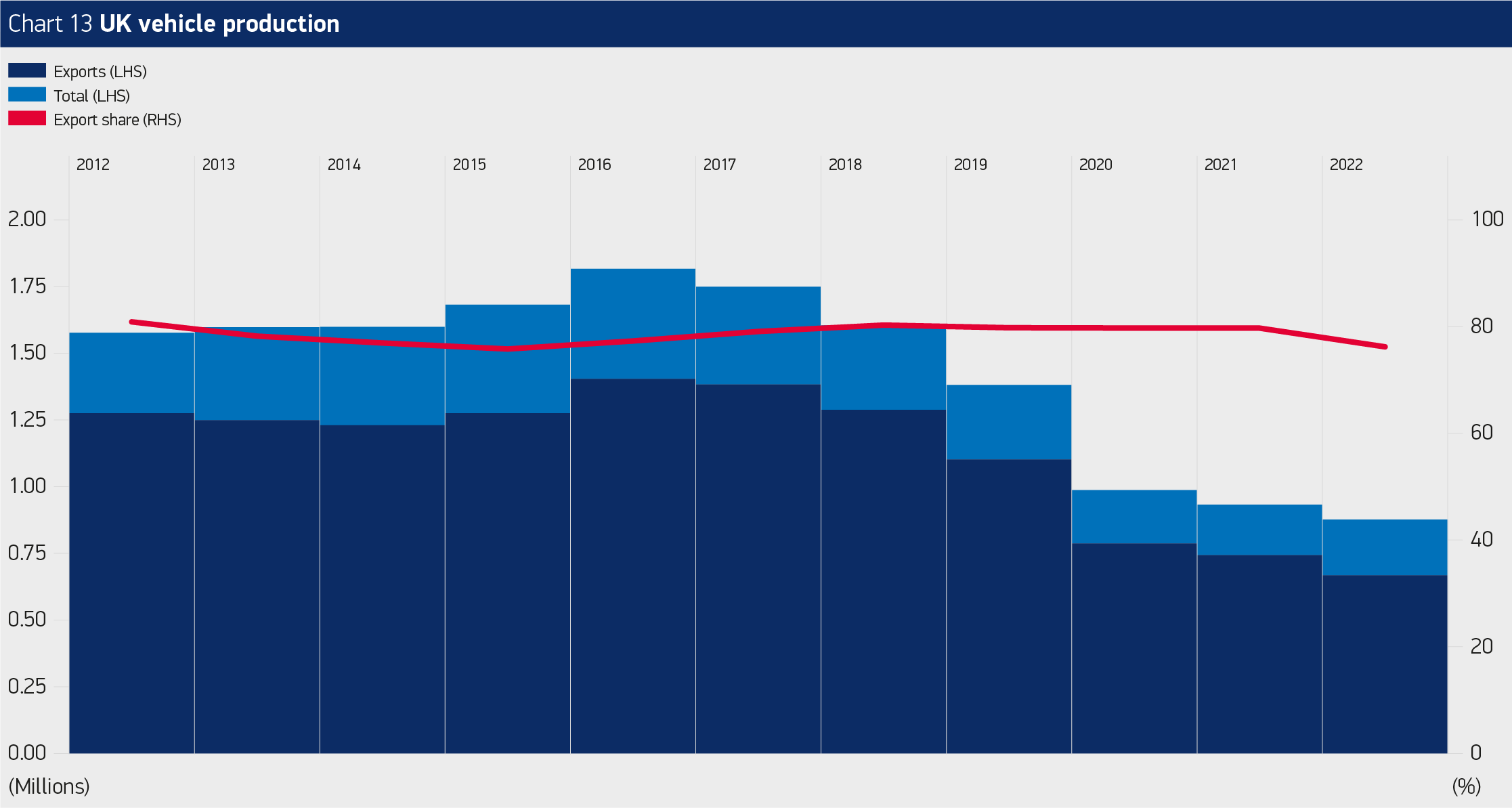

UK vehicle production declined -6% in 2022 to 876,614 units. Global supply chain challenges continued to negatively impact UK production, limiting the ability of manufacturers to build vehicles in line with demand. The dataset for 2022 also reflects significant changes to UK capacity, with the loss of production at two volume manufacturing sites, one permanently and one temporarily as a result of a transformation to a new vehicle type.

Despite these challenges, UK factories turned out a record 234,066 battery electric (BEV), plug-in hybrid (PHEV) and hybrid (HEV) electric vehicles, with combined volumes up 4.5% year-on-year to represent almost a third (30.2%) of all car production. Total BEV production rose 4.8%, with hybrid volumes up 4.3%.

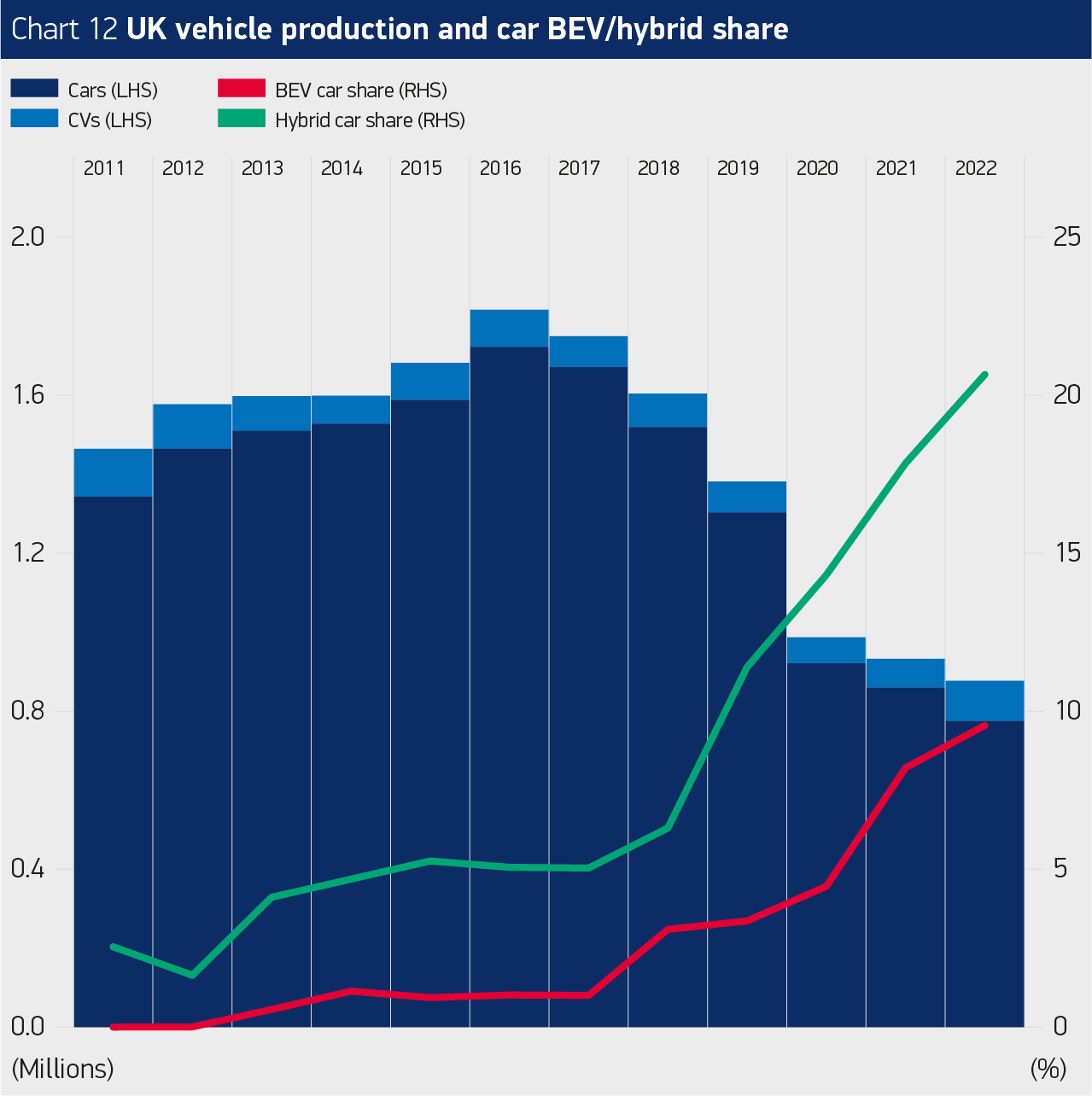

In 2022, 76.2% (668,029 units) of all vehicles manufactured in the UK were built for overseas markets. Electrified vehicles represented 44.7% of the value of all UK car exports, with the value of UK BEV, PHEV and HEV exports now worth more than £10 billion. BEVs, in particular, are critical to the future prosperity of the UK, with their export value rising to £1.3 billion.

Production

In 2020, UK car production fell by -29.3% (around 380,000 units) to 920,928 units, its lowest level since 1984. This loss was estimated to have a factory gate value of more than £10 billion.

Despite the turbulence caused by the Covid-19 pandemic and Brexit uncertainty, the UK automotive sector strengthened its focus on producing battery electric (BEV), plug-in hybrid (PHEV) and full hybrid vehicles (HEV). Combined production of these vehicles rose to an 18.8% share of all cars produced in Britain, up from

14.8% in 2019, with BEVs increasing to a 4.5% share (from 3.4%). Overall, the UK turned out 172,857 alternatively fuelled vehicles in 2020, with 79.6% of these exported – in line with overall export shares of 81.3%.

Production in the first half of 2021 rose by 30.8% to almost half a million units, albeit down -25% on 2019’s car volumes. Looking ahead, the latest independent production outlook (March 2021) expects UK car production to recover in 2021 to 1.05 million units, and 1.1 million by 2022. These figures are still below the 2019

(pre-pandemic) level of 1.3 million units, although this does reflect the closure of the Honda plant in Swindon this year. However, the ongoing semiconductor chip supply issue could take up to 100,000 units out of UK production this year, although the impacts are difficult to predict. Similarly, staff being ‘pinged’ and

having to self-isolate has disrupted some production lines.

For similar reasons, UK commercial vehicle (CV) manufacturing declined by -15.5% in 2020, with just 66,116 vans, trucks, taxis, buses and coaches produced. Similarly, UK engine manufacturing fell by -27.0% in 2020 to just over 1.8 million units, down from its usual 2.5 million plus level.