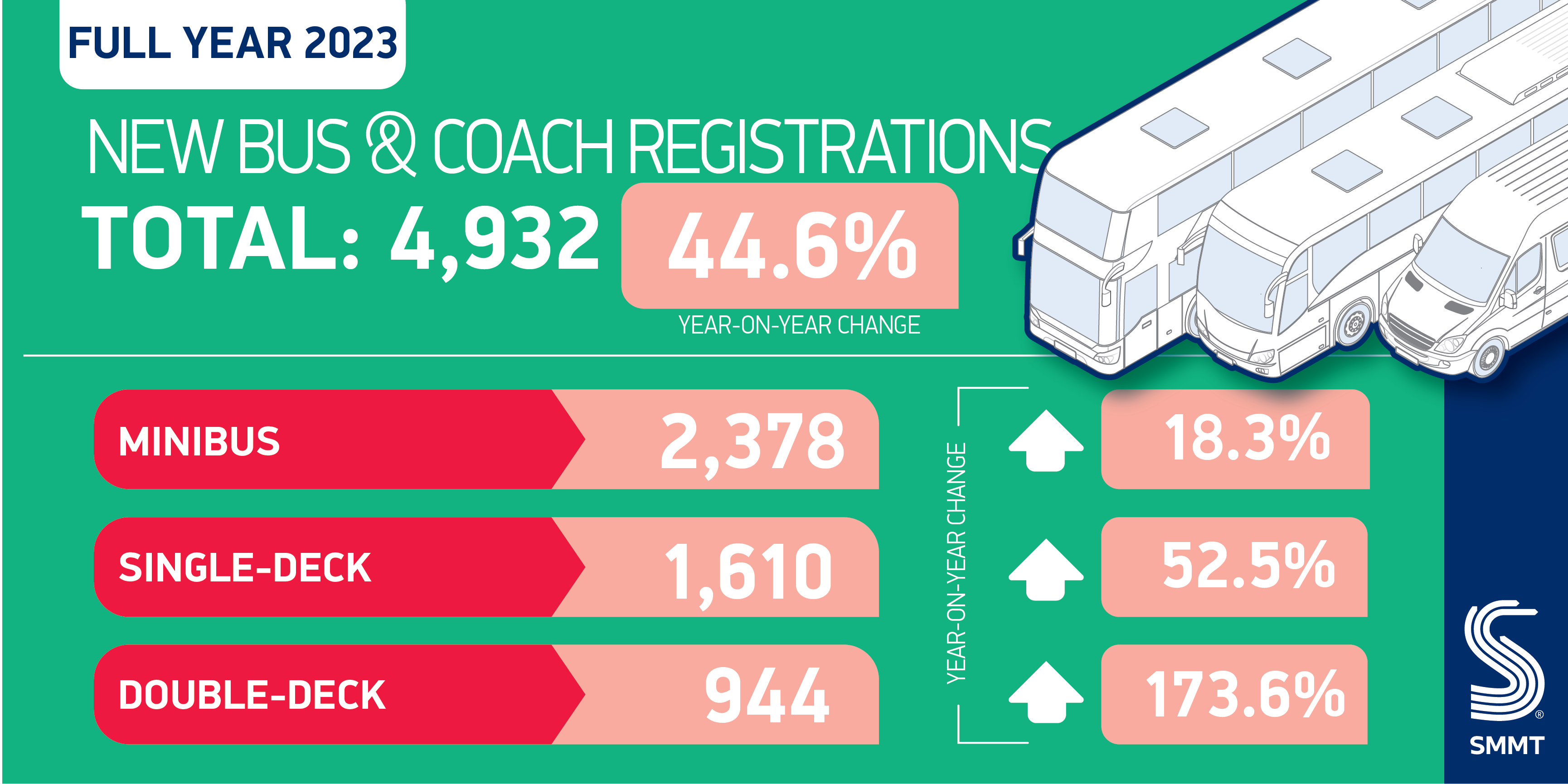

- Demand for new buses, coaches and minibuses reaches highest level since the pandemic with 4,932 new units entering service in 2023.

- Market up 44.6% on previous year but remains -16.0% down on 2019.

- Sector leads UK’s Net Zero journey as Europe’s biggest zero emission bus market, with 45.1% of new single and double deckers electric or hydrogen, but red tape holds back minibus transition.

SEE BUS & COACH REGISTRATIONS BY BRAND

DOWNLOAD PRESS RELEASE AND DATA TABLE

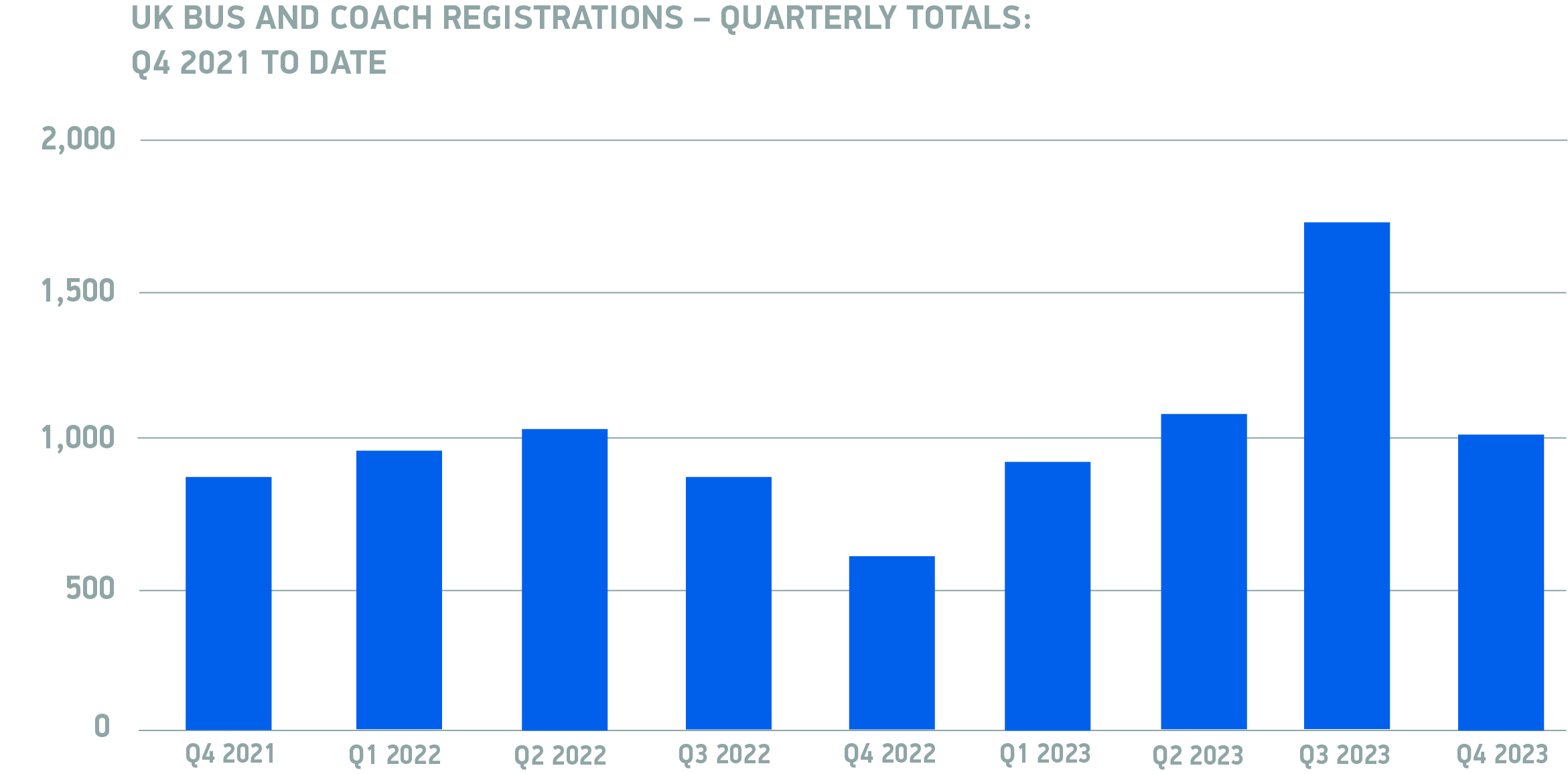

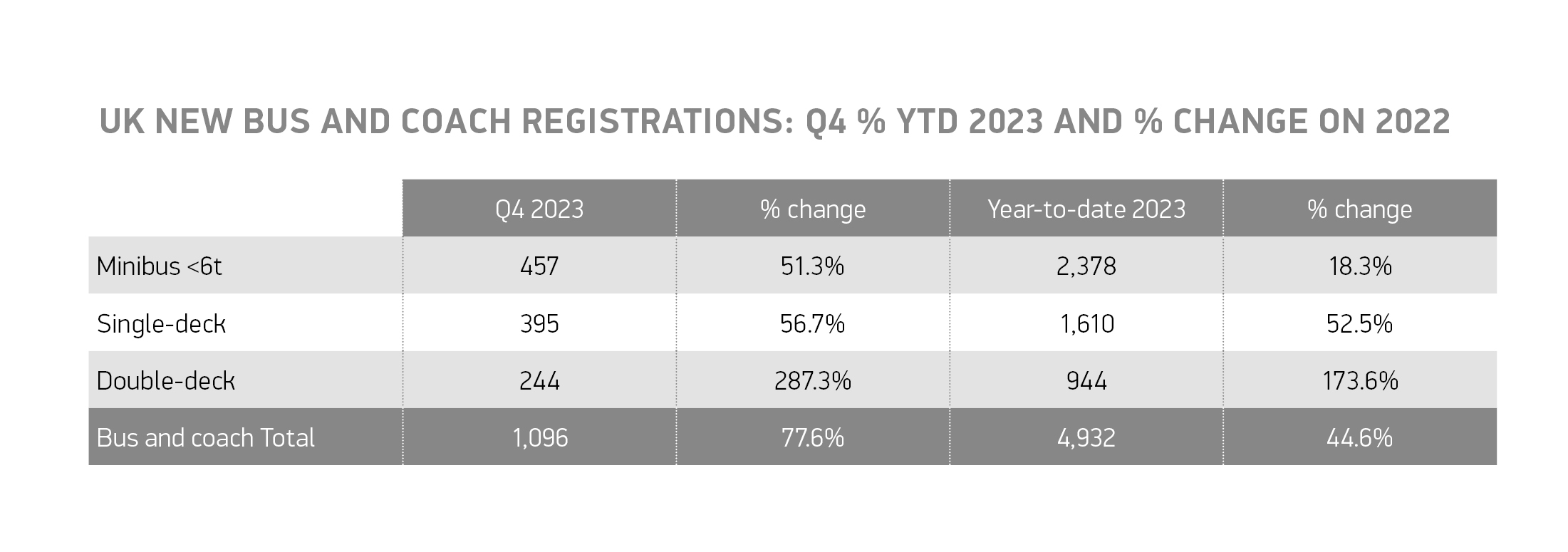

Britain’s new bus, coach and minibus market is growing back after three challenging years, with 4,932 new units registered in 2023, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). The performance represents a 44.6% increase on 2022 levels as passenger confidence continues to return, although uptake remains -16.0% below 2019 levels.1

The market was driven by strong investment in single and double-decker buses, with registrations up 52.5% and 173.6% respectively. Minibuses also recorded strong growth, rising 18.3% over the year as fleets across the UK invested in new passenger transport assets.

Uptake has been supported by Zero Emission Bus Regional Area (ZEBRA) funding, originally awarded in 2022, with finance eventually trickling through during last year. With 58 expressions of interest filed for the second round of funding at the end of 2023, ensuring rapid approval and allocation of cash will be essential to help more regions roll out affordable, zero emission mass mobility more quickly – vital for achieving the UK’s net zero goals. Given that any new funding needs to be invested by January 2025, there is no time to lose.

Given their depot-based, circular routes, decarbonising bus fleets can be less complex than some other use cases – plus, the added halo effects of mass zero emission mobility, lower noise and improved air quality all prove highly attractive. Conversely, the minibus market, which often provides transport for schools and the health and social care sector, is struggling to invest in zero emission options, due in part to licensing restrictions.

Most minibuses are based on heavy vans, but while van drivers have a licence derogation allowing them to drive zero emission vehicles weighing up to 4.25 tonnes, minibus drivers will not be able to do so until 2025. Bringing this date forward would unleash demand, with many minibus fleets presently delaying their zero emission vehicle investment until their existing drivers are permitted to drive them. Greater ZEV uptake would reduce the adverse impact of all these vehicle types on the environment and help address poor air quality which can often affect the most vulnerable in our society most severely.

Mike Hawes, SMMT Chief Executive, said,

Britain’s bus sector is recovering strongly, powered by rising passenger numbers and government funding that is finally delivering new vehicles to routes up and down the country. Zero emission buses are on the verge of becoming the mainstay of what is now Europe’s biggest ZEV market but we need the next round of funding – fast – to put even more on the road. Speeding up licence derogations could unleash demand in the minibus market, helping provide zero emission mass mobility for all with the air quality, carbon emission and wider economic benefits that come with this transition.

Notes to editors

1 2019 bus registrations: 5,874 units.

2 ZEV car market share 2023: 16.5%.

3 Based on ACEA 2023 new commercial vehicle registrations data.