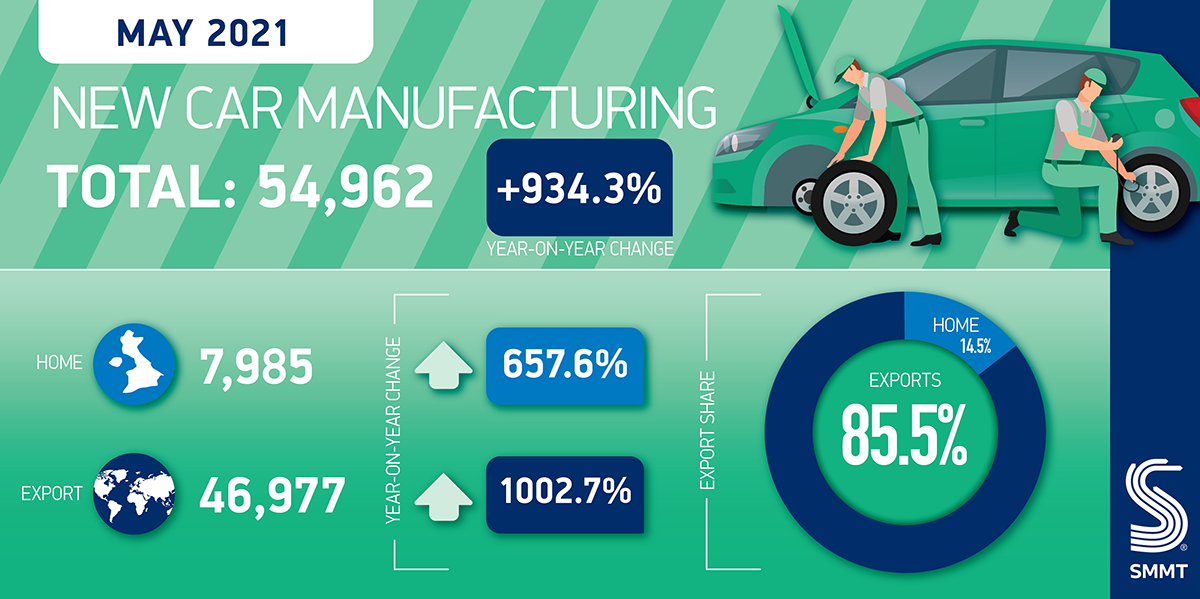

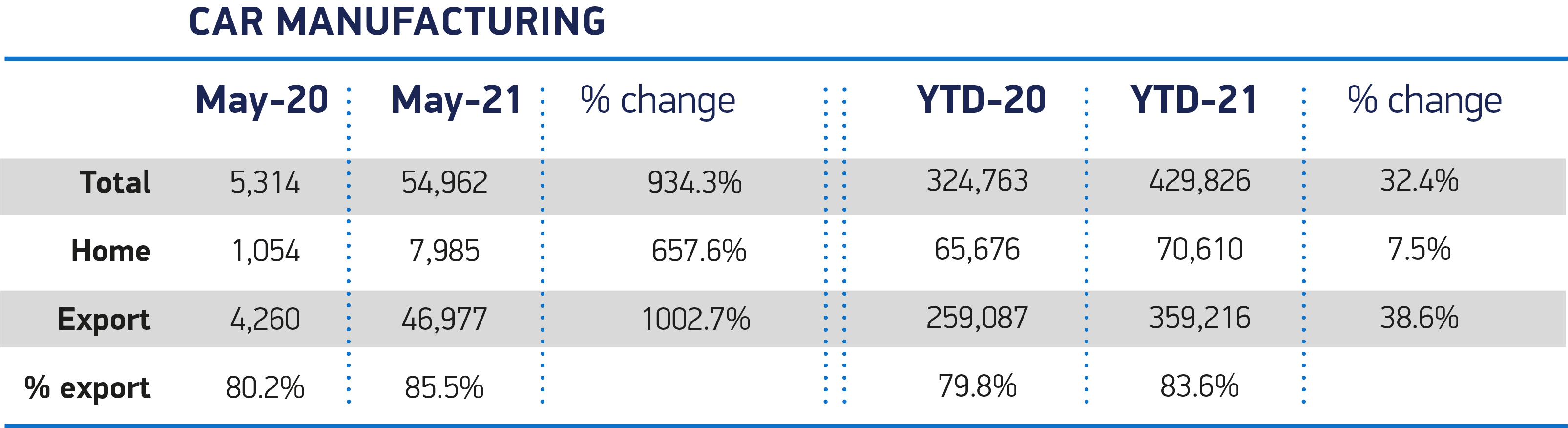

- 54,962 cars leave factory gates in May, up on Covid-wrought 2020 but still down -52.6% on 2019.

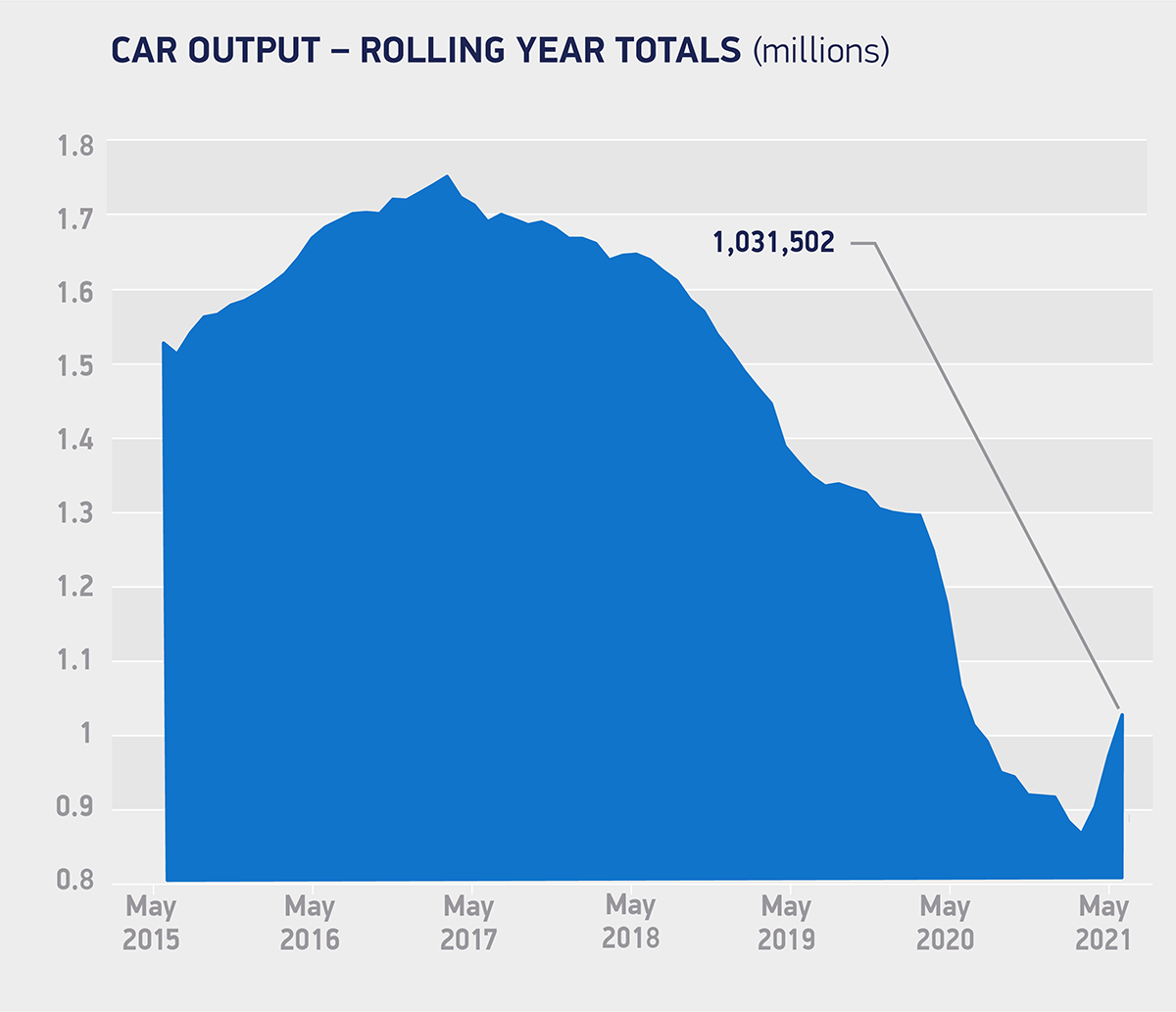

- Similar trend seen in production year to date, as some 127,469 fewer cars built since January than in the same period in 2019.1

- Alternatively fuelled vehicles account for more than 1 in 5 cars built in 2021, though only 1 in 16 are battery electric vehicles (BEVs).2

In a continuation of the recent trend, UK car production rose dramatically in May, according to the latest figures released today by the Society of Motor Manufacturers and Traders (SMMT) but still faces ongoing Covid-related issues. Some 54,962 cars rolled off production lines compared to just 5,314 a year ago, when coronavirus halted manufacturing. Performance, however, is still far below pre-pandemic levels, down -52.6% on the same month in 2019.3

So far this year UK factories have turned out 429,826 cars, up some 105,063 units on last year, the majority (95.3%) of the additional volume built for export, but overall output remains down -22.9% on the same five-month period in 2019. This is reflective of the scale of the challenge facing the industry as it seeks to recover from the pandemic while grappling with global supply shortages, notably of semiconductors.4 When compared with a five-year average, production was down -58.0% for the month and -36.3% for the period January – May.

As overall production tries to regain momentum, manufacturing of electrified vehicles is picking up speed. In the month, 19.2% of all UK car output was battery electric and hybrid cars, while in the year-to-date 1 in 5 vehicles manufactured in the UK were alternatively-fuelled models. However, this share drops to 1 in 16 for pure battery electric vehicles and 1 in 6 for hybrid cars, further highlighting the scale of transformation ahead and the importance of creating the right conditions to ensure sector competitiveness in the UK.

Meanwhile UK car production continues to be export-led, with 83.6% of all cars built so far in 2021 shipped overseas. The European Union remains by far the most important destination for British cars, taking 56.0% of all exports, followed by the US (18.3%) and China (7.3%).

Mike Hawes, SMMT Chief Executive, said,

May’s figures continue to look inflated when compared to last year’s near total standstill of production lines. The recovery of car production is, however, still massively challenged here and abroad by global supply shortages, particularly semiconductors. If the UK is to remain competitive, therefore, it must ensure it has a globally attractive policy framework for both vehicle production and the supply chain. Accelerating zero emission car production is part of this package, so while 1 in 5 models made here this year is alternatively fuelled, we need to drive investment in R&D, charging infrastructure and the market to ensure we can deliver the net zero future society demands.

Notes to editors

1: Car production Jan-May 2019 – 557,295

2: AFV share in Jan-May 2021 – 22.3%. BEV: 6.1%, Hybrid: 16.2%

3: May 2019 – 116,035

4: 2015-2019 average for May – 130,838; 2015-2019 average for Jan-May – 674,726